There are two ways of looking at the performance of Australia's stock market for 2025: half full or half empty.

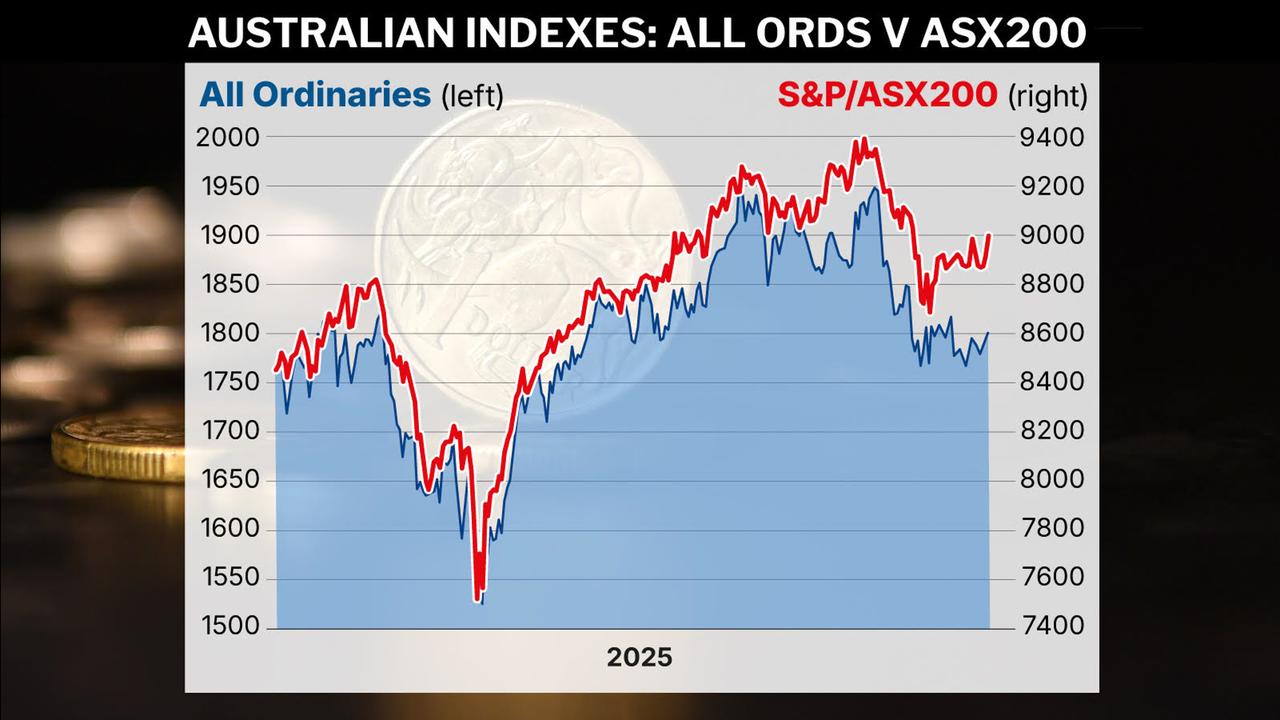

The ASX200 finished its final session on Wednesday up 6.8 per cent from where it began the year, for an annual return of 10.3 per cent when including dividends.

But the local bourse's showing was its worst since a loss in 2022, and it also underperformed compared to the stock markets of most other developed countries.

With a day of trading left, the United States' S&P500 was on track for 17.5 per cent rise for 2025, while similar indices for the United Kingdom, Japan, Germany, Canada and Hong Kong were all on pace for gains of more than 20 per cent, as was the global benchmark known as the MSCI World Index.

One of the few markets the ASX200 outperformed was New Zealand's, where the NZ50 finished up an anaemic 3.3 per cent for the year.

Moomoo market strategist Jessica Amir said relative metrics showed Australians need to be investing beyond their local market.

"Aussies better be seriously thinking about why they're not exposed to the NASDAQ 100 and think about adding some exposure," she said.

"Because the biggest companies in the world, they're investing heavily into AI, they're leading the world and building AI, and they're the biggest beneficiaries of the AI buildout, which is a multi-trillion-dollar industry."

The NASDAQ 100, which was up 21.4 per cent for the year with a day of trading left, includes tech giants such as Amazon, Meta, Microsoft and Alphabet as well automaker Tesla.

"If you're going to be boring and complacent and stay in the ASX200 you'll probably get another year of mediocre returns," Ms Amir said.

But the Australian market does offer some opportunities, Ms Amir added, including ways to play the AI trade, such as investing in the companies that mining the critical minerals needed for the AI buildout.

"I'm not going to say BHP, a lot of their money is from iron ore, but they do make a lot of money from copper, a small amount from gold," she said.

"You might be looking at those other pure-play copper companies, platinum, palladium and silver."

There are also exchange-traded funds such as Aberdeen's GLTR that offers exposure to a basket of gold, silver, platinum and palladium - the physical metals themselves, Ms Amir said.

Rory Hunter, head of emerging and small companies at boutique Australian investment manager SG Hiscock & Company, takes a similar view.

"The opportunity in critical minerals today is one of the most compelling themes we see anywhere in global markets", he said.

"The structural drivers behind it are powerful and we expect that to continue in the years to come."

He said small-cap gold and critical mineral miners - many of whom are listed on the ASX - should benefit from rising AI investment and energy transition needs.

"If you look at global trends, the sheer scale of AI-related capital spending and the energy generation and transmission build out required to support it, the demand profile for key commodities like copper, silver, uranium, and a suite of more niche critical minerals becomes increasingly strong."

China has also been increasingly weaponising its supply of critical metals, Mr Hunter noted, which adds to the dynamic.

But Mr Hunter was less sanguine about the outlook for small industrial companies, whom he said face the headwind of rising interest rates.

Another trend for 2025 was the standout performance of defence-related stocks amid the wars in Ukraine and Gaza and tensions and hostilities elsewhere.

The ASX's Droneshield finished the year up more than fourfold despite its selloff in October and November, meaning it delivered the best performance of any company in the ASX200.

Fellow military contractor Electro Optic Systems, an ASX300 component, soared more than sevenfold in 2025, while shipbuilder and defence contractor Austal grew 115 per cent.

In the US, RTX Corp, the military contractor formerly known as Raytheon, was up 58.6 per cent while Palantir Technologies was on track for a 140 per cent rise in 2025.

"Obviously the world's biggest software defence company," Ms Amir said of Palantir, which was co-founded by controversial tech billionaire Peter Thiel.

"Yes, they're volatile, so yes, people will love to hate them. They get smashed because good quality companies are not immune to pullbacks, but smart investors buy the pullbacks as we know."

The ASX's top gainers for the year were overwhelming goldminers, which turned in 12 of the best 14 performances in the ASX200 for 2025.

The exceptions were Droneshield at No. 1 and lithium developer Liontown at No. 4.

West Australian goldminer Pantoro Gold was second with a 219 per cent gain followed by Africa-focused Resolute Mining at 210 per cent.

On the flip side, Telex Pharmaceuticals, IDP Education, Treasury Wine Estate, Guzman Y Gomez and Wisetech Global were the worst ASX200 performers for the year, with losses of 54.5 to 43.3 per cent.