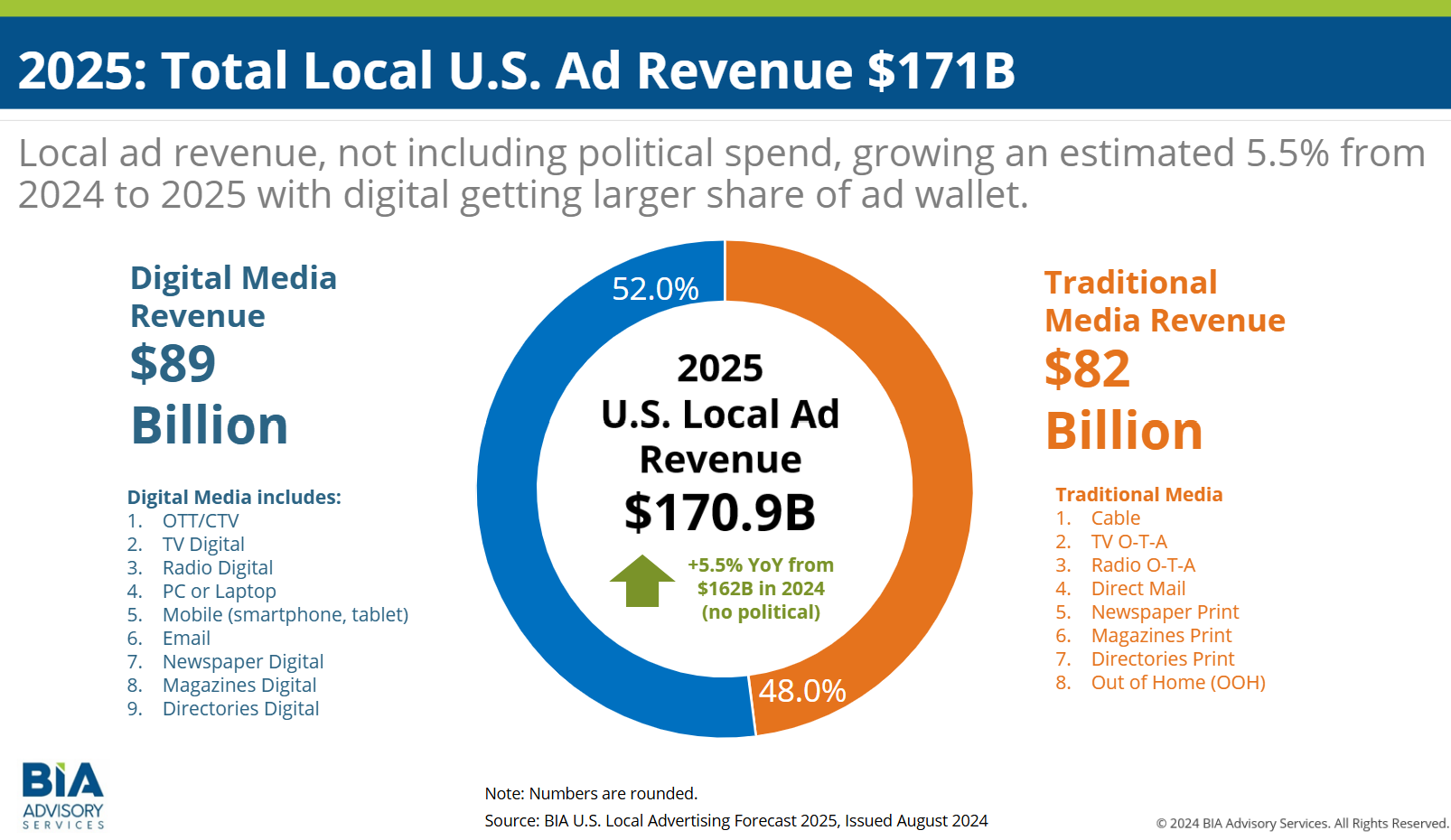

CHANTILLY, Va.—BIA Advisory Services has issued a new U.S. Local Advertising Forecast for 2025 that is predicting the local digital ad spend will surpass traditional media for the first time, with 52% of the total $171 billion local ad spend in 2025.

