Making some extra money from your hobby is a brilliant feeling. Fortunately for photographers, there's no shortage of potential clients willing to pay for your photography services, from shooting weddings for happy couples to interior architecture for realtors or product photography to video drone services.

The good news is you can pick up a lot of these jobs in your free time around your full-time working hours. The latest mirrorless cameras and optics can cost thousands of pounds, so using your spare time to earn some extra cash is a smart way to fund your next upgrade or photography trip.

It’s good to have a goal in mind. Are you happy with just picking up the odd freelance job on the side, or would you rather build up your experience and client lists so that you can eventually take your photography business full-time? It’s also not a bad idea to let your employer know about your photography, as many businesses need marketing materials, headshots or product photography – so your company may even be able to give you your first freelance job.

Even if you’re only applying yourself to it in your spare time, setting up a photography business can still be daunting. You will still need to make sure that everything is all above board when it comes to balancing your books and accounting. You’ll also need to be careful of working too hard, and making sure you regularly take a well-deserved break. In this article, we’ll cover some of the most important aspects to consider.

Keeping busy

Having a full-time job will provide you with a regular salary, enabling you to pick up some photography projects on the side. How much you work in your spare time is completely up to you, whether it’s a wedding once a month or studio photography sessions every weekend.

Be sure to spread the word around your workplace and colleagues: friends and family are likely to be your first clients when you’re first starting out. Word of mouth is an effective and low-cost way to pick up jobs, though if you need more work it’s worth considering marketing options such as advertising on social media. Make sure you have a professional website and Instagram displaying your best work, rates and contact information so customers can book you.

Part-time hours

Depending on how proactive you’ve been with your photography business, you may find that you have more clients approaching you with work than you’re able to fulfill in your spare time – which is certainly a nice problem to have. And hopefully, your photography business is more enjoyable (and more lucrative) than your full-time day job.

These are two great reasons to consider dropping your full-time hours to take on more photography jobs and build your photography business. Going part-time is a great way of still ensuring a guaranteed monthly paycheck and even pension contributions from your employer, while enabling you to build up the confidence and client contacts required to dive fully into self-employment one day.

Conflicting schedules

One of the biggest drawbacks you’ll face from a photography side-hustle is that you’ll be limited to doing shoots in your free time. If you work a regular nine-to-five job, that will usually mean just evenings and weekends – which can be frustrating.

If a photography job pops up that doesn’t fall in your usual spare time, you might occasionally need to use up some of your annual leave.

You’ll also have your family commitments to consider, such as caring for children or pets, which can sometimes be a balancing act. Your best bet is to be upfront and let your clients know what days you are and aren’t free, so that you’re not forced to make such a decision.

Keep on top of your books

Keep on top of your books with a spreadsheet that shows all your income and outgoings, and keep receipts of all your expenses so that you’re ready for your annual tax return. It also helps to have a well-organized invoicing system.

In the UK, if you aren’t already, you’ll need to register for a Self-Assessment tax return (see the www.gov.uk website). You’ll need to keep track of how much you earned from your full-time employment as well as your income and outgoings from your photography business, in order to calculate how much income tax and National Insurance contributions you need to make. You may even get money sent back to you if you’ve paid too much.

Working part-time, it’s unlikely that you’ll hit the £85,000 (taxable turnover) threshold at which your business would need to become VAT-registered – though it’s worth keeping in mind if you were to take your business full-time. If you’re in any doubt, it’s always worth paying for an accountant for professional advice: a good accountant will pay for themselves by finding savings across your business.

Don’t burn yourself out

If you’re known as the photographer among friends and family, it can feel awkward charging a fee. But remember that all your camera kit, hard drives, memory cards, insurance and other costs don’t come cheap – and that’s before factoring in your skill, experience and personal time.

In the early days, it’s okay to charge "mate’s rates" if it helps you build up your confidence and put together a portfolio, but you’ll want to start charging your full worth as soon as possible. Working overtime and not charging for it is a surefire way to burn yourself out.

It’s also vital to book in some R&R days and family time. Put days off in your calendar and stick to them – you need to be well-rested to perform at your top level. Use photography as a tool to relax, too; if you’re shooting high-pressure weddings as your side-hustle, try going out with your camera to take landscapes and unwind in nature.

