Normally, you get into this time of May and the big crush of earnings reports eases off, giving investors a breather in time for the Memorial Day Holiday.

Not this year. This week brings a number of market-moving earnings reports that bulls hope will fuel a continuation of last week's big rally.

In addition, two big housing reports will show whether the residential real estate market is showing signs of life.

Related: Housing has a problem bigger than interest rates

Last week saw the major indexes hit new highs, including the Dow Jones Industrial Average's dramatic last-second push Friday to close above 40,000 for the first time.

The index finished up 134 points, or 0.3%, to 40,003.59. The Dow had crossed 40,000 briefly on Wednesday but fell back. It moved lower on Thursday, and only a feverish rally in the waning moments of Friday's trading pushed the average to its new closing high.

There's an irony in the Dow's big close. The index counts just 30 stocks. Nvidia (NVDA) isn't a member, though Apple (AAPL) , Amazon.com (AMZN) , Microsoft (MSFT) and Salesforce (CRM) are.

And its year-to-date gain is 6.1%, compared with just under 11.2% for both the S&P 500 and the Nasdaq Composite.

But right now, the Dow's levels are little frothy. The Dow's relative strength index finished the week at 70.4. The index measures how fast the price of something is moving.

A reading above 70 suggests a stock is overbought and, at the least, might be a warning that continued gains might be harder to obtain.

