It’s been a brutal year for anything considered a risk-on asset, and bitcoin and cryptocurrencies more broadly are no exception.

The group has been hammered, while some of bitcoin’s biggest advocates — like Cathie Wood and Elon Musk — have been steamrolled via their own assets, like the ARK Innovation ETF (ARKK) and Tesla (TSLA).

Of course, the blowout from the FTX scandal didn’t help, as trust must be at or near an all-time low for crypto.

As for bitcoin specifically, the charts don’t look all that constructive.

I’m not a doom-and-gloom type of person. But after years of working in technical analysis, you can get a pretty good sense of a good trend vs. a bad trend with a glance at the charts.

In time, bitcoin might well rebuild a constructive upside trend. For now, the charts don’t look good.

Trading Bitcoin

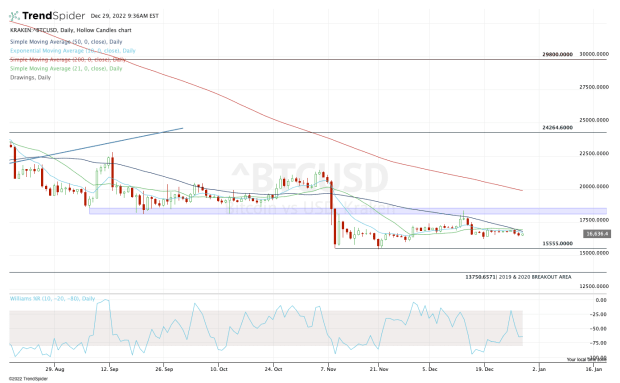

Chart courtesy of TrendSpider.com

How can a trader make a snap observation on a chart? In the case of bitcoin, take note of two things.

First, it’s below all its daily moving averages, ranging from the 200-day down to the 10-day. That shows that both the active trend and the long-term trend have been bearish.

Second, the prior support zone between $18,000 and $18,500 failed, then turned to resistance.

From here, though, we can strategize.

So long as bitcoin is below all its daily moving averages, the recent low near $15,500 remains vulnerable. We’ve seen that level hold twice now, but can it hold as support again if it’s tested?

If it can, traders have a line in the sand to trade against. If not, it opens the door down to the $13,750 area, which is the prior breakout zone from 2019 and 2020.

On the upside, let’s see if bitcoin can get a daily close above its 10-day, 21-day and 50-day moving averages, say $17,000.

If it can do that, it would technically open the door back up to the $18,000 to $18,500 zone.

I don’t know that bitcoin has bottomed; if I'm forced to estimate, experience tells me it has not.

The trends are still bearish, and bullish traders must remain defensive and tactical when trading bitcoin.

Expert Investing Insights Are Just a Click Away.For a limited time, save $200 on actionable market insights from your own team of money managers, traders and experts. Hurry — this offer won’t last!