Cryptocurrencies boomed during the pandemic, as many people worked from home and looked for things to do with their extra time (and make some money on the side). As a result, Bitcoin and Ethereum reached all-time highs in late 2021 before dropping significantly in 2022.

Now, the Biden administration is looking to curb any financial benefits companies gain by imposing a new tax on electricity used for cryptomining. According to the administration, cryptomining operations have an outsized impact on energy consumption in the United States.

So as part of its FY 2024 budget, the White House is proposing a 30 percent tax on the electricity used by cryptomining operations. The Digital Asset Mining Energy (DAME) tax would go into effect on December 32, 2023, and phase in, starting at 10 percent in the first year. The tax would increase to 20 percent during the second year and hit 30 percent in the third and subsequent years. It's estimated that the DAME tax could generate $3.5 billion in revenue within the first decade of enactment.

The White House claims that "the increase in energy consumption attributable to the growth of digital asset mining has negative environmental effects and can have environmental justice implications as well as increase energy prices for those that share an electricity grid with digital asset miners."

In other words, everyday citizens face the consequences of the increased energy demands from cryptominers in the form of higher rates to offset the costs of energy producers. However, the administration also notes that the volatility of cryptomining can have other consequences. "Because cryptomining is geographically mobile and the stability of the business model remains unclear, local utilities also face financial risks if they invest in upgrading capacity that may not be needed if mining activity ceases or moves away," the White House said in a press release.

The White House wants these energy hogs to foot the bill through higher taxes to combat this perceived threat. The hope is that the up to 30 percent tax will be enough to deter cryptominers in a market that has already seen profitability drop.

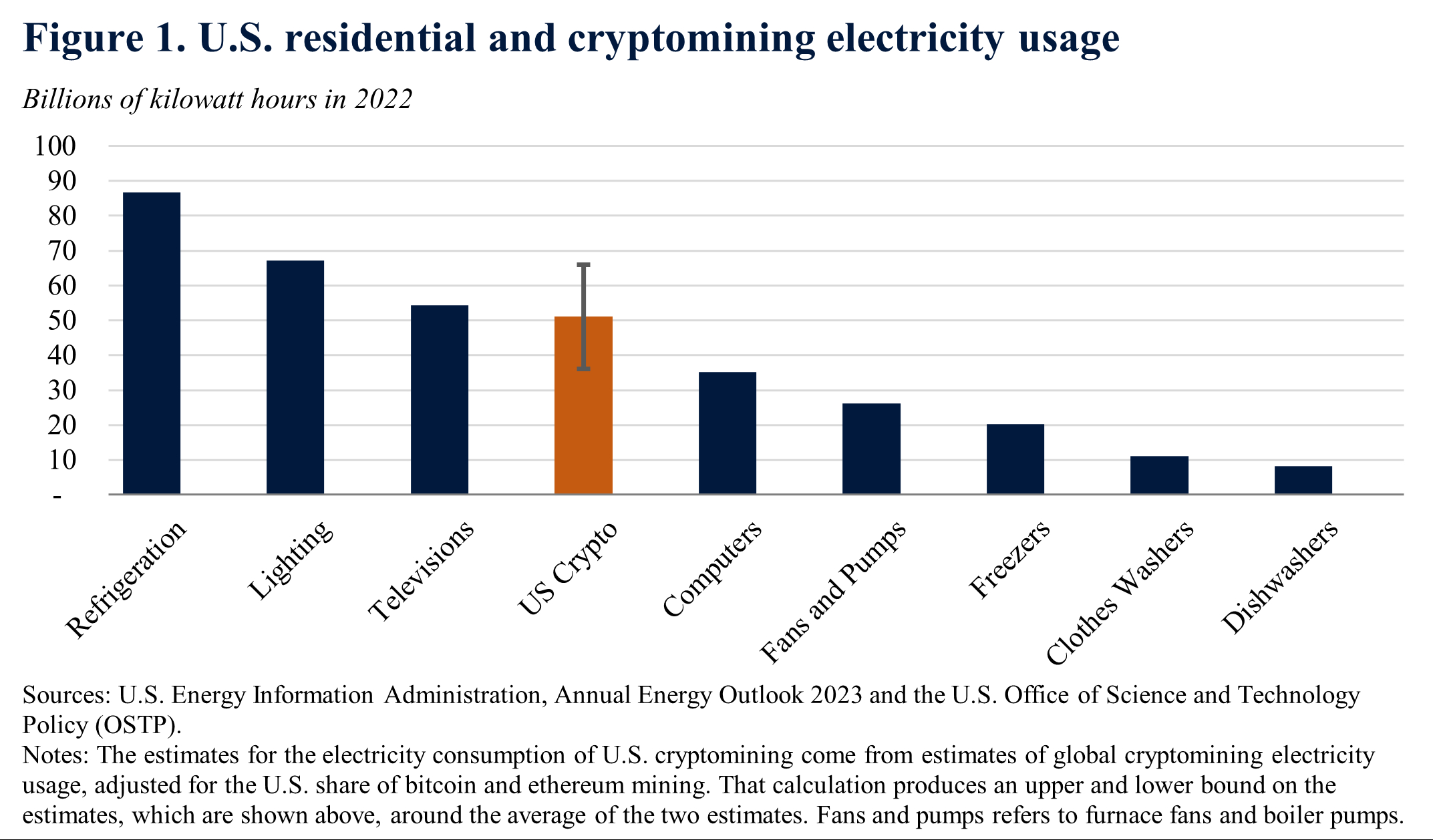

For example, figures from the U.S. Energy Information Administration show that refrigeration accounts for the majority of electricity usage at 85 billion kilowatt hours (kWh) in 2022. Lighting was second at around 65 million kWh, while televisions came in third at just over 50 kWh. The surprising entry on the list is cryptomining, which consumed 50 million kWh in 2022 and landed in the fourth-place spot.

To put those numbers in perspective, the 34 largest cryptomining operations in the U.S. consume enough electricity in one year to power three million homes. In addition, "Cryptominers' high energy consumption has negative spillovers on the environment, quality of life, and electricity grids where these firms locate across the country."

The economic benefits of cryptomining are dubious at best, with the White House arguing that it doesn't offer nearly the type of return on investment for communities as businesses that consume similar energy levels. Interestingly, firms would have to self-report the amount and value of the energy they consume specifically for mining. Those figures would serve as the tax base for the cryptomining operations.

Cryptomining was previously embraced by companies like Nvidia, which experienced widespread and lengthy graphics card shortages due to immense demand. Nvidia even developed GPUs specifically to target the cryptomining market. However, in recent months, even Nvidia has soured on the industry.

"All this crypto stuff, it needed parallel processing, and [Nvidia] is the best, so people just programmed it to use for this purpose," said Michael Kagan, chief technology officer for Nvidia, in a March 2023 interview with The Guardian. "They bought a lot of stuff, and then eventually it collapsed, because it doesn't bring anything useful for society. I never believed that [crypto] is something that will do something good for humanity."