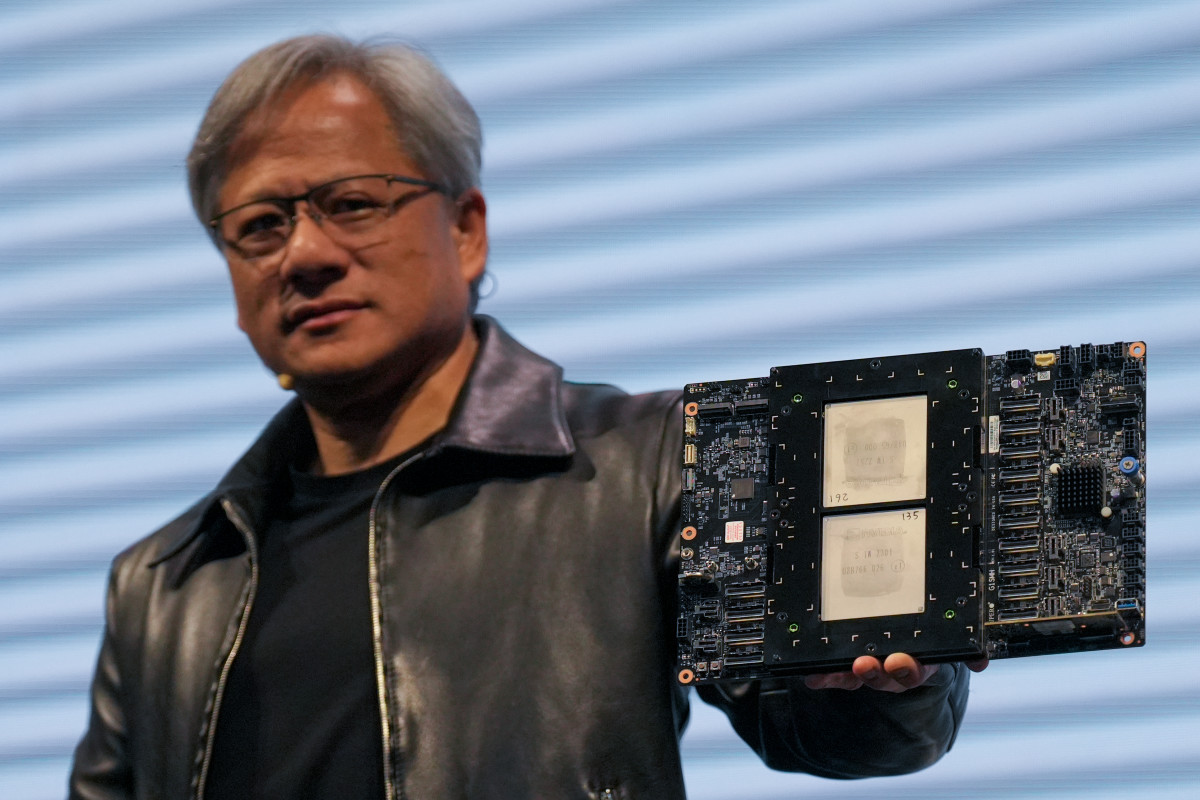

Nvidia takes center stage — again

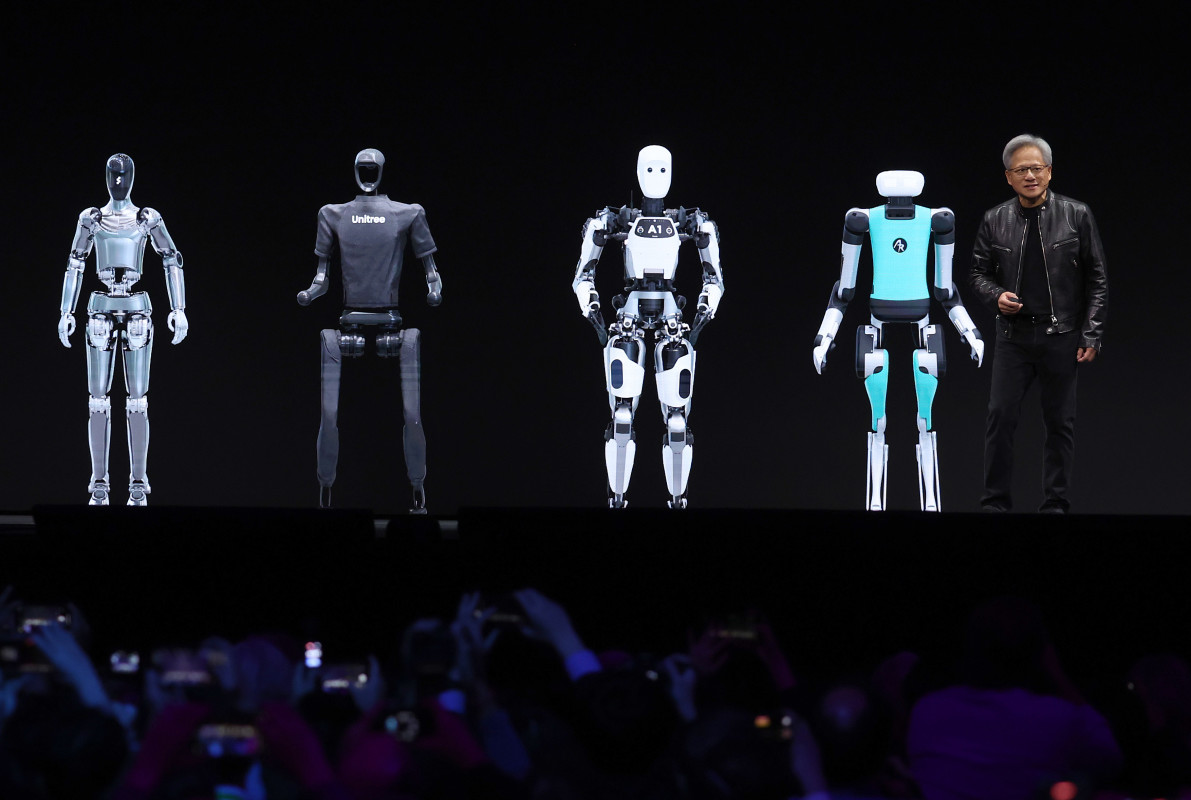

Since the beginning of 2024 — and 2023, for that matter — Nvidia has been the market's star. Interest in its March technology conference was intense. Co-Founder Jensen Huang was treated to a profile on CBS's "60 Minutes" program a few weeks later.

Related: Nvidia earnings will be crucial to stock market zeitgeist this week

This week, Nvidia will command total investor attention again.

That's partly because its market capitalization is the third largest among U.S. companies, trailing only Microsoft and Apple.

But most important Nvidia reports fiscal-first-quarter earnings after Wednesday's close. Analysts are estimating $5.57 a share in earnings, up 468% from 98 cents a share in the year-ago quarter.

