Whales with a lot of money to spend have taken a noticeably bullish stance on Microsoft.

Looking at options history for Microsoft (NASDAQ:MSFT) we detected 126 trades.

If we consider the specifics of each trade, it is accurate to state that 61% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $302,871 and 118, calls, for a total amount of $7,229,628.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $190.0 to $460.0 for Microsoft over the last 3 months.

Insights into Volume & Open Interest

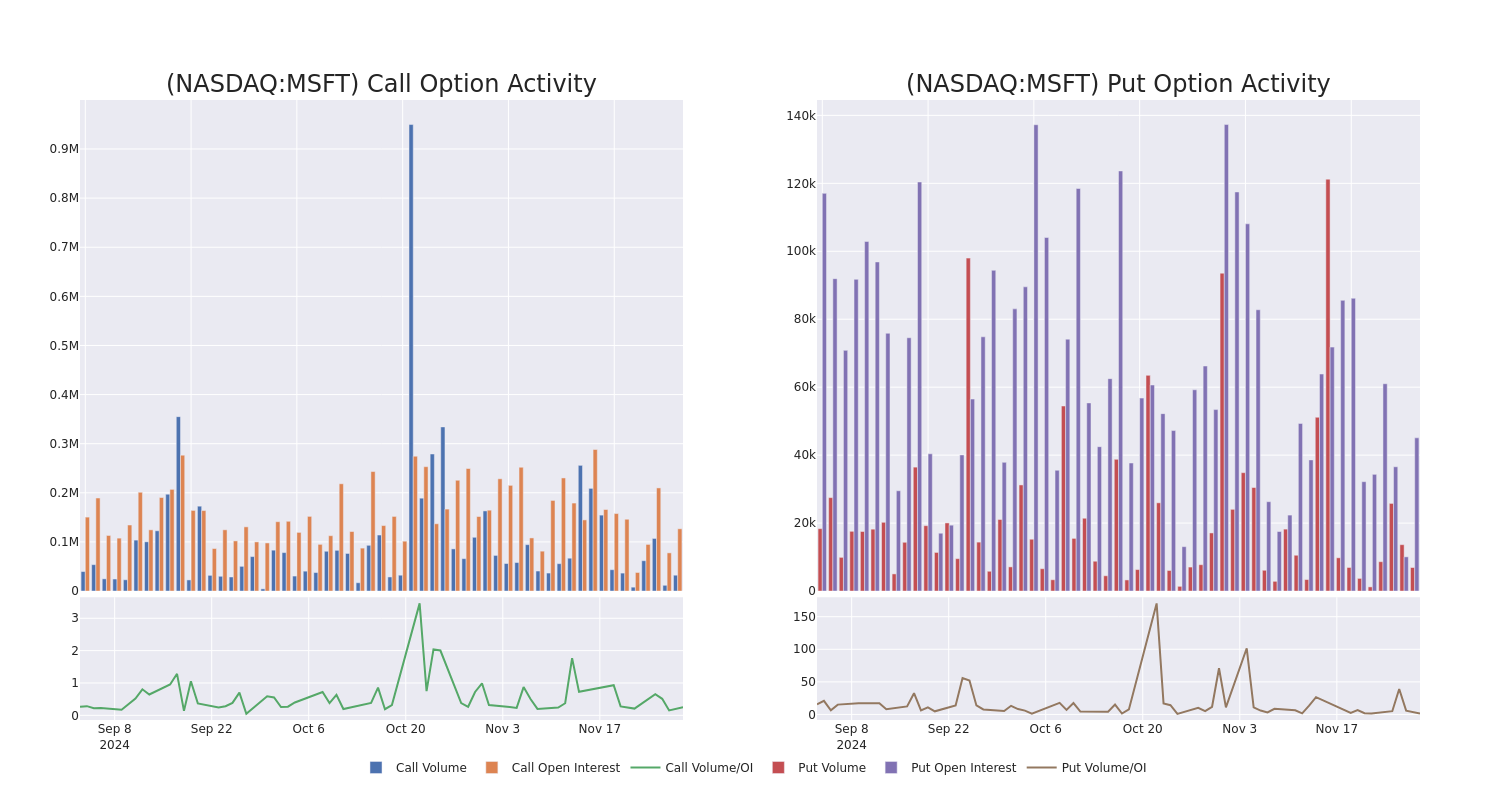

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Microsoft's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Microsoft's substantial trades, within a strike price spectrum from $190.0 to $460.0 over the preceding 30 days.

Microsoft Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | CALL | SWEEP | BULLISH | 01/17/25 | $76.7 | $76.55 | $76.7 | $350.00 | $138.0K | 7.0K | 33 |

| MSFT | CALL | TRADE | NEUTRAL | 01/17/25 | $48.4 | $47.8 | $48.13 | $380.00 | $120.3K | 4.8K | 45 |

| MSFT | CALL | SWEEP | BULLISH | 12/06/24 | $1.55 | $1.52 | $1.55 | $430.00 | $108.5K | 6.1K | 6.2K |

| MSFT | CALL | TRADE | BEARISH | 02/21/25 | $22.85 | $22.75 | $22.75 | $420.00 | $100.1K | 6.6K | 242 |

| MSFT | CALL | TRADE | NEUTRAL | 01/16/26 | $221.1 | $219.15 | $220.2 | $215.00 | $88.0K | 59 | 34 |

About Microsoft

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

Current Position of Microsoft

- With a trading volume of 16,259,550, the price of MSFT is up by 0.02%, reaching $423.08.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 60 days from now.

What The Experts Say On Microsoft

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $496.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Morgan Stanley persists with their Overweight rating on Microsoft, maintaining a target price of $548. * An analyst from Piper Sandler has decided to maintain their Overweight rating on Microsoft, which currently sits at a price target of $470. * An analyst from RBC Capital downgraded its action to Outperform with a price target of $500. * An analyst from JP Morgan persists with their Overweight rating on Microsoft, maintaining a target price of $465. * Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Microsoft with a target price of $500.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Microsoft options trades with real-time alerts from Benzinga Pro.