Good growth continues. The surprising slowdown recorded for February, when the AV Sales Index (AVI-S) dropped from 60.7 to 53.4, looks more like a blip than ever.

[AVIXA Report: March Bounces Back]

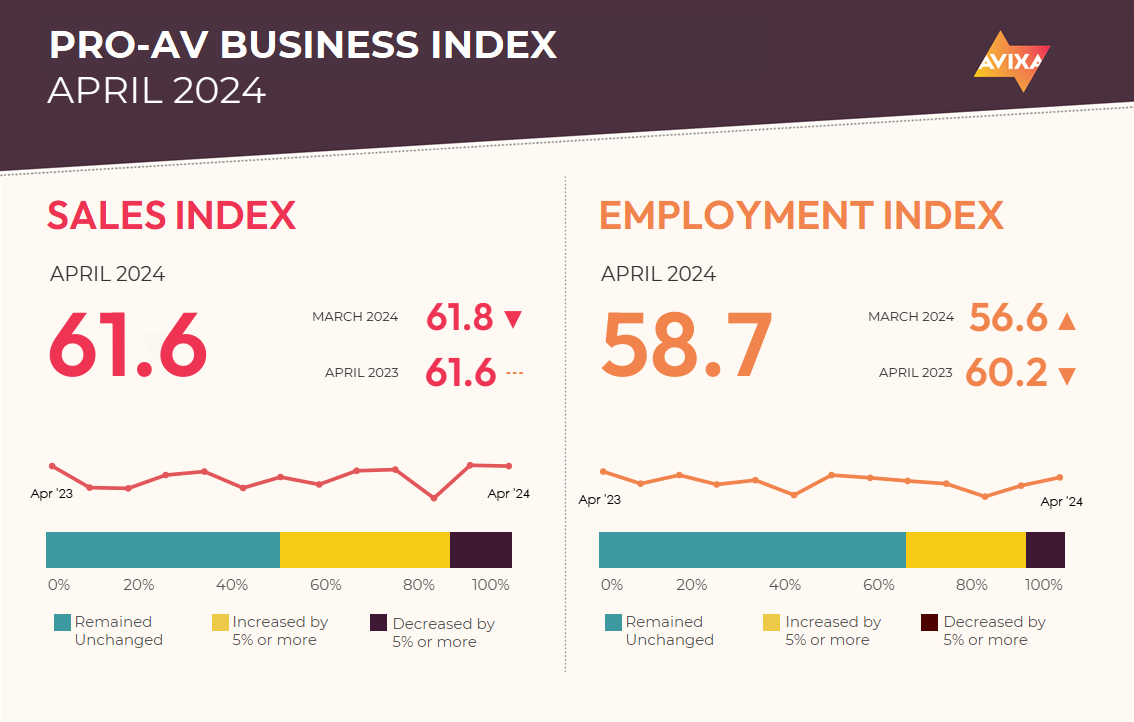

In March, the AVI-S immediately rebounded to 61.8, a strong growth level that was actually the highest in a year. The strength continued in April, with the AVI-S measuring 61.6—essentially the same as in March. This level is well above the no-net change mark of 50, meaning that the Pro AV industry is expanding at a strong rate. To add more context, 61.6 is also the level that the AVI-S measured in 2019.

In the wider economy, the news was mixed. For the EU, revisions to their 2023 4th quarter GDP numbers shaved enough off to tip the Eurozone into back-to-back quarters of decline for the second half of 2023 (sometimes referred to as a “technical recession”). On the other hand, Q1 growth came in solid, with annualized expansion of 1.2%. This growth was enough to recover from the back-to-back quarters of contraction.

In the United States, Q1 GDP was disappointing. Though it was faster than the Eurozone expansion at 1.6%, it was also below the expected 2.4%. When adding in news of a little labor market weakness, the momentum is gaining for the U.S. Federal Reserve Board to shift interest rates lower to support economic expansion.

For Pro AV, the employment news was positive. The AVI-E (AV Employment Index) improved 2.1 points from its March level, rising to 58.7. While this is lower than the AVI-S, it’s the highest result since November 2023. That said, this isn’t a particularly high result for the AVI-E.

The AVI-E has been somewhat subdued so far in 2024 (though still growing), and the current level is still a little shy of what would be normal in pre-pandemic times. In wider employment news, there is increasing worry that the remarkable and sustained strength of so many global labor markets is beginning to subside. The U.S. labor force added 175,000 jobs against an expectation of 240,000.

[InfoComm 2024: Be Sure to Check Out the Business, Project Management Program]

If you’re going to miss an expectation, it’s always good to miss a high one like 240,000 is for the U.S. economy. But it’s nonetheless a signal that the remarkable run of post-COVID labor market expansion is running out of steam. Assuming that’s true, the challenge now is for the Federal Reserve Board to manage interest rates to get jobs and economic growth to settle in around where it is now, with inflation at target, too.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.