To the delight of investors across the cryptosphere, the price of bitcoin (BTC) has rallied over 53% since its low of US$15,476 (£12,519) in November. Now trading around US$23,000, there’s much talk that the bottom has finally been reached for the leading cryptocurrency after a year of painful decline – in November 2021, the price peaked at almost US$70,000.

If so, it’s not only good news for bitcoin but the whole market in cryptocurrencies, since the others broadly move in line with the leader. So is crypto back in business?

Dotcom lessons

The past is littered with various periods of market turmoil, from the global financial crisis of 2007-09 to the COVID-19 collapse in 2020. But neither of these is a particularly good comparison for our purposes because they both saw sharp drops and recoveries, as opposed to the slow unwinding of bitcoin. A better comparison would be the dotcom bubble burst in 2000-02, which you can see in the chart below (the Nasdaq is the index that tracks all tech stocks).

Nasdaq 100 index 1995-2005

Look at the bitcoin chart since it peaked in November 2021 and the price action looks fairly similar:

Bitcoin bear market price chart 2021-23

Both charts show that bear markets go through various periods where prices rise but don’t reach the same level as the previous peak – known as “lower highs”. If bitcoin is following a similar trajectory to the early 2000s Nasdaq, it would make sense that the current price will be another lower high and that it will be followed by another lower low.

This is partly because like the 2000s Nasdaq, bitcoin seems to be following a pattern known as an Elliott Wave. Named after the renowned American stock market analyst Ralph Nelson Elliott, this essentially argues that during a bear phase, investors shift between different emotional states of disappointment and hope, before they finally despair and decide the market will never turn in their favour. This is a final wave of heavy selling known as capitulation.

You can see this idea on the chart below, where bitcoin is the green and red line and Z is the potential capitulation point at around US$13,000 (click on the chart to make it bigger). The black line is the path that the Nasdaq took in the early 2000s. The blue pointing finger above that line is potentially the equivalent place to where the bitcoin price is now.

Bitcoin now vs Nasdaq in the early 2000s

The one other thing to note on the chart is the wavy line that’s moving horizontally along the bottom. This is the stochRSI or stochastic relative strength index, which is an indication of when the asset looks overbought (when the line is peaking) or oversold (when it’s bottoming).

A sign of a coming shift is when the stochRSI moves in the opposite direction to where the price is heading: so now the stochRSI is coming down but the price has held up around US$23,000. This too suggests a fall could be imminent.

The game of wealth transfer

Within markets, there is often a game that investors from institutions such as banks and hedge funds play with amateur (retail) investors. The aim is to transfer retail investors’ wealth to these institutions.

This is particularly easy in an unregulated market like bitcoin, because it is easier for institutions to manipulate prices. They can also talk up (or talk down) prices to stir up retail investors’ emotions, and get them to buy at the top and sell at the bottom. This “traps” the irrational investors who buy at higher prices, transferring wealth by giving the institutions an opportunity to convert their holdings into cash.

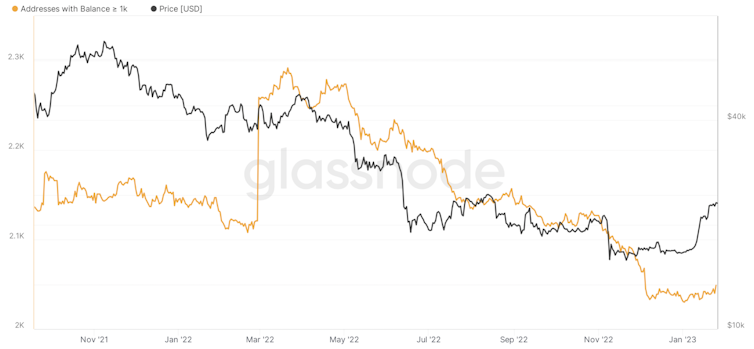

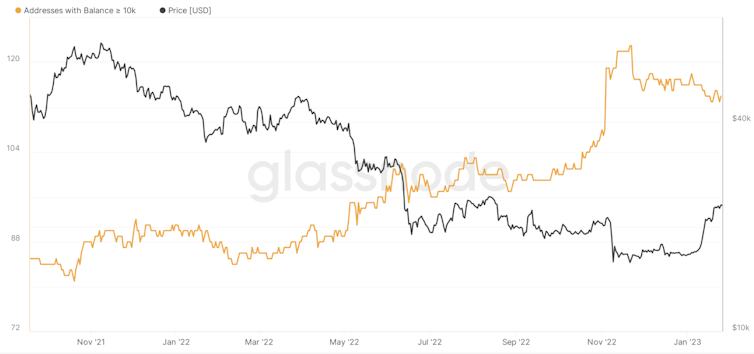

It therefore makes sense to compare how the retail and institutional investors have been behaving lately. The following charts compare those crypto wallet addresses that hold 1 BTC or more (mostly retail investors) with those holding upwards of 1,000 BTC (institutional investors). In all three charts, the black line is the bitcoin price and the orange line is the number of wallets in that category.

Retail investor behaviour

Institutional investor behaviour pt 1

Institutional investor behaviour pt 2

This shows that since the FTX scandal back in November, which led to the world’s second-largest crypto exchange collapse, retail investors have been buying bitcoin aggressively, resulting in the highest number of addresses holding at least one BTC ever. On the other hand, the biggest institutional investors have been offloading. This suggests that the institutional investors agree with our analysis.

Where we’re heading

There are those who argue that bitcoin is a bubble and that ultimately cryptocurrencies are worthless. That’s a separate debate for another day. If we assume there is a future for blockchains, which are the online ledgers that enable cryptocurrencies, the key question is when bitcoin will reach the accumulation phase that typically ends a bear phase in any market.

Known as Wyckoff accumulation, this is where the price of the asset repeatedly tests two areas: the upper bound where traders previously sold heavily enough for the price to stop rising (known as resistance), and the lower bound where traders bought heavily enough that the price stopped going down (known as support).

At the point where institutional investors decide the lower bound has proved to be sufficiently resilient – in other words, they think the price is cheap at that level – they will start buying the asset again. That moment is only likely to come after there has been a capitulation.

Of course, history does not repeat itself exactly. It may be this is the first time that retail investors have outsmarted the large institutions, and that the only way is now up.

More likely, however, there is more pain on the way. With a recession on the cards, unprecedented job layoffs and weak retail data coming out of the US, it doesn’t point to the kind of optimism that tends to move markets higher. It would therefore make sense to brace yourself for another plunge in the price of bitcoin and the rest of the crypto market.

James Kinsella works part-time as an investment analyst for Tyndall Asset Management.

Richard Fairchild does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.