Auckland Councillor Maurice Williamson warned his fellow councillors that there’s plenty coming down the pipe – but how much debt headroom does the council actually need?

When Auckland Council’s governing body met to decide the final configuration of the budget, it began the meeting by being not-so-subtly discouraged by council staff from taking on further debt.

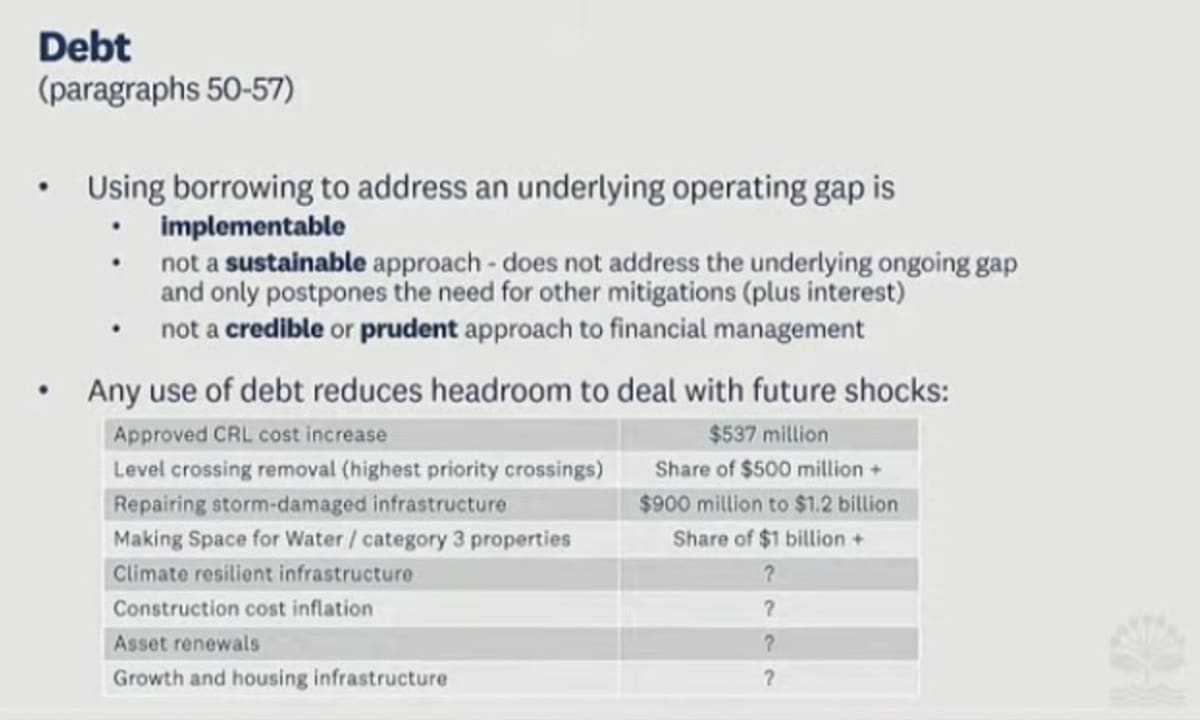

Council chief financial officer Peter Gudsell told Mayor Wayne Brown and the councillors any approach to addressing the council’s $325 million operating shortfall needed to be credible, sustainable, affordable and implementable – with further debt failing at least one of these tests.

READ MORE:

* 'Arduous and gruelling': tempers flare at budget decision

* Councillors pass budget after two days of debate

“It is implementable, but not a sustainable approach,” Gudsell said in his advice around borrowing more to address the budget hole. “It’s likely to be a short-term approach.”

In figures he presented to the gathered councillors, Gudsell played soothsayer in showing costs of at least $2 billion that the council may face across an undefined time period, necessitating a healthy bit of debt headroom. (Headroom being the buffer the council leads itself between its current debt and its declared debt limit.)

Indeed much of the debate last Thursday and Friday circled around just how unappealing each of Auckland’s councillors find debt. Brown was clear on his feelings, saying “to me, debt is the essence of financial mismanagement”.

Other councillors like Andy Baker of Franklin were “adamant” that climbing out of a financial hole on a ladder made of debt is “not only irresponsible but ... I believe it's a road to insolvency”.

The council’s more left-leaning representatives were keener to use debt to mitigate the risk of further cuts and to avoid asset sales.

Manukau ward councillor Lotu Fuli’s proposed amendment to the budget called for an increase in additional debt this coming financial year by $140m and a $20m one-off on top to pay for storm recovery.

