Valued at $25.2 billion by market cap, AvalonBay Communities, Inc. (AVB) is one of the largest U.S. residential real estate investment trusts (REITs), specializing in the development, acquisition, ownership, and management of high-quality apartment communities. The company operates more than 97,000 apartment homes across major high-demand metropolitan markets.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and AVB perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the residential REIT industry. Focused on markets with strong employment and limited housing supply, AvalonBay aims to deliver stable long-term returns through a mix of established properties, new developments, and redevelopment projects.

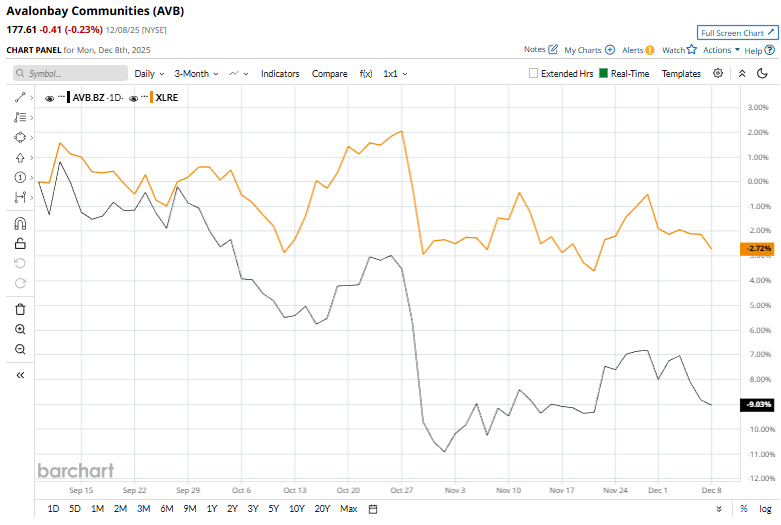

Despite its notable strength, the Virginia-based company has slipped 23.2% from its 52-week high of $231.21. Over the past three months, AVB stock declined 8.7%, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 2.8% decline during the same time frame.

In the longer term, shares of AVB dipped 19.3% on a YTD basis and fell 21.6% over the past 52 weeks, underperforming XLRE’s marginal YTD gains and 6.9% drop over the last year.

To confirm the sustained bearish trend, AVB has been mostly trading below its 50-day and 200-day moving averages since March.

On Oct. 29, AVB stock tumbled 4.3% following the release of its Q3 earnings report. While core FFO per share edged up to $2.75 from the prior year, it still came in 2.1% below analyst estimates, triggering investor concern. The company posted modest operating gains, with same-store residential revenue rising 2.3% year over year to $685.4 million and same-store residential NOI up 1.1% to $461 million.

In the competitive arena of residential REITs, Mid-America Apartment Communities, Inc. (MAA) has fared similarly, down 15.3% YTD and has suffered 17.6% losses over the past 52 weeks.

Despite that, Wall Street analysts are reasonably bullish on AVB’s prospects. The stock has a consensus “Moderate Buy” rating from the 25 analysts covering it, and the mean price target of $204.03 suggests a potential upside of 14.9% from current price levels.