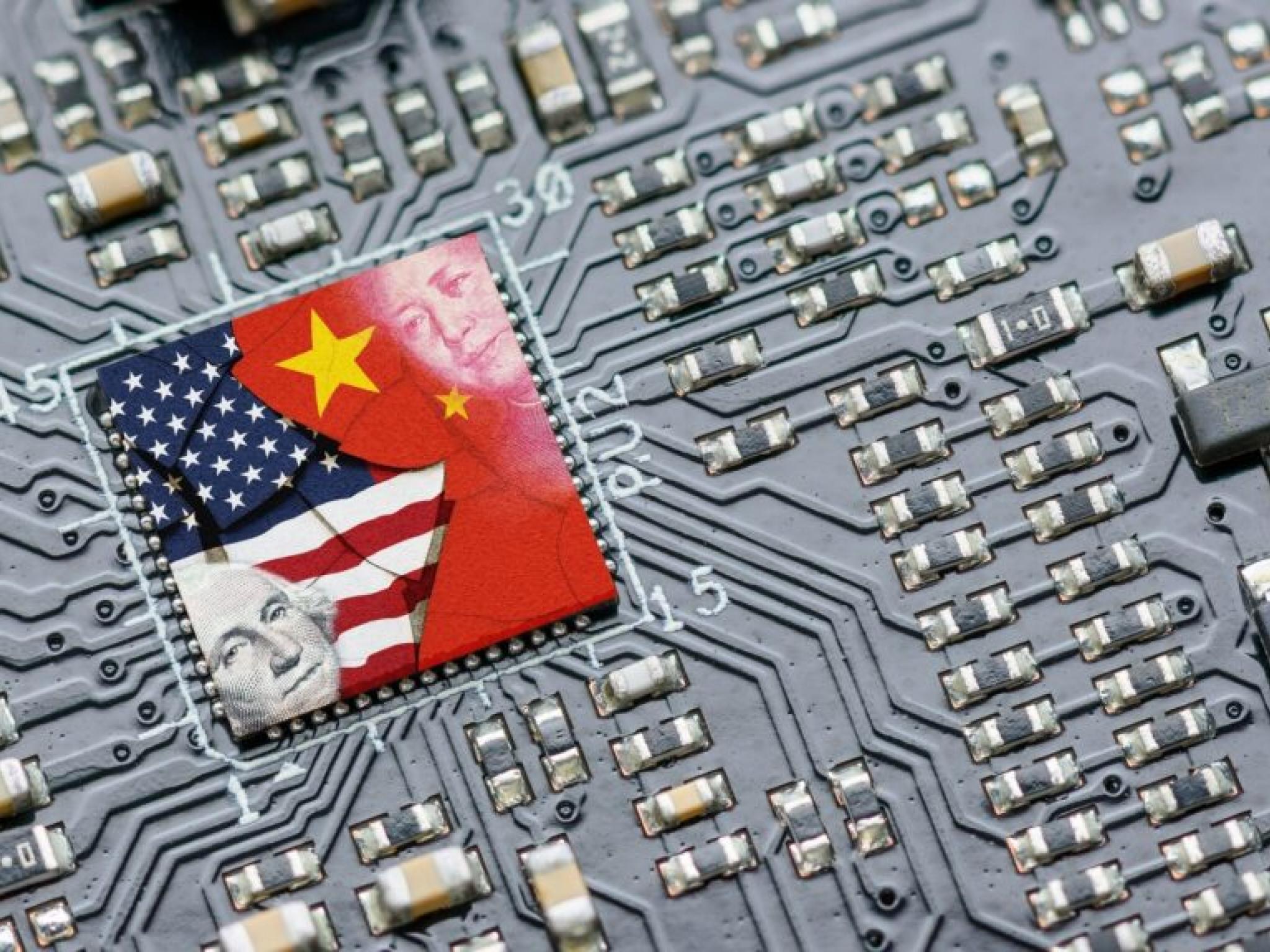

On Monday, the outgoing Biden administration will implement its third crackdown on China’s semiconductor industry within three years, citing the same national security threats as reasons it mentioned for its prior sanctions, intensifying geopolitical tensions between the countries.

The initiative, launching Monday, will impose export restrictions on 140 Chinese entities, including chip equipment manufacturers such as Naura Technology Group and other firms, targeting advanced memory chips and chipmaking tools.

Nvidia Corp (NASDAQ:NVDA) stock is trading lower on Monday. Prior reports indicated Nvidia’s potential to earn $12 billion in sales from 1 million H20 GPUs in China in 2024.

Also Read: Stellantis To Suspend Production Of Fiat 500 EV At Turin Plant Again: What’s Going On?

Reuters reports that the restrictions will also affect Chinese chip toolmakers Piotech and SiCarrier Technology and shipments from nations like Singapore and Malaysia.

The package includes new controls on 24 additional chipmaking tools, software, and high-bandwidth memory chips essential for AI training and high-end applications.

Lam Research Corp (NASDAQ:LRCX), KLA Corp (NASDAQ:KLAC), and Applied Materials Inc (NASDAQ:AMAT) could face significant impacts alongside non-U.S. firms such as Dutch company ASM International (NASDAQ:ASML). These controls are part of a broader strategy to limit Beijing’s access to advanced technologies critical for its semiconductor sector.

Prior reports indicated that the U.S. proposed to go softer on China for the third semiconductor embargo following intense negotiations with allies like Japan and the Netherlands and American chip equipment makers.

Chinese entities added to the list include over 100 semiconductor and chipmaking toolmakers, two investment companies, and others linked to Huawei Technologies, a telecom giant pivotal to China’s chip advancements.

Companies on the list will require special licenses to receive shipments from U.S. suppliers, with most license requests likely to be denied.

The new rules also expand the foreign direct product rule, restricting exports from U.S., Japanese, and Dutch manufacturers to essential Chinese chip plants.

Due to agreements with the U.S., Japan and the Netherlands are exempt, which relieves ASML Holding N.V. (NASDAQ:ASML) and Tokyo Electron Ltd. (OTC:TOELY).

However, manufacturers in other nations, such as Israel, South Korea, and Taiwan, are affected, to the dismay of Taiwan Semiconductor Manufacturing Co (NYSE:TSM) and Samsung Electronics Co (OTC:SSNLF).

Investors can gain exposure to semiconductor stocks through the Invesco Semiconductors ETF (NYSE:PSI) and the SPDR S&P Semiconductor ETF (NYSE:XSD).

Price Actions: At the last check on Monday, NVDA stock was down 0.53% at $137.52 in premarket trading. LRCX is down 0.31%, and AMAT is down 0.32%. ASML is up 0.32%, TSM is up 2.32%.

Also Read:

Photo courtesy: Shutterstock