Australia's share market has traded lower, with miners and energy stocks tumbling as commodity price volatility continues.

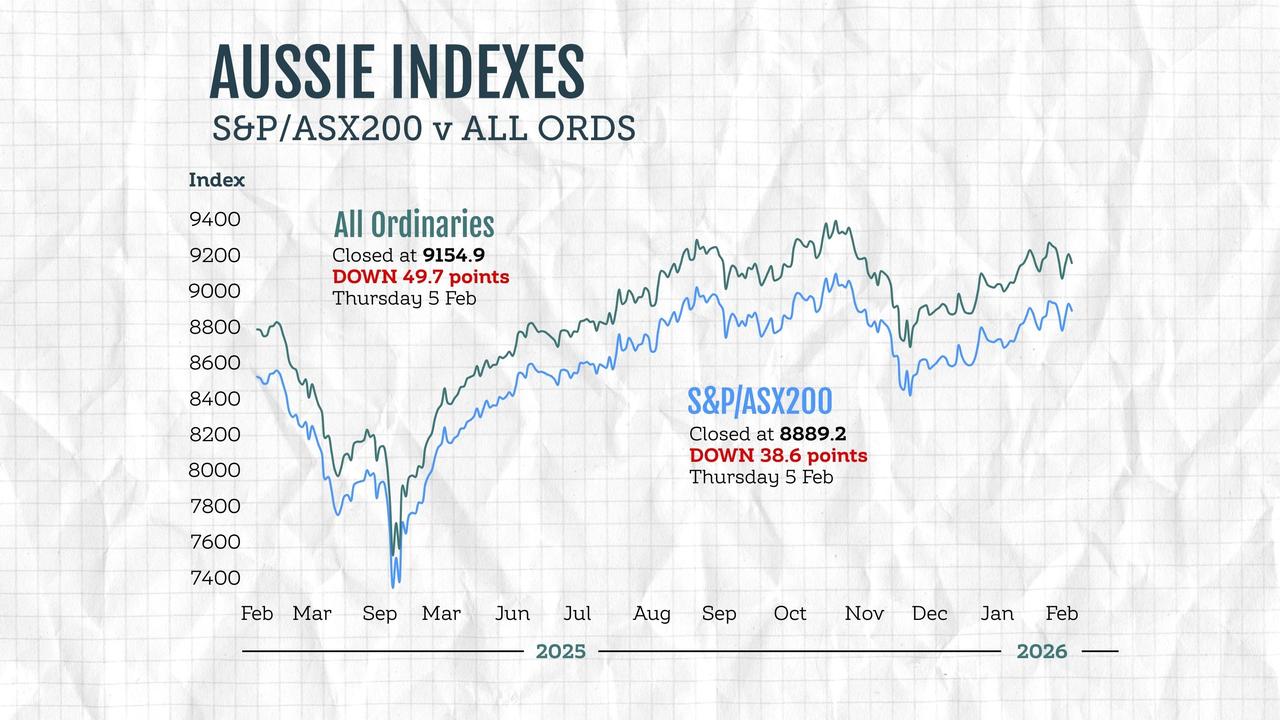

The S&P/ASX200 fell 38.6 points on Thursday, down 0.43 per cent, to 8,889.2, as the broader All Ordinaries lost 49.7 points, or 0.54 per cent, to 9,154.9.

Only three segments ended the day lower, but a more than three per cent slump in raw materials weighed heavily following an aftershock from the weekend's gold sell-off, dragging down ASX-listed miners.

"The ASX200 eased from the open today, snapping a two-day winning streak with its falls coming courtesy of this year's top two performing sectors - the energy and materials sectors," IG market analyst Tony Sycamore said.

The energy sector slipped 1.3 per cent, but with oil prices relatively steady ahead of US-Iran nuclear talks planned for Friday, it was uranium producers falling behind after a major US chipmaker's outlook raised questions about AI demand.

"The reason for the slump is AMD's report and disappointing guidance and questions now around what it means for data centre build-outs and the need for nuclear power," Mr Sycamore told AAP.

ASX-listed uranium producers such as Paladin, Deep Yellow and Boss Energy each fell six per cent or more.

The basic materials sector tumbled 3.3 per cent with gold stocks under renewed pressure as the precious metal's price continued to whipsaw following Friday and Monday's sharp sell off.

Spot gold was changing hands at $4,860 ($A6,977) an ounce, cutting more than 4.5 per cent from the valuations of miners Northern Star and Newmont.

Iron ore giant BHP also dragged on the broader bourse with a 3.9 per cent dip to $25.90 after hitting an all-time high of $52.54 on Wednesday, briefly eclipsing Commonwealth Bank as Australia's largest company.

CBA retook the crown on Thursday, its shares up 1.4 per cent to $159.28, taking its market cap to $266.5 billion.

A 0.8 per cent boost in the heavyweight financials sector wasn't enough to push the bourse higher, despite strong performance from ANZ, CBA, and the major insurers.

Consumer-facing stocks also notched solid gains, with cyclicals up 1.4 per cent and staples gaining one per cent, tracking with upticks in Wesfarmers, Woolworths and the Lottery Corporation.

Agribusiness Elders slipped more than four per cent after naming Rene Dedoncker as its new chief executive. He'll take the reins from Mark Allison on October 1.

In company news, Beach Energy shares lost 4.4 per cent after reporting a dip in first half profits, as the oil and gas company expressed concern about a planned east coast gas reservation policy.

Shares in Amcor are up more than 10 per cent in two sessions after the packaging giant reported a 70 per cent sales boost in the six months to December on the equivalent half.

Bitcoin has slumped to $US70,280 ($A244,315), its lowest price since November 2024. The cryptocurrency has been on a downward trajectory since October, when it hit an all-time peak above $US126,000.

The Australian dollar is buying 69.72 US cents, down from 70.29 US cents on Wednesday at 5pm.

ON THE ASX:

* The S&P/ASX200 fell 38.6 points, or 0.43 per cent, to 8,889.2

* The broader All Ordinaries fell 49.7 points, or 0.54 per cent, to 9,154.9

CURRENCY SNAPSHOT:

One Australian dollar trades for:

* 69.72 US cents, from 70.29 US cents at 5pm AEDT on Wednesday

* 109.42 Japanese yen, from 109.88 Japanese yen

* 59.13 euro cents, from 59.41 euro cents

* 51.18 British pence, from 51.25 British pence

* 116.44 NZ cents, from 116.39 NZ cents