The revenue estimate is $24.6 billion, up 277% from $6.52 billion a year ago.

The company is the most powerful player in chips developed to handle the demands of artificial intelligence applications.

The stock jumped 239% last year and, in March it hit a 52-week high of $974. Right now, at $924.79, the stock is up 86.7% this year.

Beating the earnings estimates by a lot is critical. Nvidia's per-share earnings have beaten Wall Street estimates each of the past four quarters by an average 19.5%.

Just meeting estimates would disappoint investors. An actual earnings miss would be a totally unexpected shock, and the news surely will hit the stock hard — and probably the entire stock market.

There's an additional matter.

A substantial beat would increase the drumbeat for the company to split the stock, as Walmart did earlier this year.

Nvidia, in fact, has split its stock five times since 2000, the last a 4-for-1 split in July 2021.

If you'd bought 100 shares in June 2000 and held on through all the splits, you would have 4,800 shares. That stake would be valued about $4.4 million.

So, yes, attention to Nvidia will be paid Wednesday afternoon.

Target, Lowe's, Palo Alto Networks, Workday also on tap

Along with Nvidia, investors will also study results from Target (TGT) , home-improvement retailer Lowe's Cos. (LOW) , Palo Alto Networks (PANW) , Workday (WDAY) and others.

Target reports Wednesday, a day after Lowe's. Both companies will offer a lot of insight into the current health of the consumer right now.

The core market for both companies is middle-class consumers. Both have commented that those customers have been decidedly cautious this year.

Target shares are up 12.4% this year, despite its worries. One reason is that Wall Street is applauding its restructuring moves over the past two years.

More on markets

- Stanley Druckenmiller forecasted Nvidia's rally; now he has a new target

- Analysts revise Walmart stock price targets after earnings

- Analyst reboots Palo Alto Networks stock price target before earnings

The average estimate for Target is $2.05 a share, flat with a year earlier. The revenue estimate is $24.5 billion, down slightly from a year ago.

Lowe's shares are up 3.9%, for the year, but the shares fell heavily in April. The cause: fears that the home-improvement market might be stalling out because mortgage rates are holding back home sales. (Shares of rival Home Depot (HD) also fell in April.)

Analysts don't disagree on either company's cautious outlook. The quarterly estimate for Lowe's is $2.94, down from $3.67 a year ago. Revenue of $21.1 billion would be off 2% from a year ago.

Palo Alto Networks' primary customers are more than 70,000 organizations in more than 150 countries trying to defend their networks against computer thieves, aka hackers.

The core product is a platform that includes advanced firewalls and cloud-based offerings that extend those firewalls to cover other aspects of security.

The stock is up 7.8% this year. The estimate for third-quarter earnings is $1.25, up from $1.10 a year ago. The revenue estimate is $1.97 billion, up 14%.

Workday. The software company's primary product is a financial-and-human resources management system, used by companies big and small.

The stock is down 6.6% this year, and investors have been betting the company will show a turnaround. The first-quarter earnings estimate is $1.59 a share, up 21% from a year earlier. Revenue of $1.97 billion would be up 20% from a year ago.

Pay attention to this week's big housing reports

Home sales are a big piece of how the U.S. economy works.

You buy a house, and you promptly buy other stuff: bookshelves, sofas, appliances, new lighting, paint and maybe a new lawnmower.

If home sales fall, the supplementary activity may dry up.

Sales of existing and new homes have been stagnant because of higher mortgage rates. The rate on a 30-year mortgage is at about 7%, down from about 7.5% in early April. The annual savings to a homeowner who has taken out a $280,000 mortgage is about $1,200 in interest.

So maybe the mortgage-rate drop will give a little boost to the National Association of Realtors' report on existing-home sales, due Wednesday. The consensus estimate is for April sales to run at an annualized rate of 4.18 million homes, down from a 4.19-million annualized rate in March.

The Commerce Department will issue a report of new-home sales on Thursday. The consensus estimate is for a 680,000 annualized rate.

Wall Street will cheer if either set of numbers is better than expected. The downside may be a delay in Federal Reserve rate cuts.

Related: Veteran fund manager picks favorite stocks for 2024