Whether the downsides of debt were worth taking to keep the council's airport shares was one of the main dividing lines in the Town Hall, but Fuli’s amendment failed to pass.

Gudsell’s debt warnings may not have tipped the balance, but they certainly would have validated fears of councillors concerned about keeping ample headroom for debt in case of unexpected costs.

It makes sense that everyone is thinking of unexpected costs – it has been an unprecedented season for the council receiving unwelcome bills in the mail. But what are these costs that require the council to keep its debt headroom available?

First there’s the City Rail Link, which earlier this year estimated final costs at $5.493 billion.

Howick ward councillor Maurice Williamson said he’d been told the number was going to end up closer to $7.25 billion, although neither Auckland Council nor City Rail Link Limited would back up this claim.

Then there were the twin weather events of this summer, which have left the council with a bill that continues to shift and change.

If you squint optimistically, it’s a cost of around $900 million, but a less hopeful take will add around $1.2 billion, according to figures Gudsell presented.

Williamson warned his fellow elected members there could be plenty of potholes in the road ahead.

“A warning to you: there is so much coming down the pipe at us,” he said. “And that debt ratio is already near the ceiling. So please, please look at trying to bring that back down.”

He said house buyouts out west were going to require a “whole chunk of debt”.

Just this week, the council has sent out the first batch of letters to 700 property owners, placing them in the Government’s new categories of storm-damaged property.

The details of who will pay for the buyout process on Category 3 homes are still being worked out, although the Government has made a commitment to provide some funding: $100m was put aside in this year’s Budget to help.

Finance Minister Grant Robertson has signalled councils will need to pitch in, too.

“The Government is committed to assisting local councils to find solutions for those who have been affected,” he said. “As I have said many times we cannot meet all the costs, particularly knowing that we will see more extreme weather events like this.”

The council expects to pay an indeterminate share of $1 billion for category 3 properties and its new ‘Making Space for Water’ initiative, a wide-ranging plan that will see disaster resilience prioritised in the maintenance and construction of council assets.

Gudsell also included a share of $500 million or so that will go into the removal of level crossings around the Auckland rail network.

Level pedestrian crossings are currently being removed to make the city’s rail system safer.

Safety regulations curtail the frequency of train services running through a certain number of level crossings. Removing the crossings means more trains will be allowed to run per hour – a desired outcome particularly for the Western Line, which the City Rail Link will feed into.

Crossing removal is pegged at around $50,000 per location. With seven crossings currently in the crosshairs (four on the Western Line and two on the Southern), the construction bill would add up to around $350,000.

However, the council has reported potential costs of level crossing work at $500m plus, without a clear indication of the scope of the project – this could be the removal of level road crossings across a lengthy span of time.

Other costs like asset renewal and inflation affecting construction costs were also thrown into the mix, although costs for these are at this point not even given an estimate.

These 'future shocks' add up to at least $2 billion, although the wide estimates and the columns in the table with nothing but a question mark mean the crystal ball remains maddeningly murky, especially for councillors making tough decisions about asset sales and council borrowing.

Some of these future shocks aren’t so shocking anymore – the City Rail Link numbers were presented in June, so would perhaps more reasonably be labelled “recent past shocks”. But if Williamson’s numbers stack up, they represent a hefty increase to the tab.

With many of the shared costs yet to go through negotiations, it seems both central and local government are in the awkward position of sitting around a restaurant table after an expensive meal waiting to see who will pick up the tab.

Even if central Government shells out the bulk of costs, local government will likely be expected to cover the tip.

A doom and gloom approach on coming costs certainly helps to sell the idea of asset sales to those on the fence, but asset-sale opponents in the council last week were not easily swayed.

Early last Thursday, Fuli asked council staff to reiterate what they found in their feedback from local boards.

Fourteen of 21 local boards had voted for moderate debt increases, while five of them had supported an increase of debt beyond a $75 million level.

Manurewa-Papakura’s Angela Dalton said this wasn’t a business-as-usual budget, and as such some extra debt might need to be stomached.

“We’ve heard quite clearly from Aucklanders: they want us to use short-term debt, they want us to increase the rates, they want us to keep the shares and they want us to keep the services that mean so much to them,” she said.

But although Dalton and Fuli both tabled amendments that leaned harder on debt than asset sales, it was not to be, with 14 votes for a partial sale bringing the debate to an end.