Comcast chairman and CEO Brian Roberts on Tuesday said his conglomerate will soon bundle its own streaming service, Peacock, along with Apple TV Plus and Netflix for Comcast Cable video and broadband customers at a "vastly reduced price."

Speaking at a conference conducted by equity research firm MoffettNathanson, Roberts didn't reveal what that price will be, or much in the way of any other details, although he did say the bundle will be called "Stream Saver." (Here's a Seeking Alpha transcript of Roberts' appearance.)

The announcement was immediately noted as a follow-up to last week's declaration by Disney and Warner Bros Discovery that Disney Plus, Hulu and Max will soon be available in a discounted bundle, as well.

“Following the Hulu-Disney-Max announcement last week, it’s not surprising that Comcast is following up with its own bundling plans that can help both Peacock and Xfinity broadband, offering great value to its customers," said Jason Cohen, co-founder and CEO of MyBundle, which works with broadband suppliers to bundle streaming video services for their customers.

"Broadband providers are in the strongest position to facilitate the re-bundling of streaming, but expect plenty more streaming-streaming and broadband-streaming bundles to come," Cohen added.

Of course, Stream Saver's quality and popularity will rests in the key details. But here's why we think Comcast's announcement surpasses Disney's -- it's in the churn.

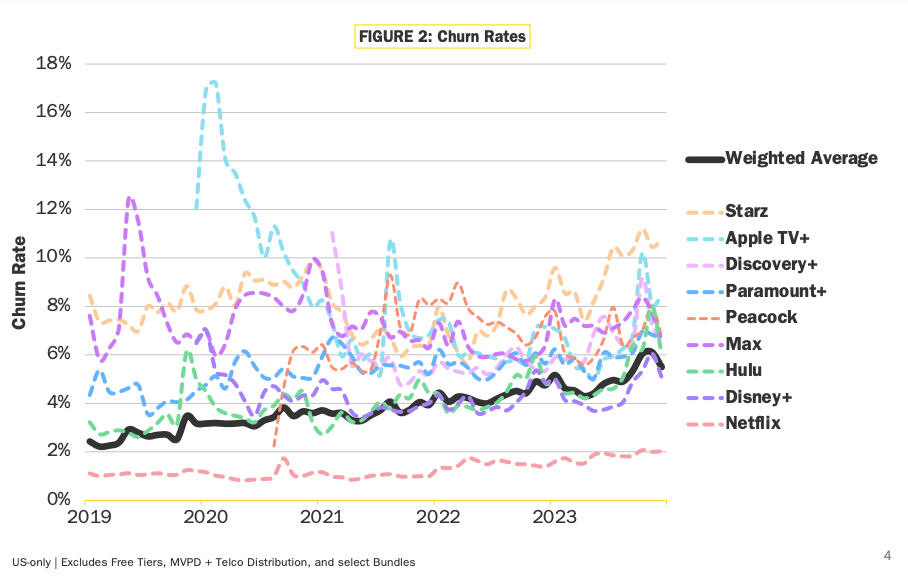

Netflix, which now has more than 80 million customers in the U.S. and Canada, has maintained an annual churn rate of less than 2% over the last five years, while the weighted industry average is at 5.5%, according to figures published in February by research company Antenna.

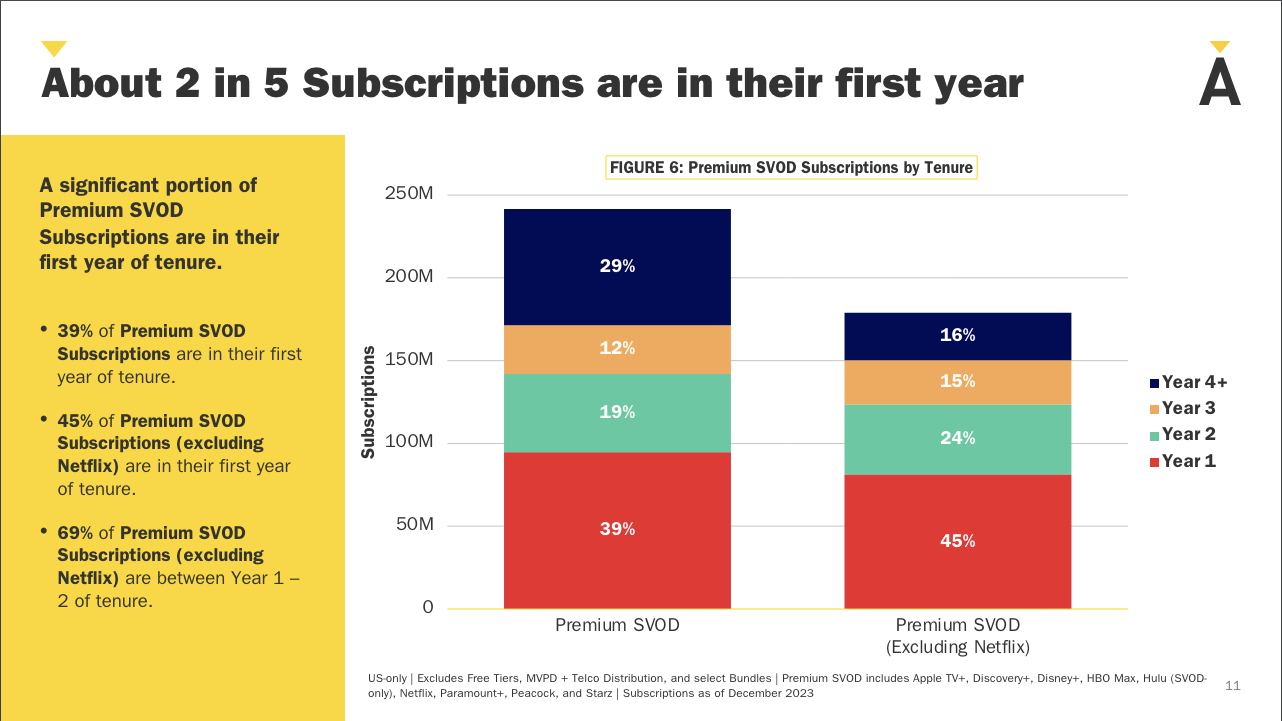

Antenna also measured how many subscribers stick with SVOD services over four years. With Netflix factored in, 29% of premium streaming service subscriptions are in their fourth year, on average, the research company said in its February State of Subscriptions report. Not factoring in Netflix, that number drops to 16%.

That resistance to customer quitting will undoubtedly help the $9.99-a-month Apple TV Plus, which has never published a subscriber count and has maintained one of the subscription video streaming business' highest churn rates, according to outside observers like Antenna.

The same holds true for Peacock, which ended the first quarter with 31 million customers while also maintaining an above-average churn rate.

Certainly, with Comcast losing 481,000 linear pay TV customers in the first quarter, hooking the monthly Xfinity TV bill to an SVOD service many American TV homes deem essential might ply some added resistance to cord-cutting, as well.