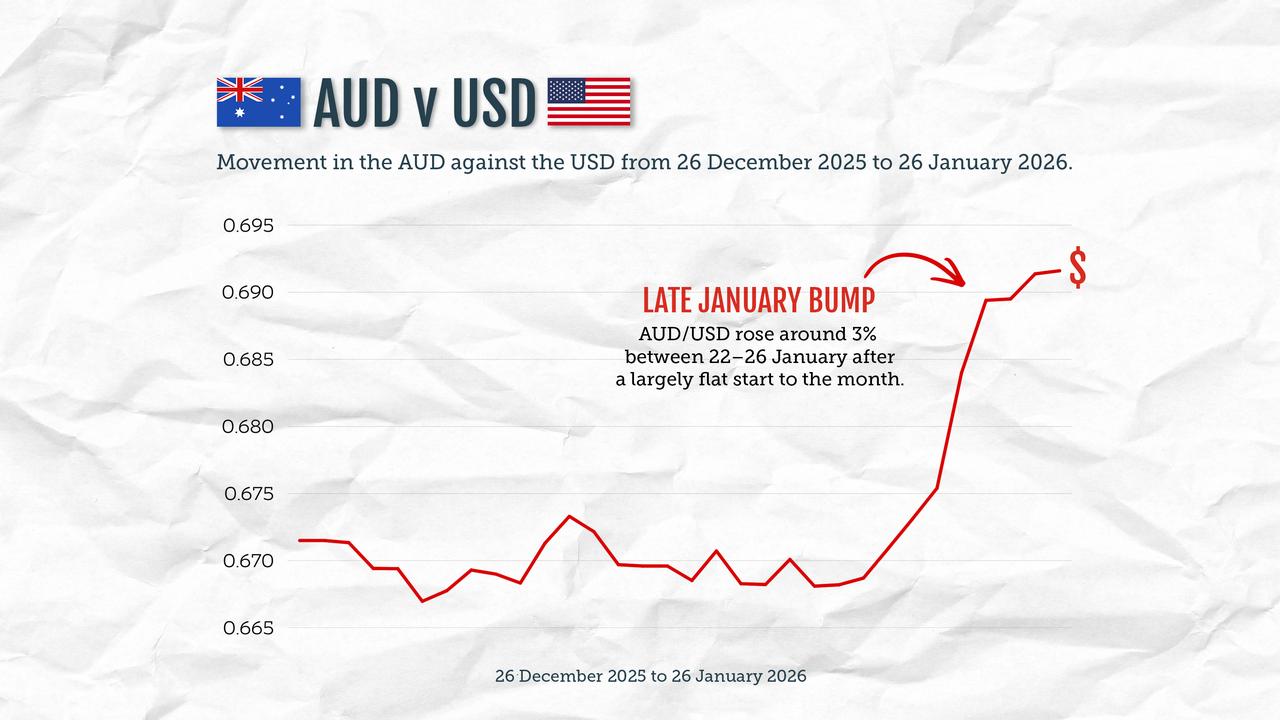

Australia's currency hit a near three-year high against its American counterpart after sticky inflation data raised the odds the Reserve Bank will soon raise interest rates.

The Aussie jumped from 69.93 US cents to 70.22 US cents in just two minutes late Wednesday morning immediately after the release of the consumer price index readout.

It's the first time the Aussie had breached 70 cents since early 2023.

By mid-afternoon the Aussie had retreated a little, changing hands at 69.86 US cents, up from 69.15 US cents late Tuesday afternoon.

Its move on Wednesday was prompted by an Australian Bureau of Statistics report showing consumer prices climbed 3.8 per cent in the year to December, up from 3.4 per cent in the 12 months to November, with trimmed mean inflation coming in at 0.9 per cent for the December quarter.

AMP economist My Bui called it a "red hot" inflation report that left the Reserve Bank with little choice but to raise interest rates at its next meeting on Monday and Tuesday.

Foreign exchange values are exquisitely sensitive to interest rate expectations, because higher rates make it more valuable to hold a nation's currency.

