President Joe Biden on Wednesday announced plans to forgive a portion of federal student debt for qualified borrowers and to extend the loan payment freeze until the end of the year.

What To Know: The Department of Education will provide up to $10,000 in federal student debt cancellation for individuals with annual income below $125,000 or married couples with combined income of $250,000 or less, according to a statement from the White House.

Up to $20,000 in debt cancellation will be made available to Pell Grant recipients.

Biden also announced the pause on federal student loan repayment will be extended one final time through Dec. 31 in order to ensure a smooth transition and prevent unnecessary defaults. Borrowers should expect to resume payment in January 2023.

The targeted relief is the first part of Biden's newly announced three-part plan.

As a second initiative, the Biden administration aims to make the student loan system more manageable for current and future borrowers by cutting monthly payments in half for undergraduate loans and fixing the loan forgiveness program.

The Department of Education is proposing a new repayment plan that caps monthly payments for undergraduate loans at 5% of a borrower’s discretionary income. This is expected to lower the average annual student loan payment by more than $1,000.

The Department of Education is also proposing a rule that would make sure borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government, receive appropriate credit toward loan forgiveness.

Lastly, the president announced plans to reduce the cost of college and to hold schools accountable when they raise prices. Biden also plans to continue to fight to double the maximum Pell Grant and make community college free.

"A college education is a ticket to a better life. But that ticket is too expensive," Biden said in a tweet following the announcement.

If all borrowers claim the relief to which they are entitled, the actions announced by Biden on Wednesday are expected to provide relief for up to 43 million borrowers, including canceling the full remaining balance for roughly 20 million Americans.

Lender Price Action: Navient Corp (NASDAQ:NAVI) shares are up 0.37% at $16.34, Nelnet, Inc. (NYSE:NNI) shares were down 0.57% at $85.61 and SoFi Technologies Inc (NASDAQ:SOFI) shares were up 4.59% at $6.45 in Wednesday afternoon trading.

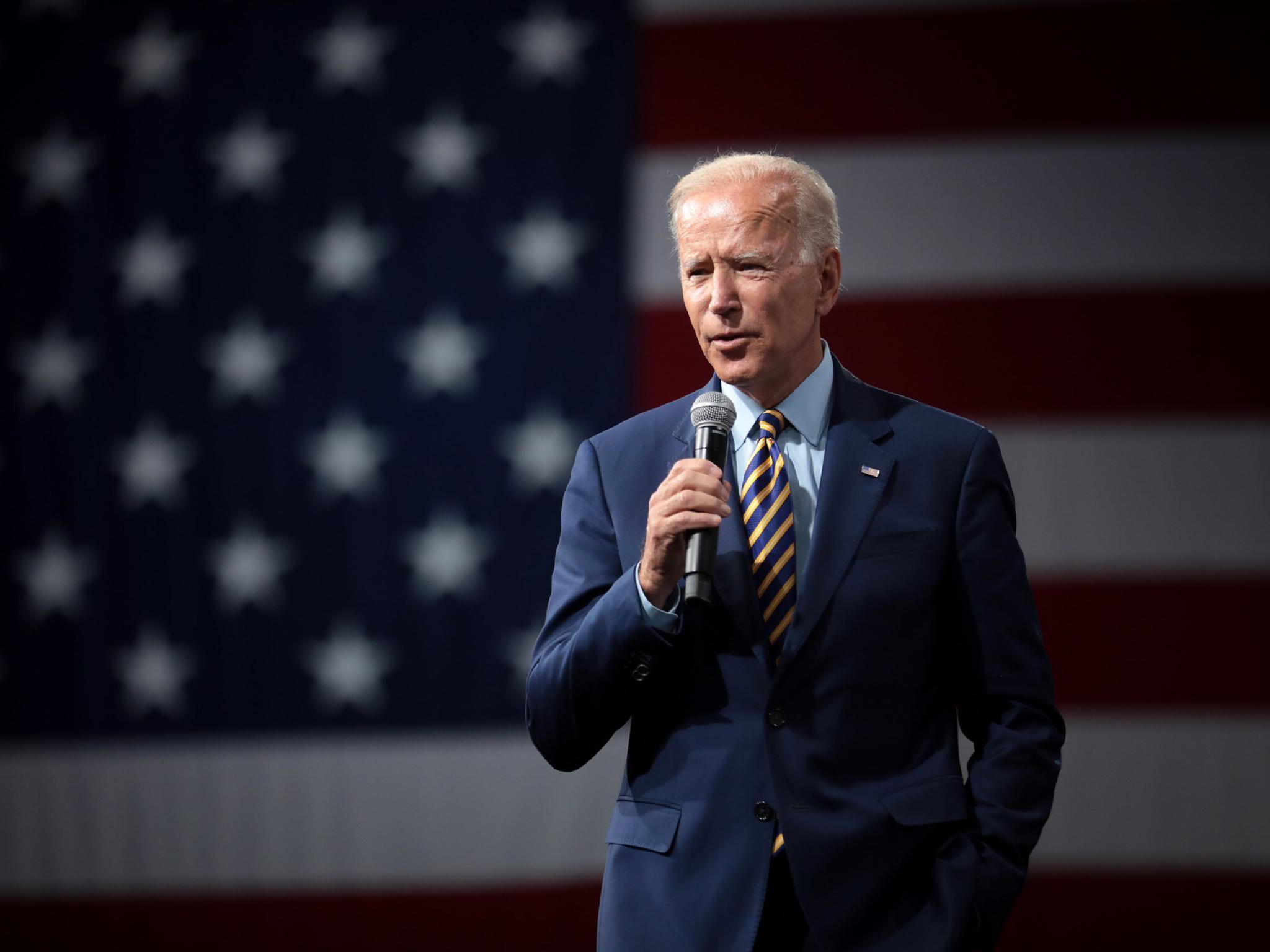

Photo: Gage Skidmore from Flickr.