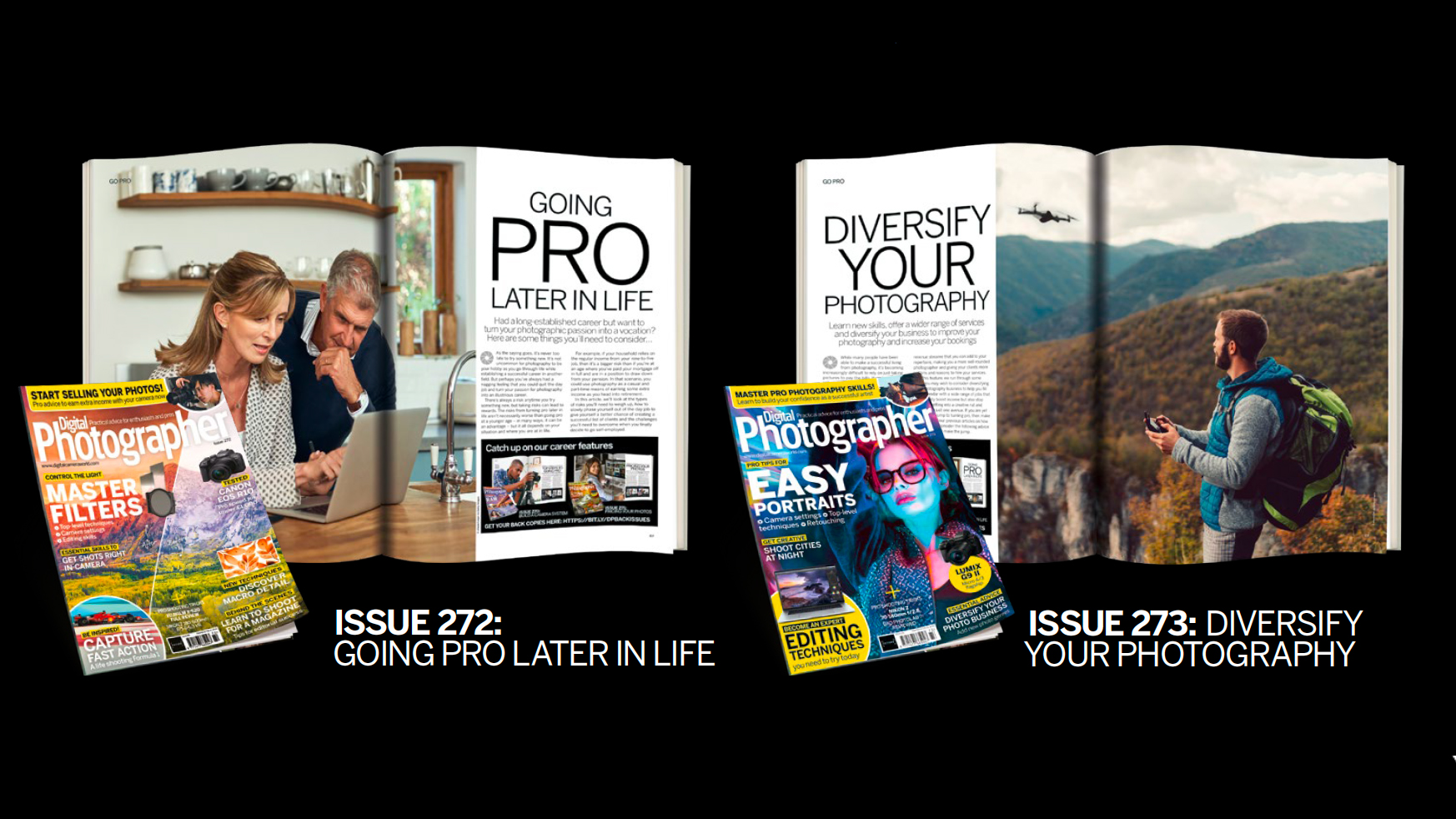

Catch up on our career features

Digital Photographer magazine has regular features on professional photography and navigating the business side. Get your back issues here.

If you're going to shoot professionally, you might be interested in the best professional cameras – along with the best cameras for wedding photography and the best cameras for portraits.