Major coins remained rangebound around psychologically important levels Monday evening as the global cryptocurrency market cap retreated 0.85% to $934.25 billion at press time.

See Also: How To Get Free NFTs

Cryptocurrencies continue to shadow Wall Street where stocks “can’t win right now,” according to Edward Moya, senior market analyst with OANDA.

“Either the economic data softens and the economy is much weaker than we thought or robust readings pave the way for the Fed to be more aggressive with their inflation fight,” wrote Moya in a note, seen by Benzinga.

“The mood for risky assets is to fade all rallies, which means Bitcoin should remain trapped in its tight trading range a little while longer.”

Cryptocurrency trader Justin Bennett said Bitcoin lagged the S&P500 in the latest run-up. “We've seen this before. The moment stocks start to roll over, [crypto] is likely to dump,” tweeted the analyst.

$BTC continues to lag the S&P 500 on this run-up.

— Justin Bennett (@JustinBennettFX) June 27, 2022

We've seen this before. The moment stocks start to roll over, #crypto is likely to dump. https://t.co/wWRgD4C8N6

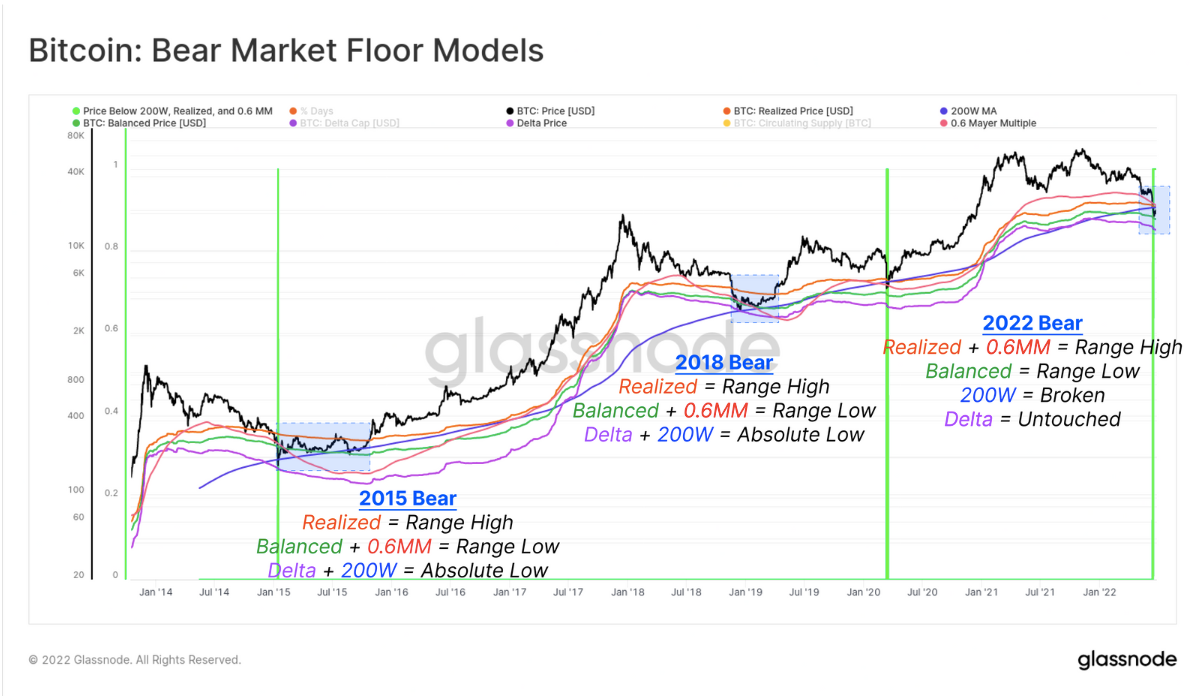

Data from Glassnode indicates that the Bitcoin spot price is trading below various models developed from both technical and on-chain foundations to gauge bear market lows.

Glassnode pointed out that Bitcoin at $21,300 traded below the Realized Price ($22,500), the 0.6 Mayer Multiple band ($23,380), and the 200 Week MA ($22,390), and recently broke below the Balanced Price ($17,980).

Bitcoin:Bear Market Models — Courtesy Glassnode

“Only 13 out of 4,360 trading days (0.2%) have ever seen similar circumstances, occurring in just two prior events, Jan 2015 and March 2020,” wrote the on-chain analysis company in a blog post.

As the weekend rally faded, a trend of traders shorting altcoins and flocking to Bitcoin emerged, according to a tweet from Santiment.

As prices gradually fell on Sunday, traders have shown that though they may proclaim to be #buyingthedip, they are #shorting more on these mini drops. Interestingly, this only applies to #altcoins right now, indicating that #Bitcoin is being flocked to as the safe haven. pic.twitter.com/4bikBRij5j

— Santiment (@santimentfeed) June 27, 2022

Chartist Ali Martinez said Bitcoin must close above $21,820 for a chance of further advance, as there aren’t any “significant supply barriers ahead.”

Martinez said in a tweet that BTC “also needs to keep $20,800 as support for the bullish outlook to be validated. If not, then expect a downswing to $19,000.”

#Bitcoin | Data shows $BTC must close above $21,820 to have a chance of advancing further. Notice there aren't any significant supply barriers ahead.#BTC also needs to keep $20,800 as support for the bullish outlook to be validated. If not, then expect a downswing to $19,000. pic.twitter.com/yYNdWoN02x

— Ali Martinez (@ali_charts) June 27, 2022

On the Ethereum side, the important area is between $1,140 and $1,170, according to cryptocurrency trader Michaël van de Poppe. If the second-largest coin cannot hold those levels it could slip to $1,060.

Important area for me on $ETH is the area between $1,140-1,170.

— Michaël van de Poppe (@CryptoMichNL) June 27, 2022

Would like to see it hold if we want to see further upwards momentum.

If not -> $1,060 area next to me. pic.twitter.com/d5ILDSfUxf

Read Next: Veteran Investor Thinks Bitcoin Provides Good Cues For Stock Market Bottom

Editor's Note: This story was updated to remove a table carrying inaccurate market data of multiple leading cryptocurrencies. We regret the error. [June 28, 10:29 p.m. ET]