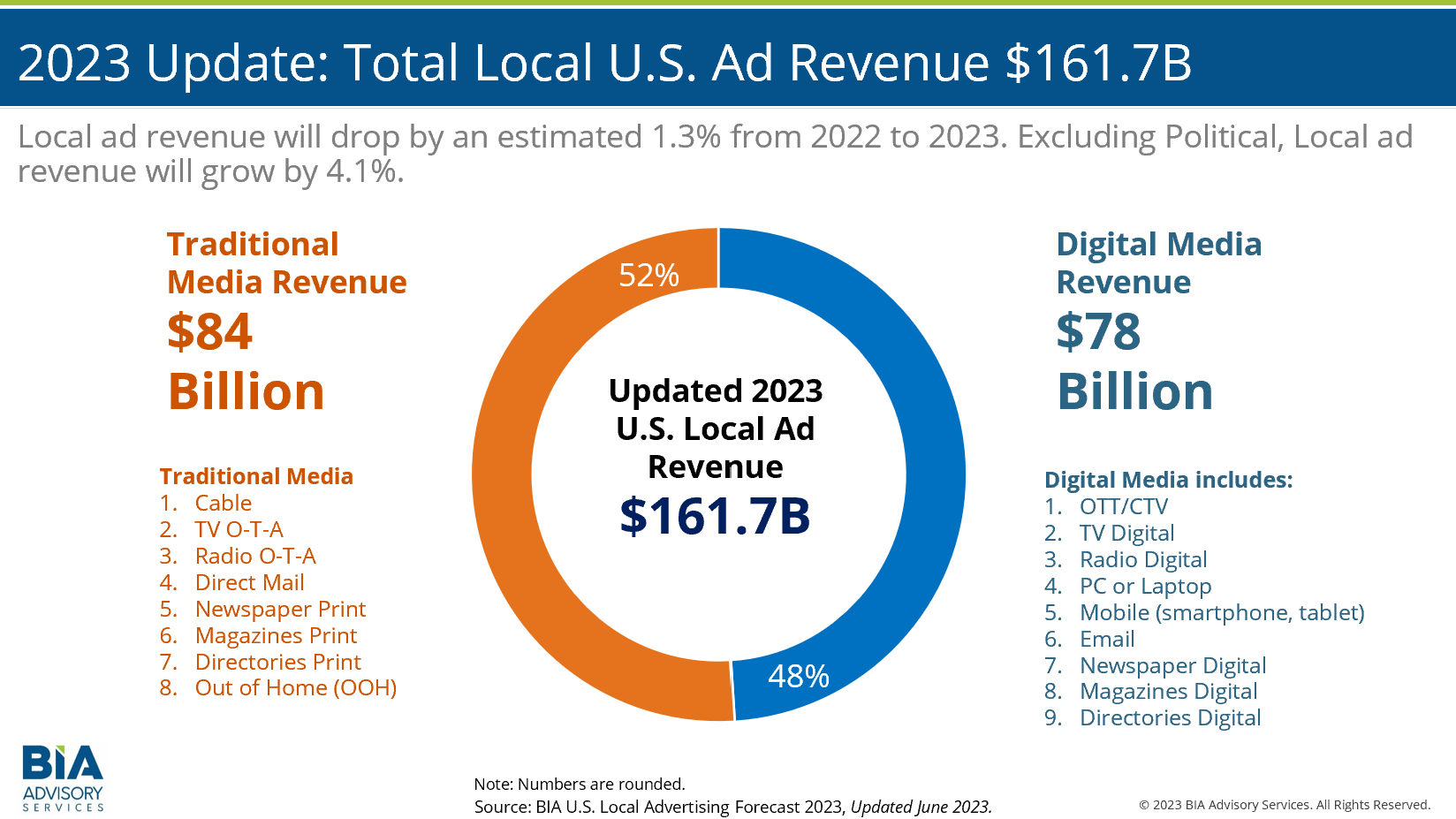

Local advertising is expected to total $161.7 billion in 2023, according to BIA Advisory Services, which lowered its earlier estimate from $165.7 billion.

The outlook was dampened by a decrease in digital advertising and a slow start for the economy this year.

Over-the-air broadcast TV is expected to grow 0.2% to $16.08 billion, while digital TV is seen growing 4.9% to $1.8 billion. Local connected TV/over-the-top is forecasted to be the fastest-growing media category, jumping 18.5% to $2.4 billion.

“Both linear TV and digital budgets are fueling the growth of CTV/OTT, as well as new dollars from publishers and aggregators that are using the channel to extend their programmatic platform to long tail businesses,” BIA’s managing director, Rick Ducey, said. “Both linear TV and digital budgets are fueling the growth of CTV/OTT, as well as new dollars from publishers and aggregators that are using the channel to extend their programmatic platform to long tail businesses.”

Traditional media is expected to generate $84 billion, little changed from BIA’s original forecast, while digital media revenue is now slated to hit $78 billion, down from the earlier forecast of $81 billion.

“After Meta, Alphabet and others lowered expectations for 2023, we examined local digital advertising spending revenues over the first six months of the year and determined a reduction was necessary,” Nicole Ovadia, VP, forecasting and analysis at BIA, said. “After years of double-digit growth, we are seeing some headwinds that will have a significant impact on digital local advertising. For traditional media, while we’ve made changes to certain media and categories throughout our forecast, the total ad forecast for this segment remains consistent with our original expectations.”

BIA said that later in the year growth is expected in the auto category, particularly at Tier-3 new car dealers and repair services.

BIA is also raising forecasts for savings and credit institutions, plumbers and HVAC and real estate.

While political advertising will be a huge category in 2024, BIA anticipates some spending to begin later in 2023.

The updated local advertising forecast lowers estimates for online gambling, office supplies and stationery stores, auto & direct property insurance and health & personal care stores.