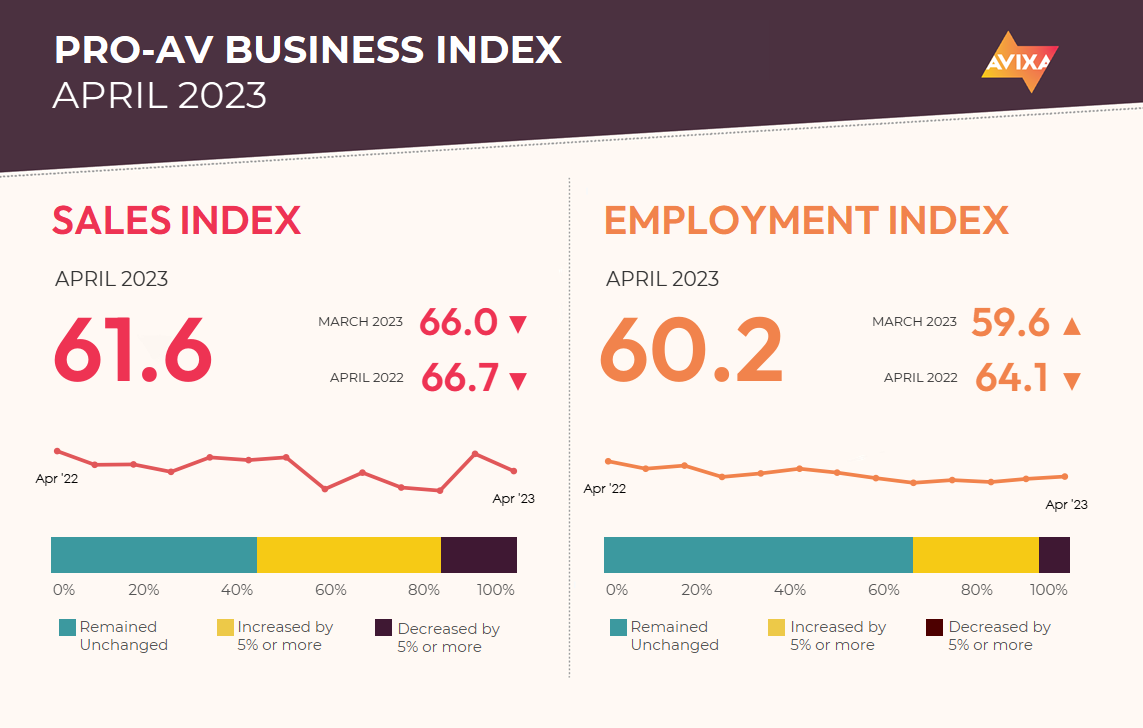

March was great; now April is good. The latest Pro AV Sales Index (AVI-S) came in at 61.6, exactly in line with expectations.

The preceding months followed an uneven course: January and February had modest but meaningful growth, with scores near 57. Then March surprised, leaping up almost 10 points to 66.0. We interpreted that as reflecting both noise and signal, suggesting that April’s results would be above February but below March. And the result lands almost exactly in the middle.

A level of 61.6 is good news, as it indicates a strong growth rate similar to pre-COVID norms. According to survey respondents, it is the net result of several important factors. On the negative side, you have continued supply issues, though they are improving. On the positive side, you have the continued return to non-pandemic norms. Uncertainty is a factor as well. As we cover in the next highlight, the possible recession is holding off for now but could easily strike.

[On Your Business: Reevaluate Your Employee Evaluations]

GDP numbers have come in for the first quarter of 2023 and closed the door on the once-popular idea that that time window would see the start of a recession. U.S. GDP increased at an annualized rate of 1.1%, EU GDP grew at an annualized rate of 1.2%, and China’s GDP increased at an annualized rate of 9.09% (though that reflects a weak 2022 Q4 as the COVID-zero policy largely ended). Altogether, it’s a picture of sustained economic growth in defiance of expectations in Fall 2022. That said, there are no guarantees of continuance.

The banking sector continues to struggle, particularly within the United States, where a domino effect is shutting down regional banks. On May 1, First Republic Bank became the second largest failure in the United States, and other mid-size banks now teeter on the edge. These bank failures represent a major tightening of credit availability far above and beyond the Federal Reserve’s rate increases. That tightening will reduce business investment and meaningfully increase recession odds this year.

[AVIXA Report: Surprising and Substantial Leap in Pro AV Growth]

The AV Employment Index (AVI-E) continued its steady show of strength. The numbers reflect a bit of backlog from 2022’s strong revenue growth, both because companies struggled to hire given the difficult labor market and because companies were hesitant to invest in staff after such a difficult couple of pandemic years. That puts the AVI-E currently at 60.2.

That level is lower than the AVI-S, but steadier employment is normal. In fact, the AVI-S is commonly farther ahead of the AV-E than just 1.4. In short, Pro AV payrolls continue to undergo healthy expansion.

Perhaps for similar reasons, the overall labor market is also a bright spot for the wider economy. For April, the U.S. Bureau of Labor Statistics reported another significant jump in payrolls (253,000), concentrated mainly in the services sector as it continues to revert post-pandemic. Meanwhile, unemployment ticked down to 3.4%. The labor market is the strongest reason to doubt that a recession is coming in the immediate future.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.