Australia's share market is trading at its highest level since late October after CommBank shares rocketed higher on a record $5.4 billion first-half cash profit.

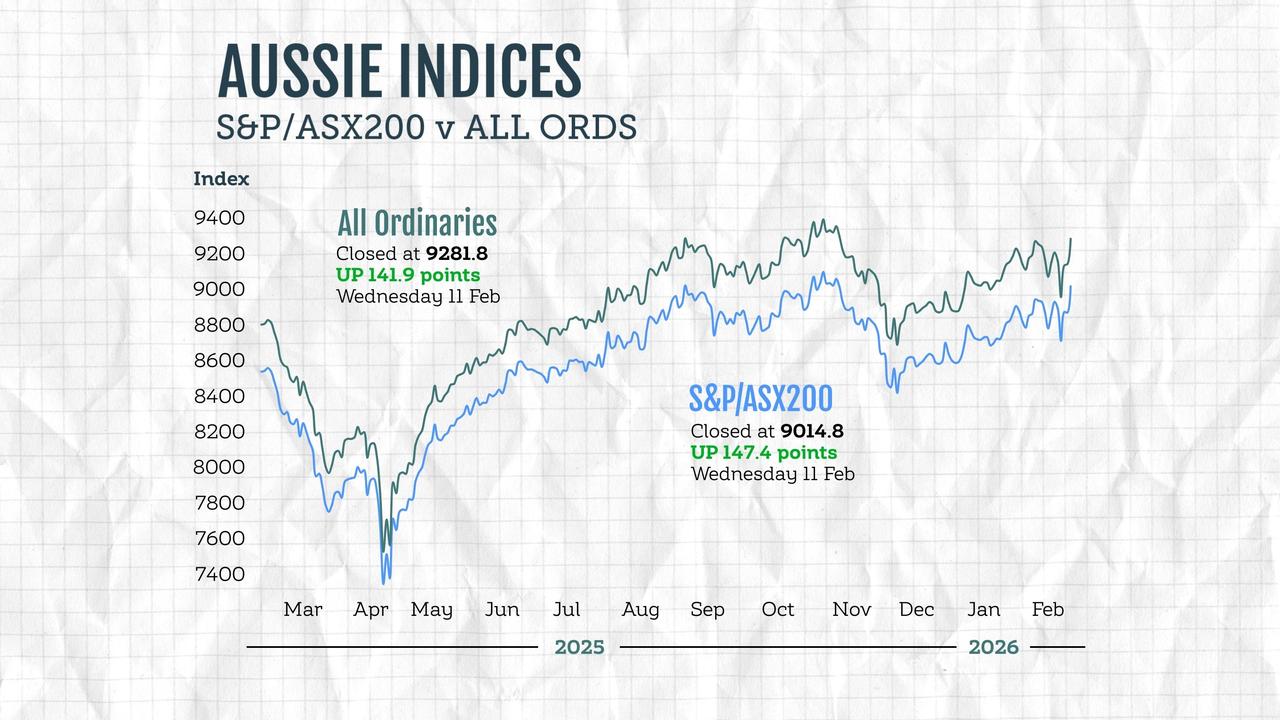

The S&P/ASX200 jumped 147.4 points on Wednesday, up 1.66 per cent, to 9,014.8, while the broader All Ordinaries rose 141.9 points, or 1.55 per cent, to 9,281.8.

Dual rallies in the heavyweight financials and raw materials sectors drove the move, led by strong earnings beats from Commonwealth Bank and James Hardie, Capital.com senior market analyst Kyle Rodda said.

"To contextualise it in terms of the broader market though, if you zoom out we've been going up in spite of earnings growth and (economic) growth, not because of it," Mr Rodda told AAP.

Commonwealth Bank shares jumped more than six per cent to $169.63, adding a tidy $20 billion to its now $286 billion market cap, sending its big four competitors higher in tandem as investors sought similar returns and fatter dividends.

NAB and Westpac carved out solid gains above three and two per cent respectively, while ANZ had to settle for a modest 1.3 per cent boost.

"The industry group is so macro driven, and this is a strong macro signal that lending was a little bit stronger throughout the half for the Australian economy that, by extension, the other banks should benefit from that as well," Mr Rodda said.

Eight of 11 local sectors traded higher on Wednesday, while energy stocks traded flat and real estate stocks missed out on the gains.

The health care segment tumbled 2.9 per cent, as CSL shares were hammered after a major profit slump and the sudden exit of boss Paul McKenzie.

James Hardie best of the basic materials large caps, soaring more than ten per cent, after its third quarter sales rose 30 per cent to $US1.2 billion ($A1.7 billion).

Mega miners BHP, Rio Tinto and Fortescue also did their bit to push the sector to new all-time highs, each gaining more than 1.2 per cent, supported by rebounding commodity prices.

Energy stocks traded just below flat,as modest upticks in oil, gas and uranium producers ballasted weakness in coal miners.

In more earnings results, Stokes family-owned SGH rose by 3.6 per cent to $50.91 after it delivered a strong first-half result, while its takeover target Bluescope Steel slipped 0.9 per cent to $28.95 by the close.

AGL shares surged almost 12 per cent higher after it beat its earnings expectations for the six-months to December, helping lift the utilities sector 2.4 per cent.

Its competitor Origin will deliver its interim results on Thursday, along with South32, Northern Star, Paladin Energy, IAG, and AMP.

Bourse operator ASX Ltd will also hand down financials, after announcing CEO and managing director Helen Lofthouse will stand down in May.

The Australian dollar is trading above 71 US cents for the first time since January 2023, propelled by rebounding commodity prices and a higher local interest rate outlook.

The Aussie is buying 71.16 US cents, up from 70.71 US cents on Tuesday at 5pm AEDT.

ON THE ASX:

* The S&P/ASX200 gained 147.4 points, or 1.66 per cent, to 9,014.8

* The broader All Ordinaries rose 141.9 points, or 1.55 per cent, to 9,281.9

CURRENCY SNAPSHOT:

One Australian dollar trades for:

* 71.16 US cents, from 70.71 US cents at 5pm AEDT on Tuesday

* 108.87 Japanese yen, from 109.84 Japanese yen

* 59.70 euro cents, from 59.40 euro cents

* 52.05 British pence, from 51.71 British pence

* 117.38 NZ cents, from 117.13 NZ cents