Bed Bath & Beyond (BBBY) wasn’t a meme stock to the extent that AMC Entertainment (AMC) and GameStop (GME) were, but that didn’t stop traders from squeezing it higher when the opportunity arose.

Because of the monstrous upside moves, Bed Bath & Beyond became a go-to short-squeeze candidate among the so-called Reddit traders and WallStreetBets groups. That's what investors were likely hoping for Wednesday morning.

As of Tuesday’s close, Bed Bath & Beyond stock had fallen a whopping 78% from its March high. It’s now down an additional 20% this morning after reporting disappointing earnings.

The company reported a worse-than-expected loss while its CEO is stepping down. In many ways, the situation here just went from bad to worse. Unfortunately, it came after a time of so much optimism, too.

Just a couple of months ago, Bed Bath & Beyond stock shot higher on reports that it would consider a sale proposal from RC Ventures — which had a near-10% stake and it is led by Ryan Cohen, the co-founder and former CEO of Chewy (CHWY) and the current chairman for GameStop.

A few weeks later, the Bed Bath & Beyond stock again popped, this time on reports that it had struck a deal with RC Ventures for three board seats.

Trading Bed Bath & Beyond Stock

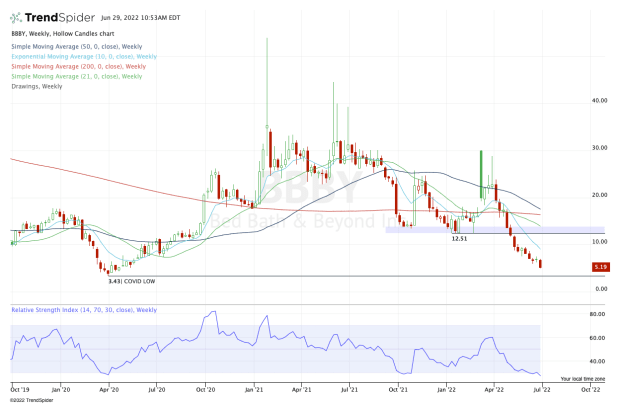

Chart courtesy of TrendSpider.com

None that seems to matter now, with the stock hitting its lowest price since April 2020. The share price has been eroding for months now, as Bed Bath & Beyond works on its eighth weekly decline in the last ten weeks.

From here, it looks like the Covid-19 lows from March 2020 are in play.

That comes into the picture at $3.43, but what catalyst exists to stop the decline? Cohen & Co. could do something or an acquisition could come about. However, supply chain issues are really plaguing Bed Bath & Beyond and even the best retailers are struggling.

In the face of a possible recession — and with many other higher quality assets on sale — investors in Bed Bath & Beyond can’t rely on a buyout to bail them out.

On the downside, the Covid-low is the level to watch. As for the upside though, bulls may have to rely on some type of short squeeze if they’re looking to unload their position.

Looking at the chart, it wasn’t that long ago that this name was between $25 and $30. It recently broke below $12.50 support and then lost the $10 level.

So it’s possible it sees some sort of pop from current levels. If it does, see how it handles active resistance via the 10-week moving average, then the $10 to $12 area. For now, those seem likely resistance zones.