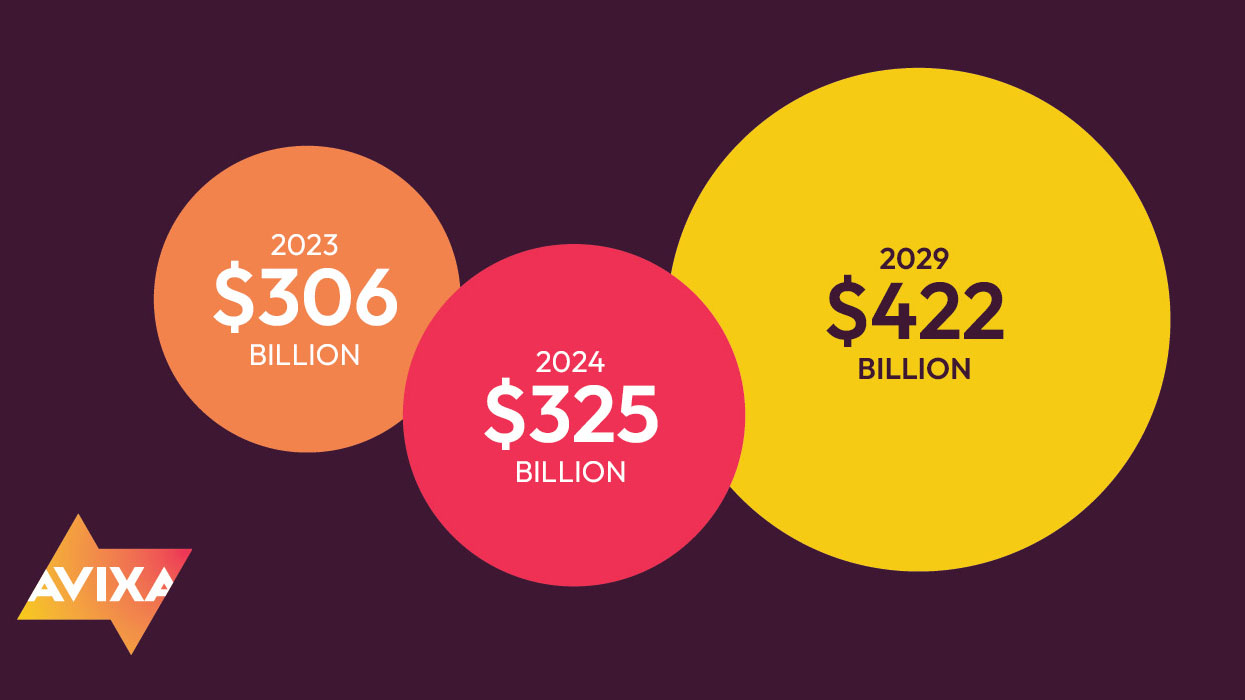

AVIXA released its findings from its 2024 Industry Outlook and Trends Analysis (IOTA). The findings are positive: Pro AV revenue will grow from $306.4 billion in 2023 to $325 billion in 2024, a healthy growth rate of 6.1%, but down from 6.9% from the previous year. The market will add $98 billion over the next five years, with a 5.35% CAGR. While office upgrades and evolution continue, the experience economy is dominating growth in Pro AV.

AVIXA’s 2024 Industry Outlook and Trends Analysis presents data and analysis about the size of the Pro AV industry with a global perspective plus regional and vertical breakouts. The research covers product trends, solution categories, and vertical markets.

[AVIXA Report: Pro AV Growth Moderates in June]

“Digging into the data, we see that growth has varied extensively across the broad landscape of pro AV. Technologies supporting conferencing and collaboration within enterprises are not performing as well as those positioned for entertainment and events,” said Sean Wargo, VP of market insight, AVIXA. “So, companies focused solely on collaboration may not be faring as well as those serving entertainment. IOTA helps provide greater visibility to where growth is strongest, highlighting opportunity for the AV channel.”

Pre-pandemic, the experience economy was one of the most influential trends, and now it has regained its strong position. From 2024 to 2029, global revenue for venues and events will grow to $57.2 billion, at a 6.3% CAGR, making it the fastest-growing vertical market. Anything related to in-person entertainment is growing fast. This includes content production and streaming, also known as broadcast AV.

[Time to Unpack: 5 Talking Points from InfoComm 2024]

The future of the corporate office remains secure. As pro AV’s largest vertical market, office spaces were a source of anxiety during the pandemic. However, as trends have moved toward hybrid working, those concerns have diminished, unlocking new market possibilities and renewed confidence in this sector. Revenue from corporate spaces will reach $91.4 billion by 2029, fueled by new construction, more opportunities in conferencing and collaboration, expanding content capture and production, as well as security, surveillance, and safety. Growth in this sector is nevertheless expected to decrease to just under 5% over the next five years.

The Asia Pacific region continues to present robust growth in pro AV, despite a decline from 7.3% to 6.9% from 2023 to 2024, largely due to China’s decelerating growth rate. Within the region, India moves into the top as the fastest-growing AV market, though and China is the largest. In the Asia Pacific region, live events and security/surveillance/safety show strong growth rates of 10.8% and 8.3%, respectively.

Led by North America’s projected market size of $104 billion in 2024, pro AV in the Americas is a mature market that leverages innovation to sustain growth as well as offering a stabilizing effect on digital infrastructure, particularly in Latin America. The region as a whole is experiencing a surge in pro AV revenue in venues and events, with 8.5% growth in North America and 10.2% in Latin America.

[Talking Points from 2024 AV/IT Summit]

In EMEA, the $86.4 billion market is bolstered by mature European markets with steady strategic investments and promising developing markets in the Middle East, where GCC countries are experiencing notable growth. The fastest-growing Pro AV sectors in the region are live events, performance and entertainment, and security.

Globally, Pro AV market challenges are shifting from supply issues to labor constraints, similar to pre-pandemic. Salary increases show continued labor market tightness and more workers are staying in their jobs at higher rates.

The impact of AI is noteworthy. AI will reshape professional AV by bringing smart automation to security, surveillance, and life safety; introducing adaptive interfaces to command and control systems; and improving the experiences delivered by conferencing and collaboration solutions.