This represents an increase of 5.5 percent in non-political spending over BIA’s revised 2024 estimate. When including political advertising, the 2025 estimate represents a 1.3% decline from the revised estimate of $173.7 billion for 2024. In this forecast, BIA raised its 2024 local advertising estimate primarily due to an expectation of increased political advertising of $560 million.

As part of the revised forecast, BIA is now predicting that TV OTA will be $20.752 billion in 2024, up 28.1% from $16.203 billion in 2023. That is a 0.2% downward revision from the March forecast.

TV digital will hit $2.2296 billion in 2024, up 25.4% from 1.7778 billion. That is a 0.4% upward revision.

BIA did not provide breakdowns by sector for its 2025 estimates.

“With macroeconomic conditions impacting 2024 local advertising spending, it has been slower than anticipated, and we've adjusted this year’s forecast,” said Nicole Ovadia, vice president of forecasting and analysis, BIA Advisory Services. “We've refined our projections for local advertising, both with and without political advertising, to better reflect anticipated overall media spend and to offer a view in the advertising marketplace from different perspectives.”

The recent forecast update shows a small increase in expectations for local political advertising in 2024. BIA now projects $11.7 billion in spending this year, up $560 million from its previous estimate in March. This political spending estimate represents a significant increase of 21.3 percent over the last general election that took place in 2020. Local television continues to get the largest share of the spending.

At the same time, the firm projects that Connected TV/Over-the-Top (OTT) will receive much of the additional political ad dollars added to the mix.

For 2025, Ovadia noted that “If the Fed adjusts interest rates as indicated, post-Q1 2025 or early Q2, and inflation cools and the labor market settles out, we anticipate some economic relief by mid-year. This will boost consumer confidence and, subsequently, increase media ad spend. While we're optimistic, we're also being cautious with our projections at this early stage.”

In 2025, BIA’s forecast shows that digital’s share of total local advertising will be greater than traditional media’s share for the first time. Digital ad revenue will get 52 percent of the overall advertising spend at $89 billion compared to traditional advertising revenue that is slated at 48 percent of the ad spend at $82 billion.

Growing media in the forecast without political for 2025 include PC/Laptop (+13%)

, CTV/OTT (+9.1%)

, Out-of-Home (+5.9%)

, and TV Digital (+5.4%).

“In previous forecast rounds, we reported robust growth in CTV/OTT, but different factors have led us to moderate expectations around the speed of that growth,” BIA’s managing director Rick Ducey said. “One factor is that while streaming viewing is growing, there’s less available ad minutes in streaming versus linear TV. However, this channel continues to present valuable opportunities for advertisers due to how it combines the power of premium TV with the precision of digital audience targeting. Political and issue campaigns are tapping into this capability, and it will be interesting to unpack the use cases and outcomes.”

BIA’s local advertising forecast covers 12 vertical categories and 96 local verticals. Key vertical categories for 2025 include: restaurants (+9.5 percent); real estate (+6.7 percent); retail (+5.5 percent)

"Restaurants, Real Estate, and Retail – we’re referring to them as the Three Rs of 2025 – are ripe for expansion, and they all tie back to local advertising and media in meaningful ways. We'll be keeping a close eye on opportunities in both traditional and digital ad spend across these verticals," Ovadia noted.

Where to Get the 2025 U.S. Local Advertising Forecast

BIA ADVantage is the company’s local advertising revenue platform that delivers immediate access to its forecasts for all local television and radio markets for 16 media and 96 vertical categories. Clients can log into the platform to view the updated U.S. Local Advertising Forecast and their local market forecast updates. To purchase a subscription to BIA ADVantage, email advantage@bia.com.

The nationwide forecast can also be purchased on the company’s shopping cart here.