Bearish sentiment kept major coins lower on Monday evening as the global cryptocurrency market cap declined 1.05% to $1.15 trillion at press time.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -1% | 0.8% | $24,020.13 |

| Ethereum (CRYPTO: ETH) | -2.4% | 5.8% | $1,868.18 |

| Dogecoin (CRYPTO: DOGE) | -4% | 9.5% | $0.08 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Chiliz (CHZ) | +8.8% | $0.20 |

| STEPN (GMT) | +7.5% | $1.05 |

| UNUS SED LEO (LEO) | +5.8% | $5.40 |

See Also: Best Crypto Debit Cards

Bitcoin and Ethereum followed stocks lower at press time as the S&P 500 and Nasdaq futures turned flat and slipped marginally into negative territory, shedding the day’s gains.

Sentiment in the stock market was marred by weak economic data emanating out of China. Industrial production came in at 3.8% in July below the 5% forecast. In an unexpected move, China’s central bank cut interest rates by 10 basis points.

“The economic data from China overnight was very disappointing, to put it mildly. Combined with the lending figures on Friday, it does not paint a good picture of domestic demand or the growth outlook,” said Craig Erlam, a senior market analyst at OANDA.

“Bitcoin has tested the water above $25,000 and been pushed back on the first attempt. It seems the cryptocurrency, like many other instruments, is testing a potentially significant barrier following the recent recovery and we may be seeing some profit-taking,” wrote Erlam, in a note seen by Benzinga.

However, there is a silver lining. GlobalBlock analyst Marcus Sotiriou noted data from Bank of America that indicates consumer spending is not decelerating in the United States.

“This is shown by online retail spending still being positive year over year, leisure services spending uptick and median account balances remaining significantly elevated relative to 2019.”

“If we look at debt service payments as a percent of personal disposable income though, which is remarkably below levels from the dot com bubble, the Global Financial Crash and 2020, we can see that consumers are in a healthy position,” wrote Sotiriou.

Investors will take stock of U.S. retail sales on Friday. On Wednesday, minutes from the Federal Open Market Committee’s recent meeting will be released.

Cryptocurrency trader Justin Bennett said he’s treading carefully with cryptocurrencies as he tracks the dollar index, a measure of the greenback’s strength against a basket of six currencies.

Another reason I'm treading carefully with #stocks and #crypto right now is the $DXY.

— Justin Bennett (@JustinBennettFX) August 15, 2022

It reclaimed that February channel on Monday.

If this holds, expect risk assets to come under pressure. https://t.co/otCWuXJkUa pic.twitter.com/3N6MJJfwKI

The dollar index was up 0.02% at 106.57 at press time. Bennett said if it holds the 106.5 levels, he expects “risk assets to come under pressure.”

Meanwhile, Michaël van de Poppe said Bitcoin is “consolidating a little” after a decent run in the last week amid profit taking. He said, a “bear mindset is still the key.” The cryptocurrency trader pointed to the $23,800 and $23,000 as key levels to look out for when it comes to longs.

#Bitcoin consolidating a little, as we've had a pretty decent run upwards in the past week.

— Michaël van de Poppe (@CryptoMichNL) August 15, 2022

� Very normal; nothing goes up in a straight line.

� Profit taking, as bear mindset is still key.

� Giving people on HL's opportunities to jump in.

