Bitcoin, Ethereum, and other major coins rose Thursday evening as fears of a bear market in equities and a weaker dollar increased the appeal of the apex coin. The global cryptocurrency market cap rose 4.8% to $1.3 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 5.4% | 4.8% | $30,304.18 |

| Ethereum (CRYPTO: ETH) | 5.3% | 3.1% | $2,018.07 |

| Dogecoin (CRYPTO: DOGE) | 3.6% | 4.9% | $0.09 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Kyber Network Crystal V2 (KNC) | +21.2% | $2.66 |

| Kadena (KDA) | +16.4% | $2.67 |

| Helium (HNT) | +12% | $91.63 |

See Also: Best Crypto Debit Cards

What Happened: The S&P 500 fell nearly 19% below its all-time high reached earlier in 2022; the index is now hovering near the bear market territory. A decline of 20% below all-time highs is construed to be a bear market by many experts.

S&P 500 and Nasdaq futures traded 0.4% and 0.7% higher, respectively, at press time.

The dollar index, a measure of the greenback’s strength against six other currencies, fell 0.05% lower to 103.74, while U.S. 10-year yields fell to 2.772, the lowest since late April, according to a Reuters report.

OANDA senior market analyst Edward Moya noted the “freefall” in the dollar as investors purchase Treasuries on concerns that the economy is headed for a “rough patch.”

“A weaker dollar and bear market stock fears are making Bitcoin attractive again,” said Moya in a note, seen by Benzinga.

“It seems the fallout from all the stablecoin drama that sent cryptos sharply lower is finally fading. Bitcoin looks poised to consolidate here, but bulls should be happy to see prices are not mimicking what happens with the stock market.”

Pointing to Bitcoin’s Relative Strength Index, Rekt Capital tweeted Thursday, that the indicator is entering a “period that has historically preceded outsized Returns On Investment for long-term investors.”

The cryptocurrency trader said previous reversals from this level were observed in January 2015, December 2018, and March 2020.

#BTC RSI is now entering a period that has historically preceded outsized Returns On Investment for long-term investors

— Rekt Capital (@rektcapital) May 19, 2022

Previous reversals from this area include January 2015, December 2018, and March 2020

All Bear Market bottoms$BTC #Crypto #Bitcoin pic.twitter.com/jofNT7gnsT

Michaël van de Poppe tweeted that due to the recent “heavy crash” there is a chance of 20%-25% relief over the market. The analyst put Bitcoin around $34,000 to $36,000 levels.

The total market capitalization of #crypto swept the lows at $1.1T and looks ready for a relief upwards.

— Michaël van de Poppe (@CryptoMichNL) May 19, 2022

Because of the heavy crash, there seems to be a chance of 20-25% relief over the entire market here.

Probably putting #Bitcoin around $34-36K. pic.twitter.com/rge5JM1Nlu

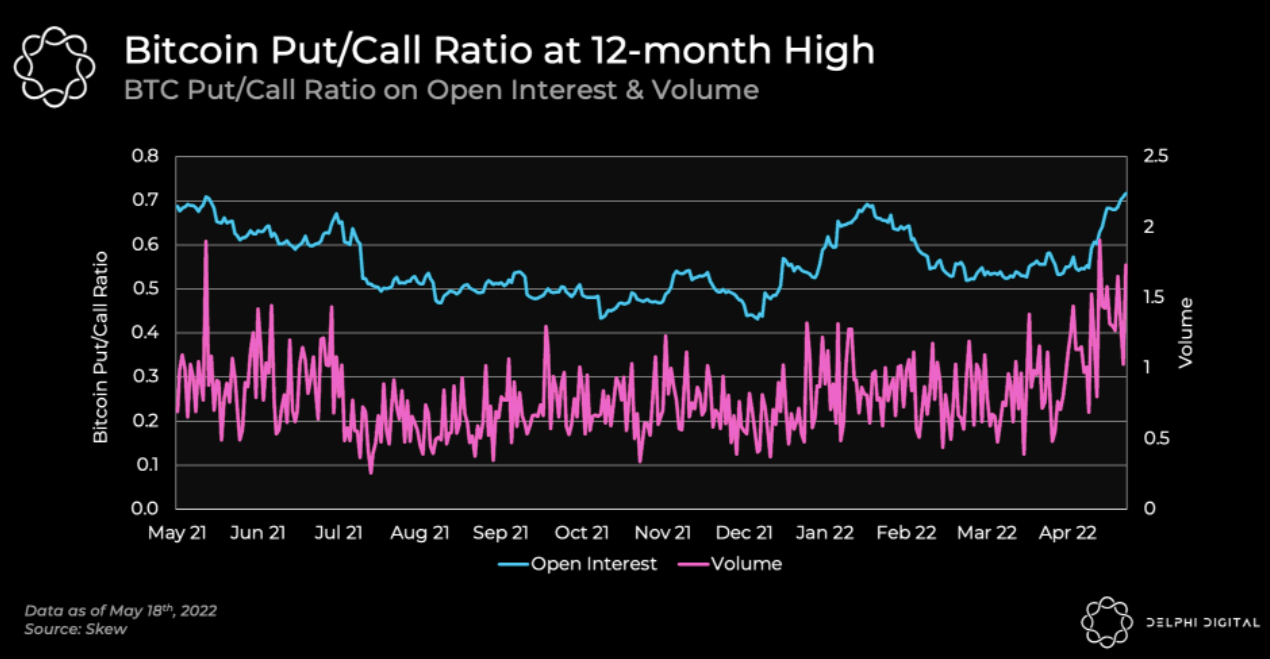

The futures market has another story to tell. Bitcoin’s put/call ratio touched a 12-month high with open interest touching a 12-month high of 0.72 this week. This is a bearish indicator, according to Delphi Digital.

The on-chain analysis company said that the put/call ratio touched as high as 0.96 before Bitcoin’s price fell over 50% in May 2021.

The put/call is a measure of the amount of put buying relative to calls. A high ratio means investors are speculating if Bitcoin will continue to sell off or it could point to investors hedging portfolios against a downturn.

Read Next: Jack Dorsey Outlines Block's Bitcoin-Centric Future, Says Company Is No Longer Just A Payment Firm