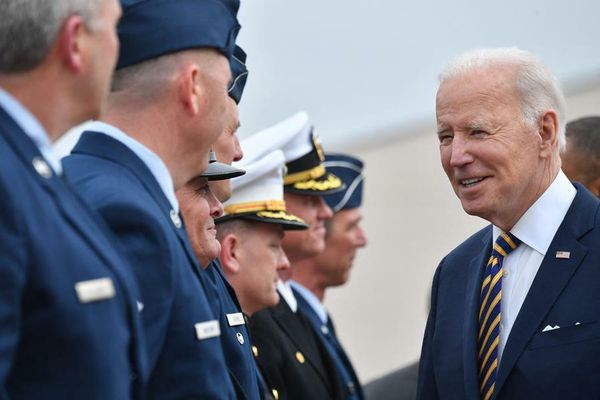

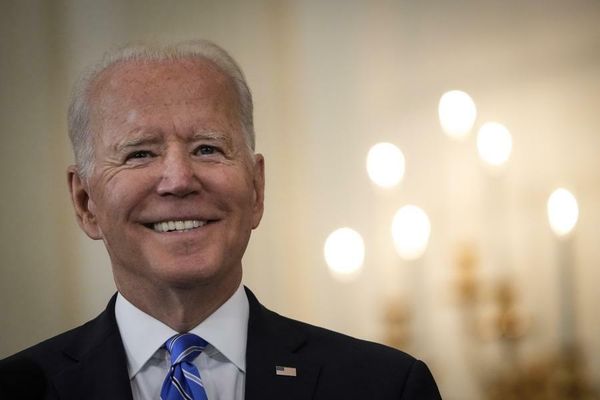

The Biden administration is looking increasingly likely to issue more student loan relief in the coming weeks and months. Here’s what it means for student loan borrowers.

Biden May Extend The Student Loan Pause

The Biden administration has given several recent indications that an additional extension of the ongoing student loan pause may be in the works.

Most federal student loan payments, interest accrual, and collections efforts have been suspended since March 2020, and that relief is currently set to expire on May 1. But last week, a top White House official indicated that a further extension of the student loan pause is under consideration. In addition, earlier this week the Department of Education instructed its contracted loan servicers to stop sending correspondence to borrowers about the resumption of repayment this spring, as first reported by POLITICO. And White House Press Secretary Jen Psaki told a reporter this week that the administration “will continue to review and assess” whether another extension of the payment pause is warranted as May 1 approaches.

There might be several reasons why Biden is considering extending the student loan pause again, including deepening inflation and rising gas prices. Officials have not indicated how long another extension might last, but with the midterm elections approaching in November, an extension of six months or longer may not be out of the question.

More Student Loan Forgiveness For Public Service Borrowers Is Coming

Earlier this week, the Education Department indicated that it has identified 100,000 federal student loan borrowers who may newly qualify for $6.2 billion in student loan forgiveness under the Public Service Loan Forgiveness (PSLF) program. Through the Limited PSLF Waiver program, the administration is temporarily relaxing key PSLF program rules and allowing past rejected payments to count under certain circumstances. This has resulted in a dramatically expanded pool of borrowers who are eligible for relief.

The Department has been working to identify borrowers who would qualify automatically without having to take certain actions, such as consolidating their loans or submitting a new certification form for their employment. These borrowers likely represent a significant majority of the 100,000 borrowers recently identified, although the Department did not respond to a request for clarification.

Other borrowers, however, may need to take certain steps to qualify for relief under the PSLF waiver. This includes borrowers with FFEL loans and Perkins loans, who may need to consolidate those loans via the Direct consolidation loan program, as well as borrowers who have not certified their public service employment by submitting key application forms. It is difficult to assess how many borrowers in this pool may qualify for student loan forgiveness, but Education Department officials have suggested that up to a million borrowers may ultimately benefit from the PSLF waiver.

Could Biden Enact Broad Student Loan Forgiveness?

Biden has said in the past that would support broader efforts to enact widespread student loan forgiveness, and administration officials have repeatedly said that he would sign a student loan forgiveness bill if Congress were to pass one. Biden supported earlier Congressional initiatives to cancel $10,000 in student loans for borrowers, although that legislation never passed. He also indicated he would support targeted student loan forgiveness for undergraduate borrowers who attended public institutions and HBCUs, but Congress has not passed legislation providing that relief, either.

Without legislative action by Congress, the only way for Biden to establish some form of broad student loan forgiveness initiative would be through executive action — something that many student loan legal experts and advocacy organizations say is allowable under federal law. But Biden and other key experts, as well as many congressional Republicans and some former Education Department officials, have expressed skepticism that sufficient legal authority exists under current federal law to allow a president to simply cancel student debt.

Last week, for the first time, White Officials suggested that some form of broader student loan forgiveness is at least under consideration. “Whether or not there is some executive action [on] student debt forgiveness when [student loan] payments resume is a decision we’re going to take before the payments resume,” said White House Chief of Staff Ronald Klain. His comments suggest that a decision on broad student loan forgiveness may either be coming within the next few weeks, or alternatively, that the payment pause will be further extended to allow the issue to be explored further.

Further Student Loan Reading

5 Reasons Why Biden May Actually Extend The Student Loan Pause Again

Biden May Extend Student Loan Pause And Is Considering Loan Forgiveness, Says White House Official

Denied Student Loan Forgiveness? Biden Administration Unveils Appeal Process

Thousands Of Jobs Qualify For Expanded Student Loan Forgiveness Program