Bitcoin and Ethereum were seen trading in the green on Wednesday evening as the global cryptocurrency market cap stayed largely flat at $921.5 billion at 9:16 p.m. EDT.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 0.4% | -5.7% | $19,149.87 |

| Ethereum (CRYPTO: ETH) | 1% | -5.5% | $1,297.55 |

| Dogecoin (CRYPTO: DOGE) | -0.8% | -7.8% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Huobi Token (HT) | +25.1% | $7.41 |

| Terra (LUNA) | +13.1% | $2.77 |

| Hedera (HBAR) | +4.7% | $0.06 |

See Also: Best Crypto Debit Cards

Why It Matters: The two largest coins were seen higher on an intraday basis on Wednesday evening even as U.S. Federal Reserve minutes for September indicated that interest rates may remain higher for longer.

Many of the Federal Open Market Committee participants indicated that once the policy rate had reached a sufficiently restrictive level it would be “appropriate to maintain that level for some time until there was compelling evidence that inflation was on course to return to the 2% objective."

Meanwhile, U.S. producer prices rose more than expected in September, with the producer price index (PPI) rising 0.4% in September, according to the Bureau of Labor Statistics. Economists were expecting an increase of 0.2%.

Wednesday’s PPI data comes just a day ahead of key consumer price index data. PPI measures wholesale inflation, while CPI is a barometer of consumer prices.

U.S. stock futures were seen trading marginally higher as investors await CPI numbers along with weekly jobless claims data, which is also expected on Thursday.

Michaël van de Poppe said there was “massive volatility” at the PPI number, while tomorrow the “volatility will be higher.”

Massive volatility at this number of PPI.

— Michaël van de Poppe (@CryptoMichNL) October 12, 2022

Atleast inflation not acceleration.

But, tomorrow, during CPI, the volatility will be higher. Tonight during FOMC minutes as well.

Don't use high leverage during those events!

The trader warned followers on Twitter, “Don't use high leverage during those events!”

Edward Moya, a senior market analyst with OANDA said investors should expect a 75 basis points hike at the second FOMC decision in November.

“The Fed is giving us subtle dovish hints here and that is good news for risky assets. Officials saw slowing the pace of hiking at some point and that could easily happen after the November FOMC meeting.”

Moya said on the apex coin, “Bitcoin could break out after the inflation report as Wall Street will have a better idea if the Fed needs to maintain an aggressive tightening stance beyond the November FOMC meeting. If inflation stays hot, Bitcoin could be vulnerable to test last month’s lows just ahead of the $18,000 level.”

Cryptocurrency trader Justin Bennett said on Twitter that this “quiet period for [cryptocurrencies] is about to end.”

This quiet period for #crypto is about to end.

— Justin Bennett (@JustinBennettFX) October 12, 2022

The longer a market coils, the more explosive the breakout. Get ready. #Altcoin market cap pic.twitter.com/qxrZmZaYAC

“The longer a market coils, the more explosive the breakout. Get ready.”

CryptoQuant CEO Ki Young Ju said that institutional adoption of cryptocurrencies could happen “in a few years.”

“Crypto market cap divided by M1 shows crypto adoption in asset allocation. It seems crypto is still in the retail-adoption phase for now. Institutional-grade infra seems almost ready to bring new capital.”

Institutional adoption could happen in a few years.

— Ki Young Ju (@ki_young_ju) October 12, 2022

Crypto market cap divided by M1 shows crypto adoption in asset allocation. It seems crypto is still in the retail-adoption phase for now.

Institutional-grade infra seems almost ready to bring new capital.

h/t @intocryptoverse pic.twitter.com/q9E1RkG0ik

M1 refers to mostly liquid money supply comprising currency, demand deposits and other liquid deposits, which include savings.

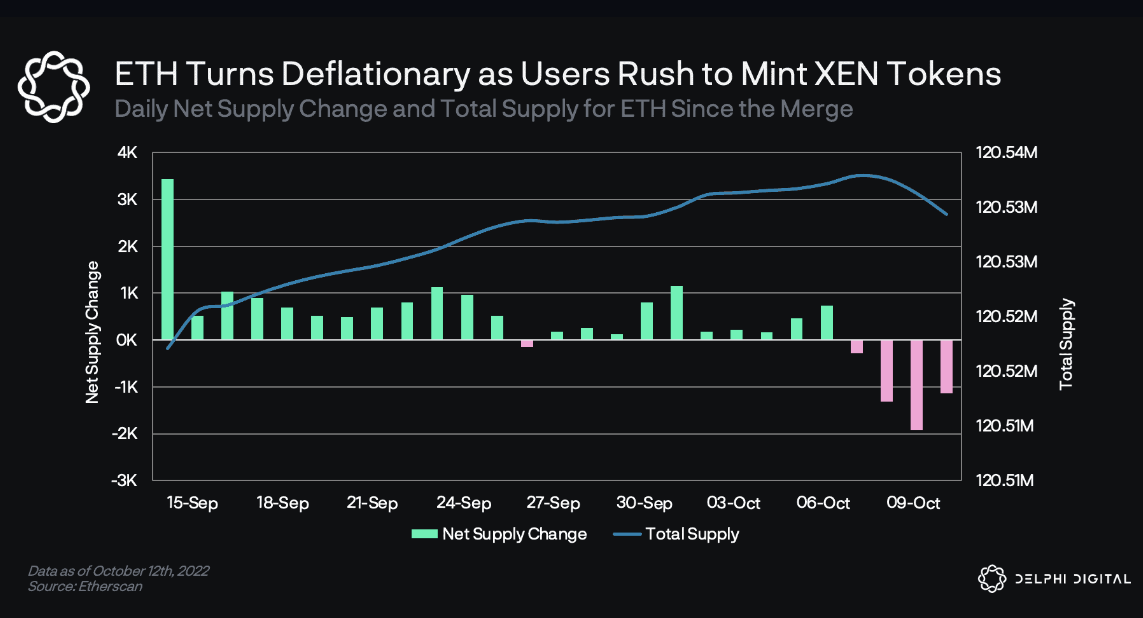

Meanwhile, on the Ethereum front, the second-largest cryptocurrency has turned deflationary as over the last four days a total of 11,200 ETH has been burned as users rush to mint XEN tokens — related to a mysterious and recently launched project, said Delphi Digital, in a note seen by Benzinga.

The XEN token was launched by the “Fair Crypto Foundation” with the project’s website stating that it was founded by Jack Levin, an early engineer at Google, according to Delphi Digital.

“Users have spent a total of [4,100] ETH to interact with the XEN token contract. At one point since the token’s launch, the contract accounted for more than 48% of the gas used on Ethereum,” said the independent research firm.

Delphi noted that since the successful merge in mid-September ETH has remained inflationary. It said that many are pointing out that deflation caused by XEN is evidence that a sustained increase in on-chain activity during the next bull market could lead to massive deflation in ETH.

Read Next: Crypto.com — Of Matt Damon Lore — Laid Off Hundreds And Now Is Spending $150M On A New HQ In Paris