I can’t hear the word “popular” without thinking of Wicked. So when a U.S. map highlighting search interest for exchange-traded funds flew across my desk like Elphaba, I had “Grande” thoughts.

In plain English, data from Google Trends shows that over the past 12 months, U.S. internet users have hungrily searched for information on the “best” ETFs of 2025. There have also been a healthy number of searches for “AI ETFs” and “Rare Earths ETFs,” and for ETFs investing in XRP (XRPUSD), the native crypto of the Ripple network. And if you think I can say much more about that last sentence, you don’t realize how old I am!

But that’s where the consummate educator in me comes out. I have seen decades of hot dots come and go. Something is popular, and then, like Elfie in the movie, falls out of favor. To the point where it is essentially banished from the minds of traders.

Hot ETFs Could Come Crashing Back to Earth… Remember This?

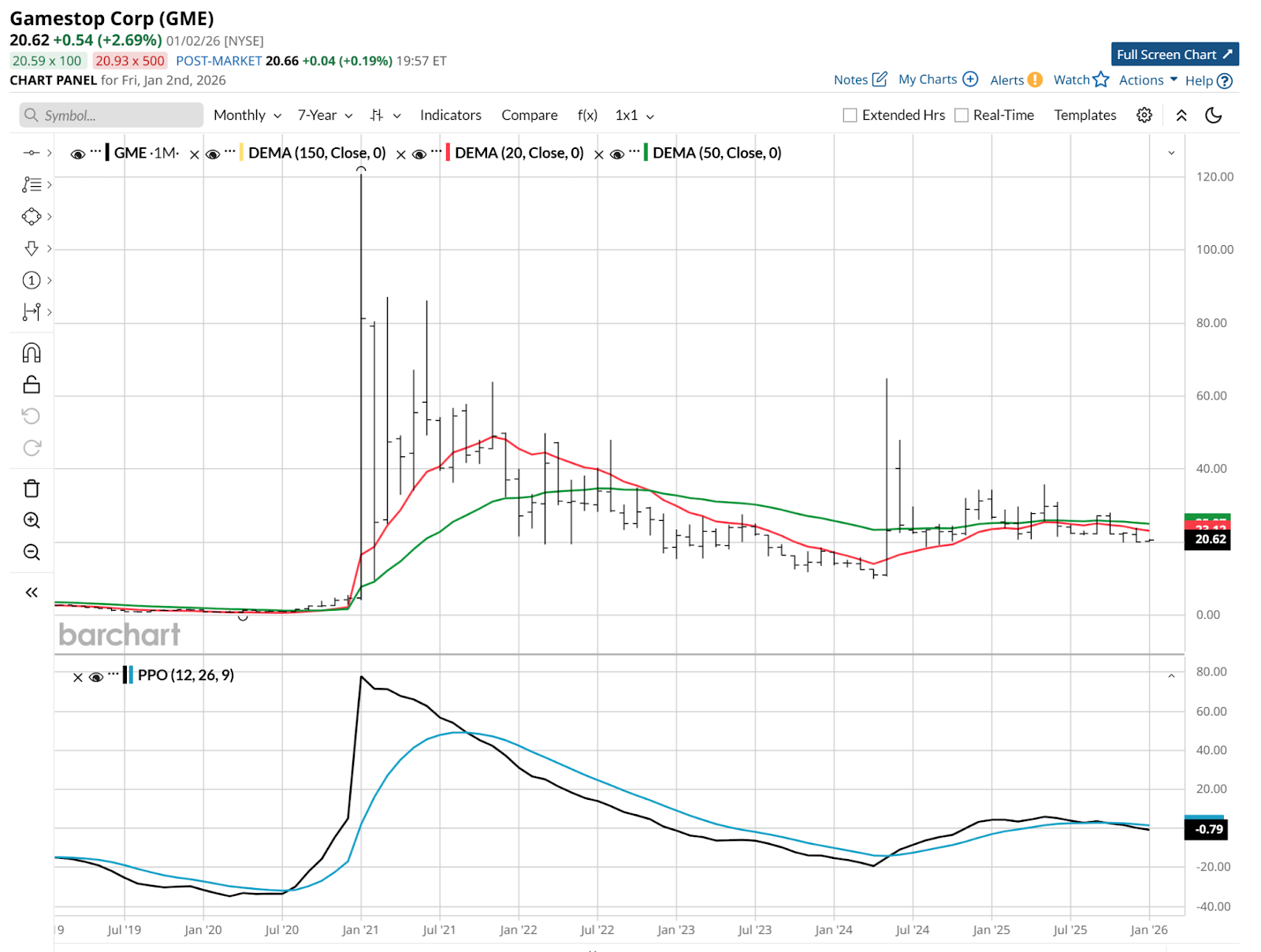

Gamestop (GME) sure made the list some years ago. In both directions. These days, those kitties just aren’t roaring anymore.

Let’s chart some of the other popular ones, to see if there’s anything interesting to fawn after. Usually that’s not the case, as the ETF has gone up in price so much, it is trading on thin ice. But maybe we can find some green in the land.

The Vaneck Rare Earth Strategic Metals ETF (REMX) was hot during parts of 2025, since these materials are critical for AI’s takeover of our daily lives. Compound that with where they are located, primarily in China, and you have the makings of a high demand/low supply balance. Which as I recall from my economics classes in college last century, means upward pressure on prices.

That’s where that spike move higher came from. REMX doubled in just a few months. But now what? It looks stalled, along with stocks and many commodities. But this is a time of high uncertainty, technically speaking. No easy path higher, and no strong signals of pending doom. But it is fair to say this is a rarer topic for buzzworthy online searches in 2026 than it was during 2025.

The Bitwise XRP ETF (XRP) missed being the first to cover that next-tier crypto by just a week. And since it is so new, I used a swing trader’s time frame for the chart. That’s a chart of 4-hour prices.

And in that context, it looks to have a decent shot to go higher. But I suspect that this is as much due to a rebound in crypto in general, rather than specifics regarding XRP.

The other factor is that each time a new type of crypto ETF debuts, tracking another coin, there’s likely to be demand. That allows traders who prefer not to invest in crypto directly, and do so in a listed, ETF wrapper, to get in via a more comfortable structure.

So, XRP is the latest “it” coin, if you will.

The Bottom Line: Buyer Beware

But be aware of popularity. It can feel friendly to start, then turn wicked overnight.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer. For more of Rob’s research and investor coaching work, see ETFYourself.com on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.