/Axon%20Enterprise%20Inc%20logo%20with%20buy%20and%20sell-by%20NPS_87%20via%20Shutterstock.jpg)

Scottsdale, Arizona-based Axon Enterprise, Inc. (AXON) is a public safety company that develops and sells both conducted electrical weapons and an integrated suite of hardware and cloud-based software solutions for law enforcement and public safety agencies. Valued at a market cap of $50.2 billion, the company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

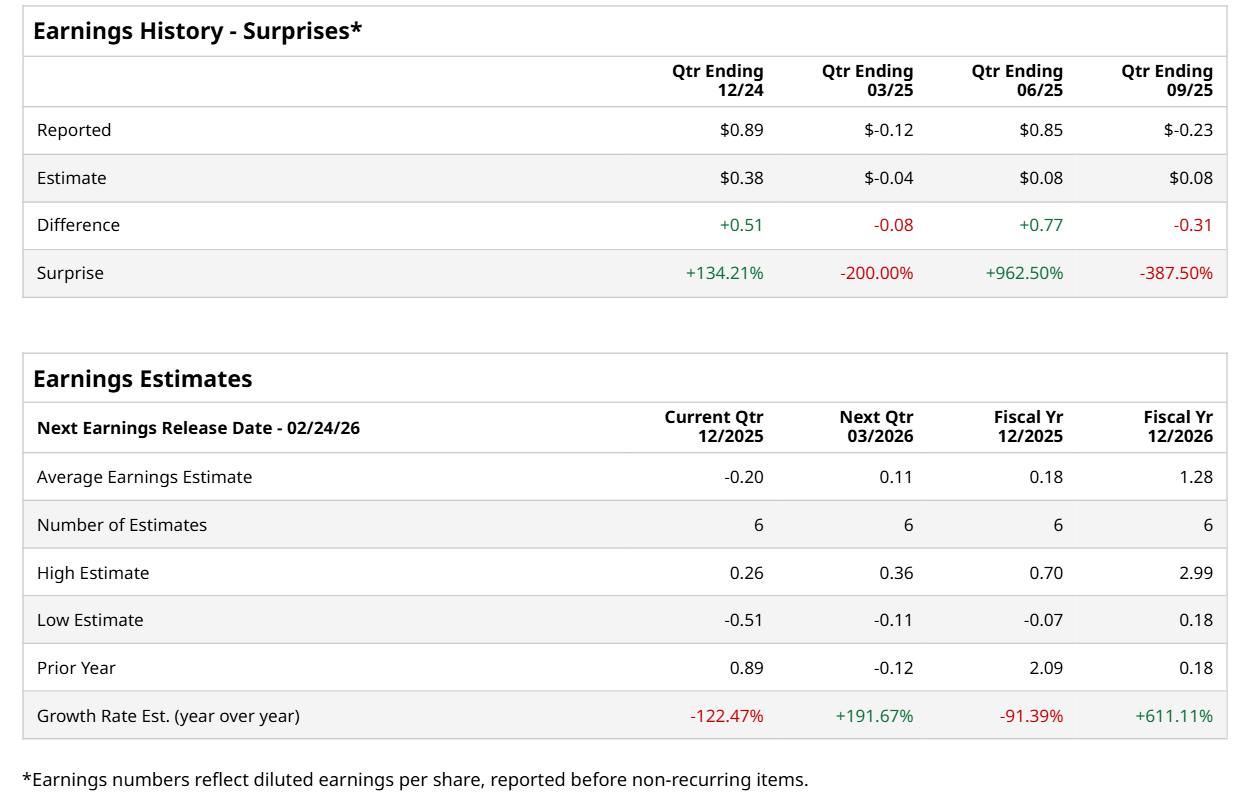

Ahead of this event, analysts expect this defense company to report a loss of $0.20 per share, down 122.5% from a profit of $0.89 per share reported in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. In Q3, its loss of $0.23 per share fell short of the forecasted figure by a notable margin.

For the current fiscal year, ending in December, analysts expect AXON to report a profit of $0.18 per share, down 91.4% from $2.09 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 611.1% year-over-year to $1.28 in fiscal 2026.

AXON has gained 5.6% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.9% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 20.2% uptick over the same time period.

On Jan. 6, shares of AXON surged 6% after Northcoast Research upgraded the stock to “Buy” from “Neutral” and assigned a $742 price target. The upgrade reflected a more optimistic assessment of Axon’s growth prospects, which appeared to strengthen investor confidence and drive the stock higher.

Wall Street analysts are highly optimistic about AXON’s stock, with a "Strong Buy" rating overall. Among 20 analysts covering the stock, 14 recommend "Strong Buy," four advise "Moderate Buy,” and two indicate "Hold” ratings. The average price target for AXON is $811.22, indicating a 30.1% potential upside from the current levels.