Watching $23.8K and $23K for longs pic.twitter.com/lfqPqMmKft

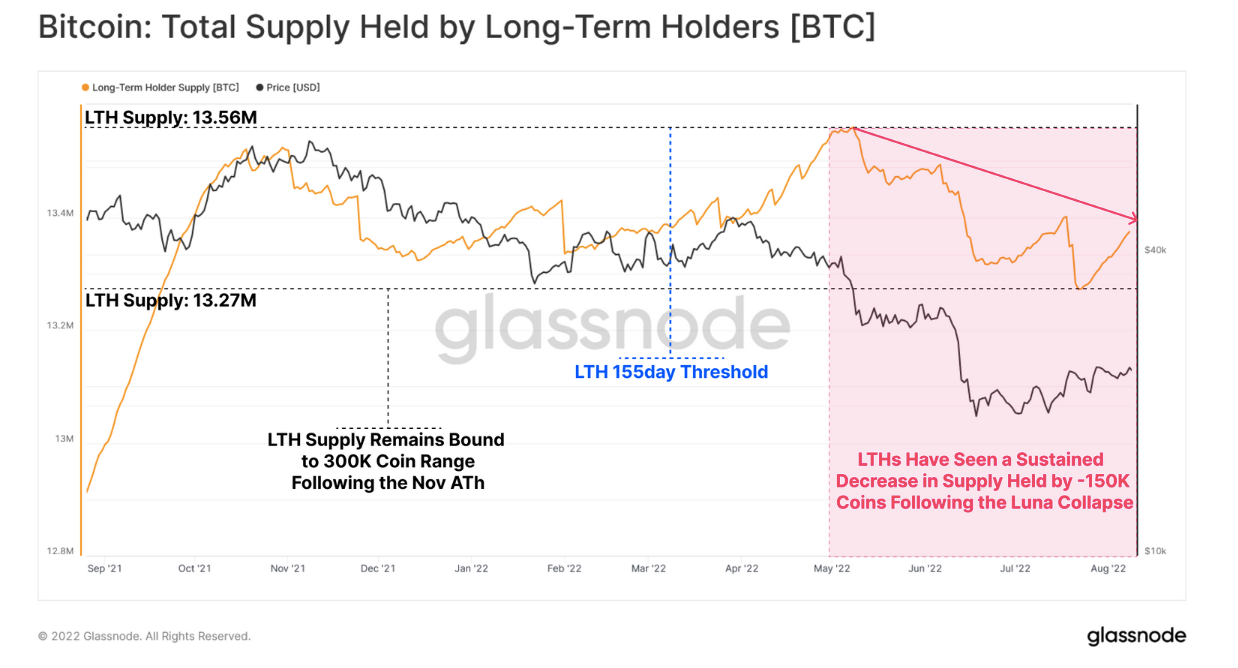

Bitcoin’s supply has undergone a “significant transfer of wealth in recent months,” on-chain analytics firm Glassnode said in a recent blog post.

While the Long-Term Holder (LTH) Supply has seen a “modest decline” following the collapse of Terra Classic (LUNC), it remains range bound.

Bitcoin's Total Supply Held By LTHs — Courtesy Glassnode

This points to contained spending by a sub-set rather than a broad loss of confidence, according to Glassnode.

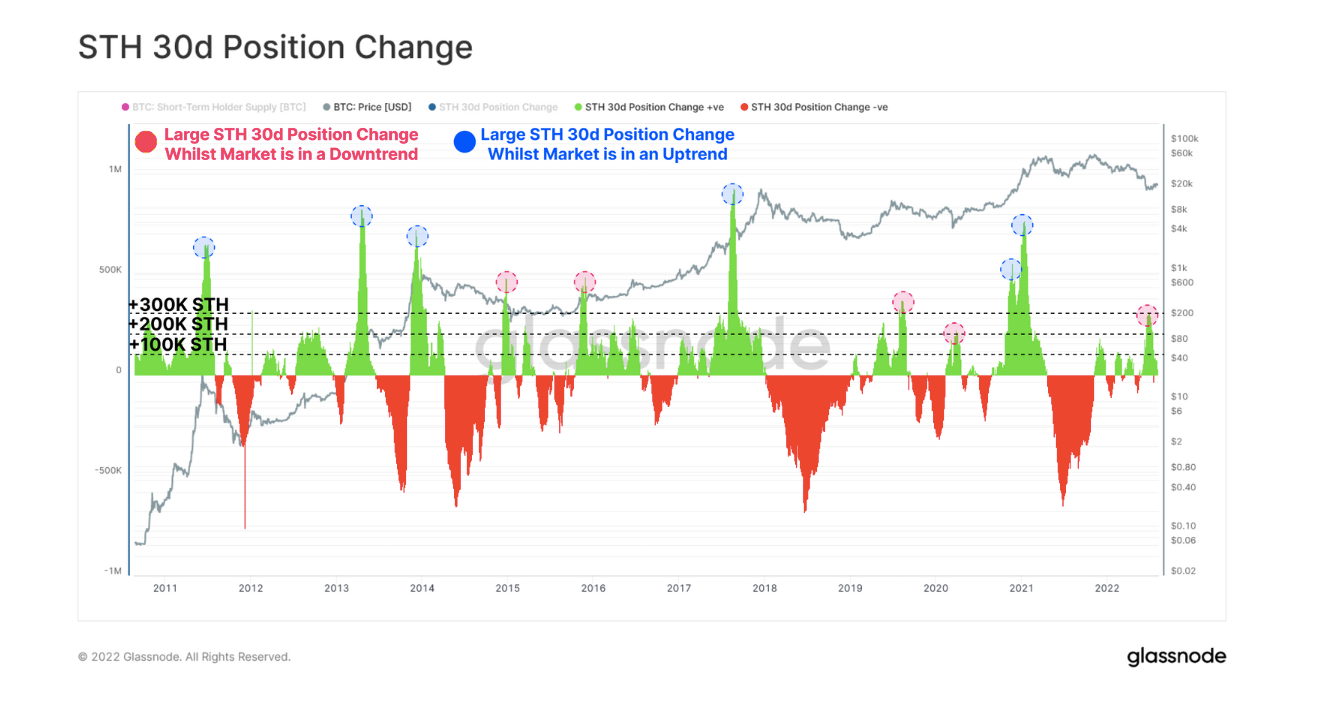

On the other hand, Short Term Holders are experiencing a divergence between BTC and dollar denominated wealth.

“This is indicative of a pool of buyers who stepped in at the lows, and now hold some [300,000 BTC], acquired at a much lower cost basis,” wrote Glassnode.

Read Next: Is Bitcoin Poised To Regain Important $25,000 Psychological Level? Here's What To Watch