Nvidia shares edged higher on Aug 15 as traders sifted through a host of regulatory filings that updated the portfolio holdings of some of the world's biggest investors.

Nvidia (NVDA) shares are down 4.4% for the quarter after their stunning first-half advance of around 150%. Still, the AI giant remains one of the market's key sentiment barometers heading into the year's final months as investors look to its second-quarter earnings later this month to consolidate the AI demand story.

Some of Wall Street's biggest investors, however, appear to be looking elsewhere for their exposure to AI stocks, although many of the top funds that attract retail, retirement, and index-tracking investors continue to add the name to their portfolios, according to the latest batch of 13-F filings from the Securities and Exchange Commission.

Investment funds with more than $100 million in assets must notify the SEC regarding portfolio changes quarterly.

The reports, known as 13-F filings, are backdated to the end of the previous quarter. While they do not include the full scope of holdings nor possible bets against a particular security, they do provide a glimpse into the strategies of some of the world's biggest investors.

Big names sell Nvidia stock

Three big names appeared to have slashed their exposure to Nvidia last quarter, including David Tepper's Appaloosa Management, which dumped around 3.7 million shares, or 84.4% of its holdings, over the three months ending in June.

The stock now represents around 1.4% of his $17.3 billion portfolio.

Stanley Druckenmiller's Duquesne Family Office unloaded around 1.5 million Nvidia shares, representing around 88% of his holdings in the stock, while activist investor Elliott Management sold a small 50,000 holding in the chipmaker.

Soros Fund Management, the investment vehicle founded by billionaire investor George Soros, also exited Nvidia, selling around 217,000 shares.

Related: Top analyst puts Nvidia stock on key list after $500 million slump

On the buy side, State Street purchased $76.6 million Nvidia shares, with the stock now representing the second-largest holding in its $2.29 trillion portfolio behind Microsoft (MSFT) .

Vanguard, meanwhile, added $11.4 million in Nvidia shares, making it the number three holding. In comparison, BlackRock purchased a net $16.9 million shares, pegging Nvidia as the second-largest holding (again behind Microsoft) in its massive $4.4 trillion portfolio. State Street, Vanguard, and BlackRock manage large exchange-traded funds that track the major market indexes as a key part of their business.

Nvidia Q2 earnings in focus

Nvidia will publish its highly anticipated second-quarter earnings on August 28. Analysts expect its bottom-line profits to rise by around 137% to 64 cents per share, with revenues more than doubling from the same period last year to $28.55 billion.

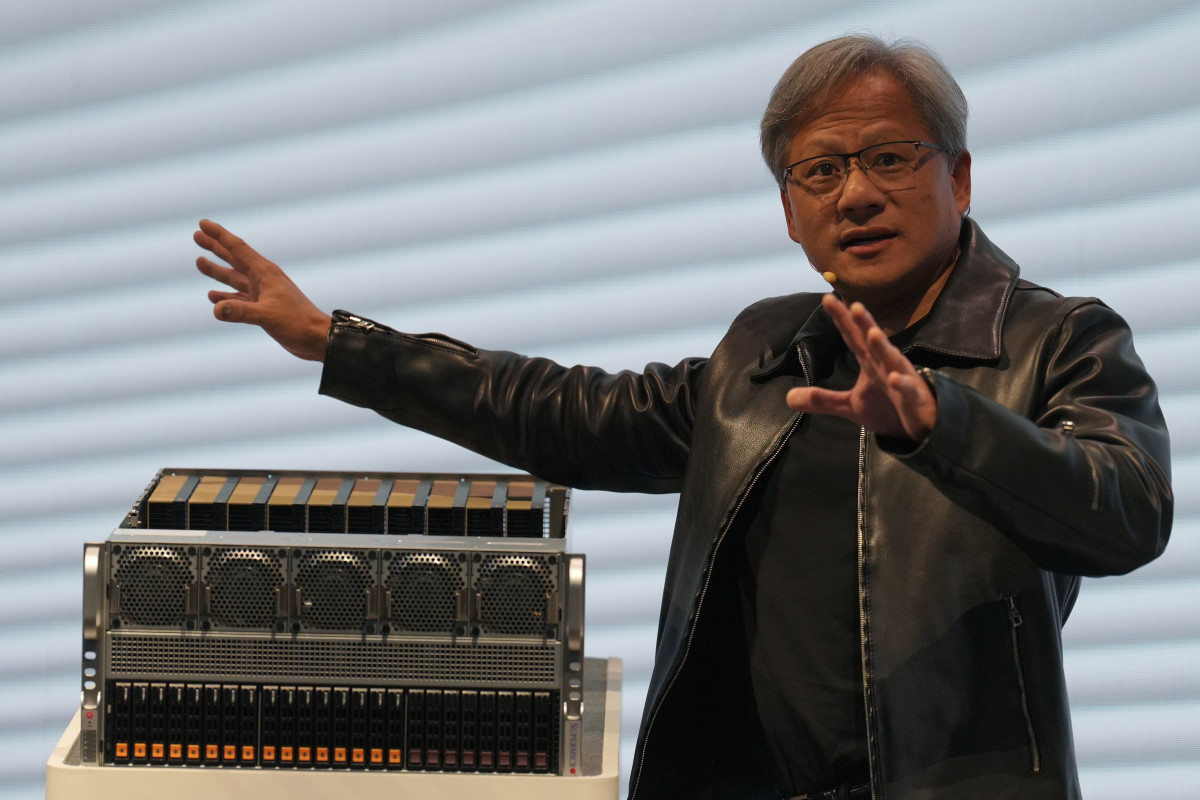

However, investors will be focused on reports that delivery of its newly launched line of Blackwell processors, which are meant to be faster, cheaper, and more efficient than its H100 'Hopper' predecessors, could be delayed due to design flaws.

Analysts had expected Blackwell to generate revenue for Nvidia starting in the third quarter and find their way into global customer data centers by the year's final three months.

Related: Nvidia stock tumbles in tech slump amid questions over key chip

AI demand and Nvidia's commanding market share are predicted to drive the group's data center revenue as high as $150 billion next year, powered largely by this year's Blackwell launch.

Some analysts are also starting to question the pace of AI spending from hyperscalers such as Microsoft, Meta Platforms (META) , Amazon (AMZN,) and Google parent Alphabet (GOOGL) and the resultant demand for the high-end chips and processors produced by Nvidia.

Hyperscalers, the major providers of massive data centers and cloud services, are, in fact, poised to spend around $500 billion over the next two years building out their massive infrastructure, according to estimates from Barclays, as they leverage their massive datasets to enhance sales of everything from drive-through dining to the most complicated pharmaceutical testing.

More AI Stocks:

- Nvidia stock tumbles in tech slump amid questions over key chip

- Microsoft exec warns of an ongoing problem

- Apple earnings top forecasts, iPhone sales slip ahead of AI launch

A recent report from S&P Global estimated that AI spending will grow by more than 20% through 2028 and will then represent around 14% of all IT spending, more than double its 2023 total.

"Cloud giants are heavily investing in AI despite uncertain monetization timelines, with combined capital spending for Microsoft, Alphabet, and Meta up 60% year over year," said S&P Global's technology director Christian Frank.

Nvidia shares were last marked 0.65% higher in premarket trading, indicating an opening bell price of $118.85 each.

Related: Veteran fund manager sees world of pain coming for stocks