After seven weeks of consecutive inflows, digital asset investment products saw $110 million worth of net outflows last week.

What Happened: In the latest edition of its Digital Asset Fund Flows Weekly Report, CoinShares found that $80 million worth of outflows were from North America alone. CoinShares believes these outflows may have been a response to the U.S. Presidential Executive Order on digital assets.

Bitcoin (CRYPTO: BTC) investment products saw $69.6 million in outflows for the week, while Ethereum (CRYPTO: ETH) recorded a $50.6 million outflow. Overall, the two leading crypto assets recorded $120 million in outflows.

Bitcoin investment funds saw $1 billion in volume last week, down from the average $1.24 billion, representing just 5% of total bitcoin trading volumes, stated CoinShares.

“Regulatory concerns and geopolitics remain at the forefront of investors’ concerns for digital assets,” said the firm.

While some large-cap altcoins, including Solana (CRYPTO: SOL), Ripple (CRYPTO: XRP), and Polkadot (CRYPTO: DOT) saw minor inflows of $300,000, $700,000, and $900,000 respectively, Cardano (CRYPTO: ADA) and Litecoin (CRYPTO: LTC) recorded $200,000 worth of inflows over the week.

See Also: https://www.benzinga.com/money/how-to-buy-cardano-ada/

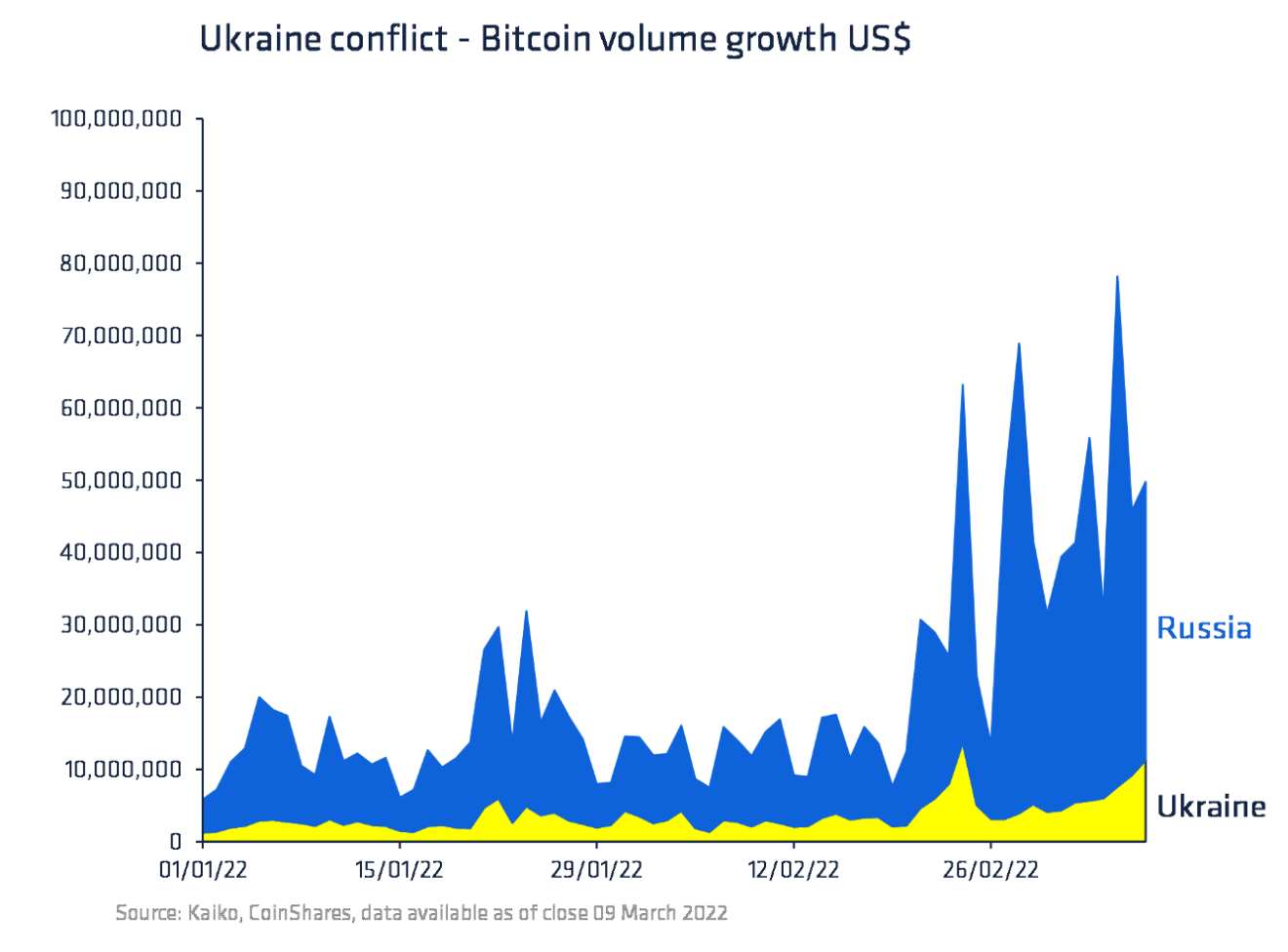

Last week, CoinShares noted another report that crypto trading volumes in Russia and Ukraine had risen sharply since the conflict between the nations escalated.

“Combined, Russia, and Ukraine have seen daily trading volumes rise to $80m/day at times. This has predominantly been against the crypto pairs USDT and BUSD, commonly used US Dollar stable coins (crypto coins that are pegged to the US Dollar), but we have also seen significant amounts of Bitcoin and Ethereum used too,” read the report.

Price Action: At press time, Bitcoin was trading at $38,812, up 0.56% in the last 24 hours. Ethereum was trading 0.88% lower at a price of $2,549.