/Axon%20Enterprise%20Inc%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $43.1 billion, Axon Enterprise, Inc. (AXON) is a global public safety technology company that develops integrated hardware and cloud-based software solutions for law enforcement and other first responders. Its two segments: Software and Sensors, and TASER, provide products ranging from body and in-car cameras to conduct energy devices, digital evidence management, and VR training.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Axon Enterprise fits this criterion perfectly. The company serves law enforcement, first responders, justice organizations, and commercial customers.

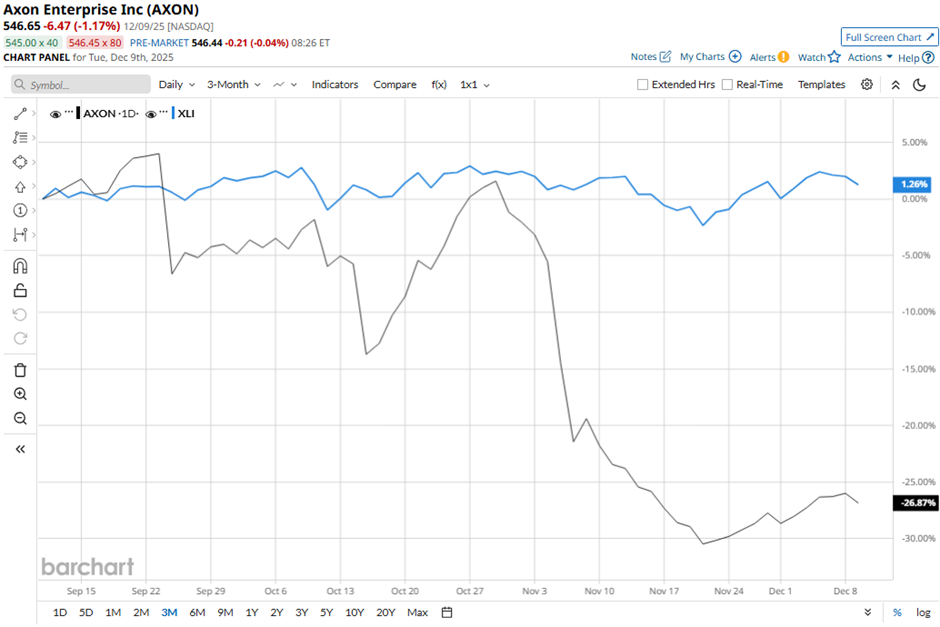

AXON stock has dropped 38.3% from its 52-week high of $885.91. Shares of the company have fallen 25.3% over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 2% rise over the same time frame.

In the longer term, AXON stock is down over 8% on a YTD basis, lagging behind XLI’s 16.3% increase. Moreover, shares of the maker of stun guns and body cameras have declined 14.9% over the past 52 weeks, compared to XLI’s nearly 10% return over the same time frame.

The stock has been trading mostly below its 50-day average since early July. Also, it has fallen below its 200-day moving average since November.

Despite reporting better-than-expected Q3 2025 revenue of $710.64 million on Nov. 4, shares of AXON tumbled 9.4% the next day as the company posted adjusted EPS of $1.17, below the forecasts. Investors were also concerned by margin pressures, with total gross margin slipping to 60.1% and elevated stock-based compensation totaling $146 million across COGS, SG&A and R&D.

Moreover, AXON stock has underperformed compared to its rival, AerCap Holdings N.V. (AER). Shares of AerCap have surged 46.6% over the past 52 weeks and nearly 46% on a YTD basis.

Despite AXON’s weak performance, analysts remain strongly optimistic about its prospects. The stock has a consensus rating of “Strong Buy” from the 20 analysts covering the stock, and the mean price target of $815.29 is a premium of 49.1% to current levels.