Major coins declined sharply Monday evening as the global cryptocurrency market cap fell 5.9% to $979.9 billion at press time.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -5.8% | -5.8% | $21,287.58 |

| Ethereum (CRYPTO: ETH) | -9.8% | -9% | $1,442.71 |

| Dogecoin (CRYPTO: DOGE) | -7.9% | -8.3% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Trust Wallet Token (TWT) | +3.7% | $0.9 |

| TrueUSD (TUSD) | +0.05% | $1 |

| USDD (USDD) | +0.04% | $1 |

See Also: How To Get Free Crypto

Why It Matters: Bitcoin and Ethereum plunged sharply as investor sentiment remained subdued ahead of a key policy meeting of the U.S. Federal Reserve and earnings data from major tech giants.

Cryptocurrencies mirrored the tech-heavy Nasdaq, which ended Monday down 0.4%. The S&P 500 and Nasdaq futures fell 0.4% and 0.5%, respectively, at press time after Walmart Inc (NYSE:WMT) cut guidance and said increased inflation was affecting consumer spending.

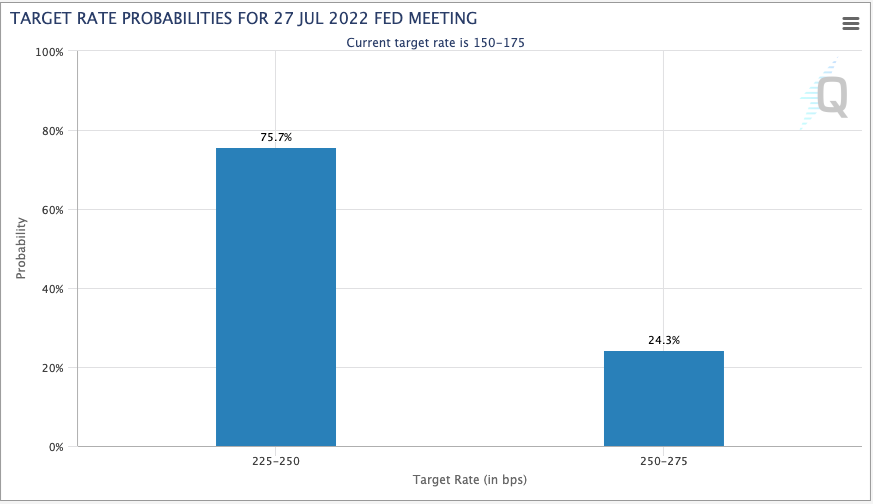

This week’s Federal Open Market Committee meeting could possibly end with a 100 basis points interest rate hike, according to some economists.

The CME FedWatch tool put the probability of a 75 bps rate hike at 77.5%, while for a 100 bps at 22.5% at press time.

The specter of rate hikes and a looming recession have not spared the dollar either, which has been inversely correlated with cryptocurrencies lately. The dollar index, a measure of the greenback’s strength against a basket of currencies, traded 0.08% lower at 106.40 at press time.

Edward Moya, a senior market analyst with OANDA, noted the stack of macroeconomic fundamentals working against Bitcoin in a note seen by Benzinga.

“Cryptocurrencies are broadly weaker as investors await an FOMC decision that will likely conclude with a 75 basis-point rate increase and reaffirm a commitment to fighting inflation.”

Delphi Digital said that going forward, there are two important timeframe levels for investors. If Bitcoin breaks above the current price range of $20,000 to $24,000, “high time-frame resistance” will come into play around the $28,000 to $30,000 region, it said.

“If [Bitcoin] breaks below the current range, we are likely looking at the $10K-$12K price range, with some possible front running in the $14K-$16K region,” Delphi Digital said in a note.

Cryptocurrency trader Michaël van de Poppe said “people really expect the worst” out of Wednesday — the final day of the FOMC meeting — ”but maybe the worst is already heavily priced in.”

People really expect the worst out of Wednesday, but maybe the worst is already heavily priced in.

— Michaël van de Poppe (@CryptoMichNL) July 25, 2022

An indicator that identifies a turning point in an asset’s price trend was used by Ali Martinez on Ethereum’s daily chart. The analyst said that TD Sequential presents a “sell signal.”

“A spike in profit taking that takes [ETH] below $1,550 could trigger a correction to $1,300.”

— Ali Martinez (@ali_charts) July 25, 2022

Ethereum’s gas consumption dominance by non fungible token activities has risen 6.2% since November, while that of decentralized finance applications fell from 27.5% to 15.1%, said Glassnode, an on-chain data focused company.

#Ethereum relative gas consumption dominance by NFT activities has grown 6.2% since November, showing a continued market preference for NFT transactions.

— glassnode (@glassnode) July 25, 2022

Meanwhile, the dominance of DeFi applications has declined from 27.5% to 15.1%.

Live Chart: https://t.co/2UTVHIyjhm pic.twitter.com/2aAIQ39l2n