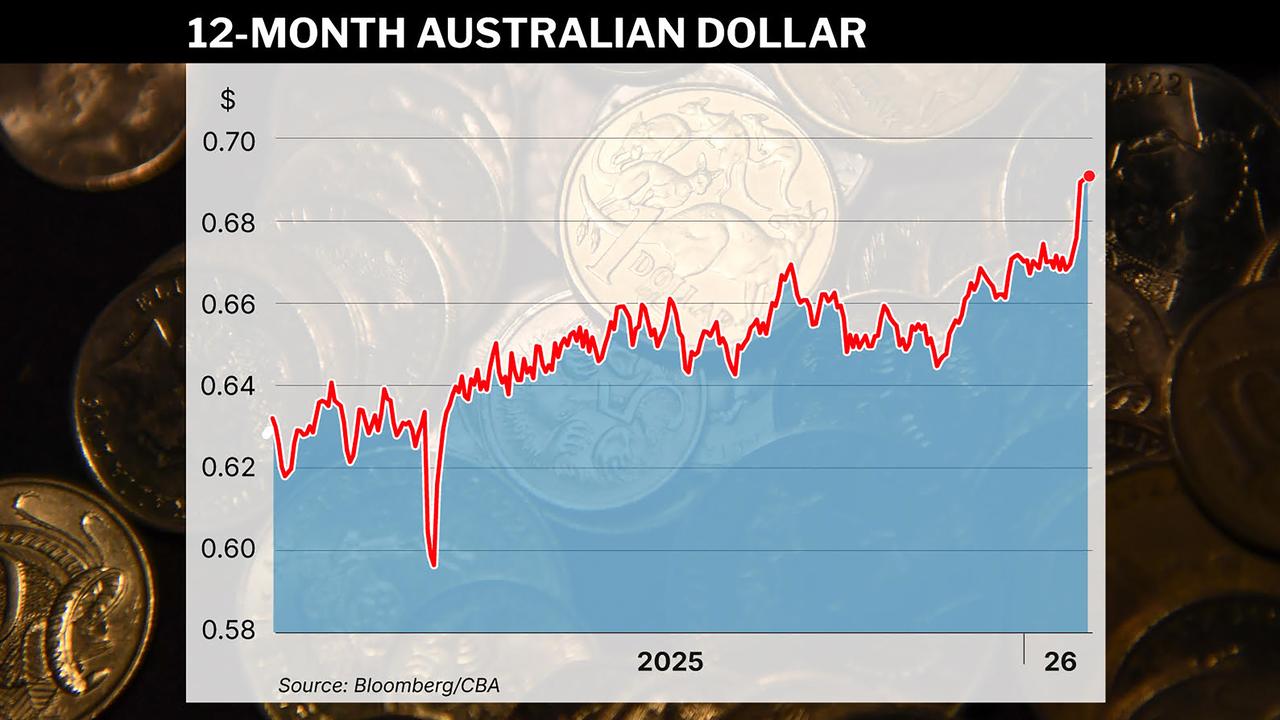

Even before Wednesday's move the Aussie had been at a nearly 16-month high against its faltering American counterpart.

"Obviously we've seen an absolutely momentous move to the upside," City Index analyst Matt Simpson told AAP on Tuesday.

Supporting the move had been soaring prices for the base and precious metals that were major Australian exports, Mr Simpson said, adding the Aussie dollar was surging even amid Donald Trump's tariffs.

"It's been a bit of a jack-in-the-box really," he said of its resilience.

Besa Deda, chief economist for the accounting and advisory firm William Buck, said the Aussie was gaining in part due to expectations the RBA would raise rates, but also because of the greenback's weakness.

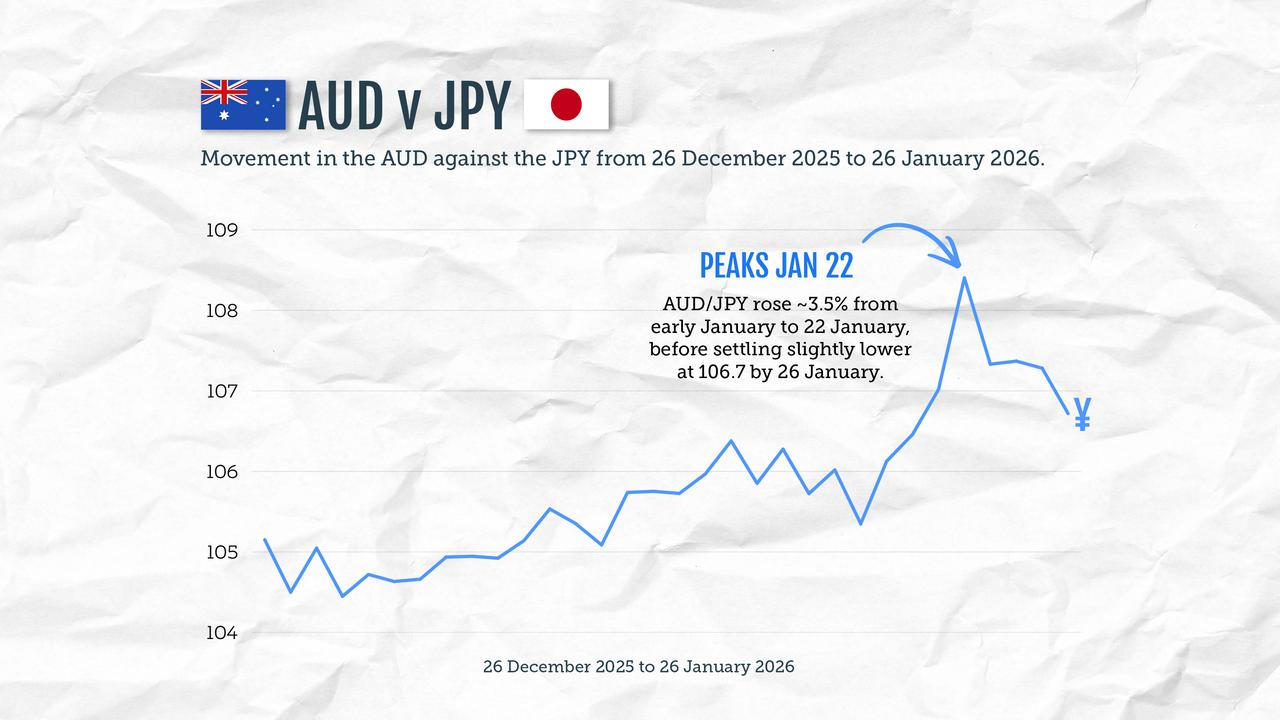

Both the Japanese yen and the US dollar had dropped in the past few days amid speculation the US Federal Reserve might intervene in currency markets - or perhaps had already done so - to shore up the yen, Ms Deda said.

But the US dollar had been weaker all year with all the geopolitical turmoil, she said.

"Here, 2026 opened up, and there's just been a wave of fresh uncertainty," Ms Deda said.

"There's Greenland and there's Venezuela and Iran, and then more recently, the threat of a 25 per cent tax on South Korea.

"So I think that elevated uncertainty is also contributing to a sell off in the US dollar."

A benchmark gauge of the US dollar's strength against other currencies fell to its lowest level since 2022, Ms Deda said.

Everyday Australians will mostly notice the difference in the Aussie when they go on holiday overseas, particularly to Japan and the United States.