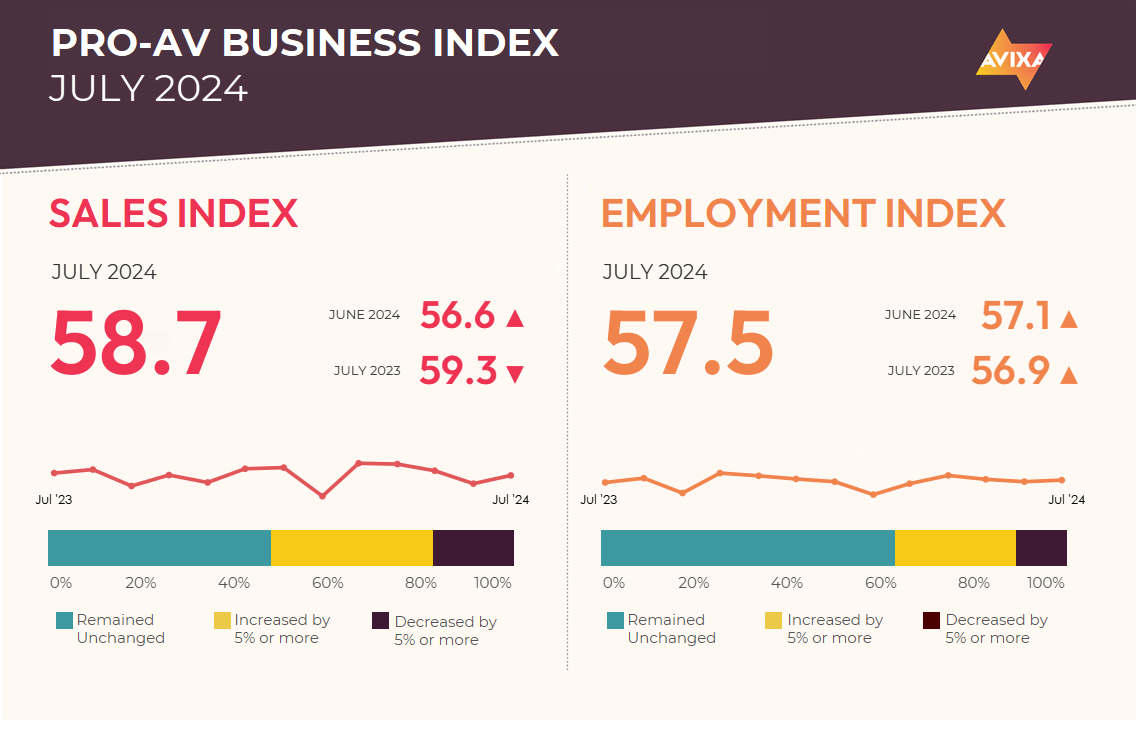

July delivered better news after a disappointing June, as the AV Sales Index (AVI-S) accelerated 2.3 points from 56.6 to 58.7. With this new reading, the AVI-S is now averaging the same level in 2024 as it did in 2023: 58.9 this year versus 58.8 last year. Last year, we described this level as roughly in line with what would be normal pre-pandemic but on the low side.

Given that pre-pandemic saw consistent strong growth for Pro AV, the current level should be seen as a signal of moderate expansion. This is closely aligned with AVIXA’s 2024 Industry Outlook and Trends Analysis (IOTA), which shows 2024 as a lower growth year before reacceleration in 2025.

[AVIXA Report: Pro AV Growth Moderates in June]

Recent economics news has been a bit negative. EU GDP expanded just 0.3% in the second quarter (an annualized rate of 1.2%). Germany fell back into contraction, with a 0.1% GDP decline. China’s GDP grew 0.7% in the second quarter (2.8% annualized), which sounds good at first, but it’s well below both the 1.5% growth for Q1 and the forecast of 1.1%.

The United States was the bright spot for GDP, as its Q2 growth was at an annualized rate of 2.8%, up from 1.4% in the first quarter and beyond the forecast of 2.1%. While that is decisively positive, it is counterbalanced by other news, especially on employment.

Overall, the news is consistent with a soft macroeconomy. We’re seeing expansion, but it’s below what we’d expect in a healthy economy. These tepid conditions are the primary reason that current Pro AV growth is a little lower than what we averaged pre-pandemic.

The AV Employment Index (AVI-E) is reliably steadier than the AVI-S. Last month, the AVI-S was surprisingly down, while the AVI-E was down only slightly. Now the AVI-S is back up, and the AVI-E is up slightly.

To share the numbers, the last three months of the AVI-E have been, in order, 57.7, 57.1, and 57.5. Like the AVI-S, this level is roughly in line with what was normal pre-pandemic but on the low side. To add a little color, the supply of available workers remains low, but a relatively small number of companies are growing payrolls right now.

In the wider economy, the U.S. July jobs report was disappointing. Unemployment moved up to 4.3% from 4.1% (though largely due to labor force expansion), while the economy added 114,000 jobs. This payroll expansion is well below expectations of 175,000, and also below what the economy averages in normal times. It’s an indicator that the economy is softening and not currently expanding at a strong rate.

[Editorial: AI Can Help Us All Be Lions]

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.