Bitcoin and Ethereum traded in negative territory Tuesday evening as the global cryptocurrency market cap fell 0.7% to $1.14 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -1% | 3.2% | $23,859.03 |

| Ethereum (CRYPTO: ETH) | -1.2% | 10.4% | $1,876.73 |

| Dogecoin (CRYPTO: DOGE) | +13.2% | 25.45% | $0.09 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Dogecoin (DOGE) | +13.2% | $0.09 |

| EOS (EOS) | +8.1% | $1.38 |

| Chiliz (CHZ) | +6.5% | $0.21 |

See Also: How To Get Free Crypto

Why It Matters: Even as the two largest coins struggled to gain upwards momentum, Dogecoin (DOGE), the bellwether meme coin with the 10th largest market cap, shot up over 13% to emerge as the top intraday gainer.

Whale activity in altcoins picked up steam this week, according to Santiment. The market intelligence platform said by counting the amount of $100,000+ transactions it is possible to see that coins like DOGE, The Sandbox (SAND), and Chilliz (CHZ) have “increased their large transaction frequencies.”

Whale activity on #altcoin networks is picking up steam in a hurry this week. By counting the amount of $100k+ valued transactions happening daily, we can see that $HEX, $DOGE, $SAND, and $CHZ have increased their large transaction frequencies. https://t.co/8ttXvhSzi4 pic.twitter.com/VTLPy1DqDw

— Santiment (@santimentfeed) August 16, 2022

Among the two top coins, Ethereum is “acting significantly stronger” than Bitcoin on account of the upcoming Merge — the shift of Ethereum from a proof-of-work to a proof-of-stake network, said Michaël van de Poppe.

The cryptocurrency trader said the crucial area to hold for ETH is $1,780 to $1,800. If that holds, then according to Van de Poppe investors could buy the “dip season” to $2,300 or $2,700.

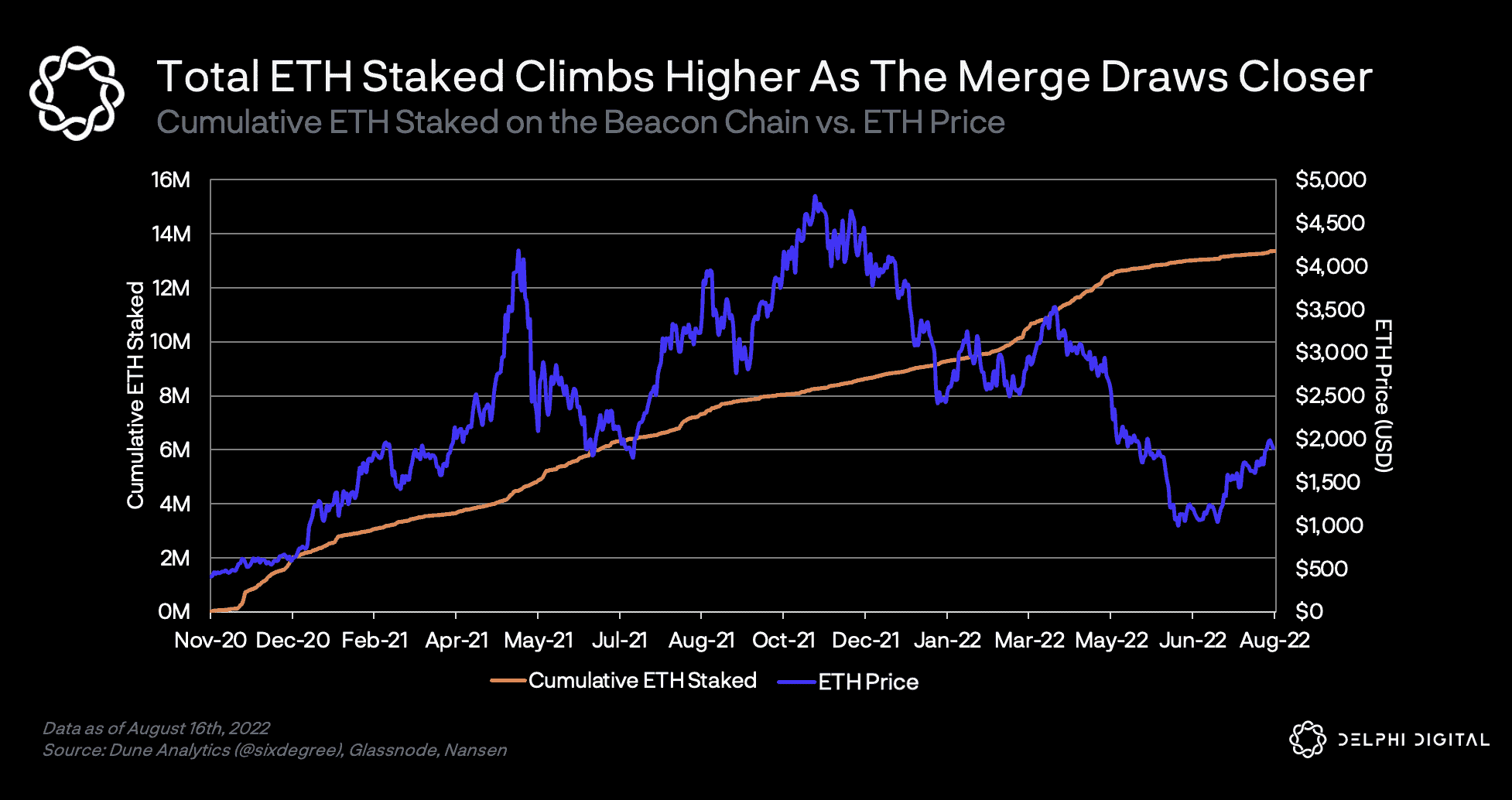

Meanwhile, the amount of staked Ethereum rose to a new all-time high of 13.29 million ETH across 415,314 validators as of Aug. 16, said Delphi Digital.

The independent research boutique said the amount of staked ETH has doubled over the past year despite the price of the second-largest coin falling by 43% in the same period.

On the Bitcoin side, “things could get ugly” if the S&P 500 decides to test the 3,400 pre-COVID-19 high, tweeted Justin Bennett. The cryptocurrency trader said it was “more than likely” that the U.S. benchmark index could do so.

The biggest concern for #crypto is the deviation from #stocks since June.$BTC and $SPX were locked together before that.

— Justin Bennett (@JustinBennettFX) August 16, 2022

Things could get ugly for #Bitcoin if the S&P 500 decides to test the 3,400 pre-COVID high, which I think is more than likely. pic.twitter.com/2RDNsG3pS0

On Tuesday, the S&P 500 closed 0.2% higher at 4,305.20, while Nasdaq was down 0.2% at 13,102.55.

“Bitcoin can’t yet break above the $25,000 level, but it seems to be maintaining a bullish trajectory here,” said Edward Moya, a senior market analyst at OANDA.

“It appears the institutional money is mostly behind this recent rebound, which suggests it could have a better chance of lasting.”