KEY POINTS

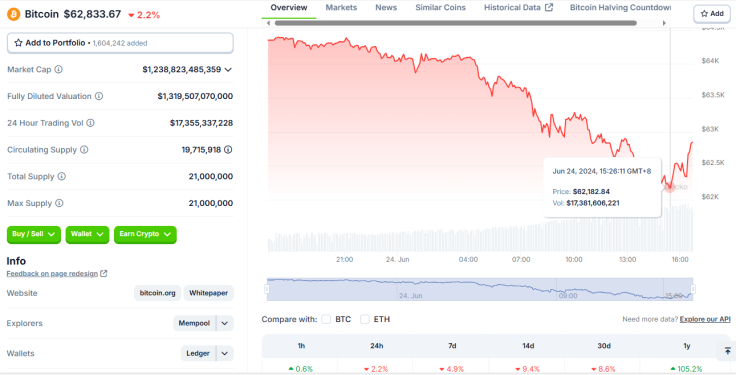

- Bitcoin slumped to $62,100 at one point late on Sunday night, and spot BTC ETFs have been negative

- Some experts are expecting the digital asset to reach a 'sufficiently boring' phase soon

- Others believe the coin will drop further before it experiences a reversal

Bitcoin has fallen further after several days of spot BTC exchange-traded fund (ETF) sell-offs and significant dumping activity among some of the digital asset's largest holders, and cryptocurrency users on X (formerly Twitter) are debating what's next for the world's first decentralized crypto.

As of early Monday morning, Bitcoin is trading at around $62,700 and $62,800, according to CoinGecko data. However, at one point, the digital currency plummeted to $62,100. It has been down by nearly 5% in the last seven days, but remains on a +100% spike in the past year.

Bitcoin's underwhelming performance in recent weeks has led to mixed reactions and speculations on X, with some crypto users convinced that the digital asset's price is in for a freefall.

Prominent BTC analyst Willy Woo said he expects between one to four weeks more of "cooling down before Bitcoin price action is sufficiently boring," suggesting that the digital asset's current phase will go on before its price sees a significant pump.

Eyeballing this model... probably 1-4 weeks more of cooling down before #Bitcoin price action is sufficiently boring.

— Willy Woo (@woonomic) June 22, 2024

Chart: Intensity of speculators playing casino games. https://t.co/GC0NlFgT6W pic.twitter.com/B3bmD6C5vG

Bitcoiner Carl Menger, who is followed by some prominent figures in the crypto space, said "Bitcoin is about to crash hard." Crypto trader Marco Johanning has similar views, saying he is expecting BTC to "go down further to range low," with a reversal possibly arriving within the next two to three weeks.

The negative projections for the next few weeks come as data from investment management company Farside revealed that Friday saw zero inflows among spot Bitcoin ETFs, while the funds saw $105.9 million in outflows, led by Fidelity's FBTC.

Throughout the weekend, Bitcoin whales moved millions worth of their treasuries, as per Whale Alert, which monitors the digital wallets of some of the world's largest BTC holders. One whale moved 10,500 BTC worth some $675 million Saturday.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 2,999 #BTC (192,906,682 USD) transferred from unknown wallet to unknown new wallethttps://t.co/UpQJAqR77Q

— Whale Alert (@whale_alert) June 22, 2024

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 10,500 #BTC (675,061,763 USD) transferred from unknown wallet to unknown new wallethttps://t.co/Si0bKWK24B

— Whale Alert (@whale_alert) June 22, 2024

🚨 🚨 🚨 800 #BTC (51,298,340 USD) transferred from unknown wallet to #Krakenhttps://t.co/8md6nFu3K4

— Whale Alert (@whale_alert) June 21, 2024

Whale Panda, another crypto whale tracker, noted that there have been "18 days of dumping" among large BTC holders.

"Sentiment isn't that bad on Bitcoin"

— WhalePanda (@WhalePanda) June 24, 2024

18 days of dumping 6 red 3 day candles in a row. pic.twitter.com/klmQfm1Ha3

Despite the increasing FUD (fear, uncertainty, and doubt) in the Bitcoin community, there were still some Bitcoiners who believed a turnaround would take place soon. One user said BTC's cooling period is necessary to "build a strong foundation," and another said the downtime should be used to study the coin's movement on a deeper level, as it "might be the calm before the crypto storm."

Former chief strategy officer at Blockstream, Samson Mow, agrees that there's something bigger in store. "You may doubt Bitcoin will reach $1.0M within the next year, but you'll see," he wrote late Sunday. Mow is a known BTC maximalist.