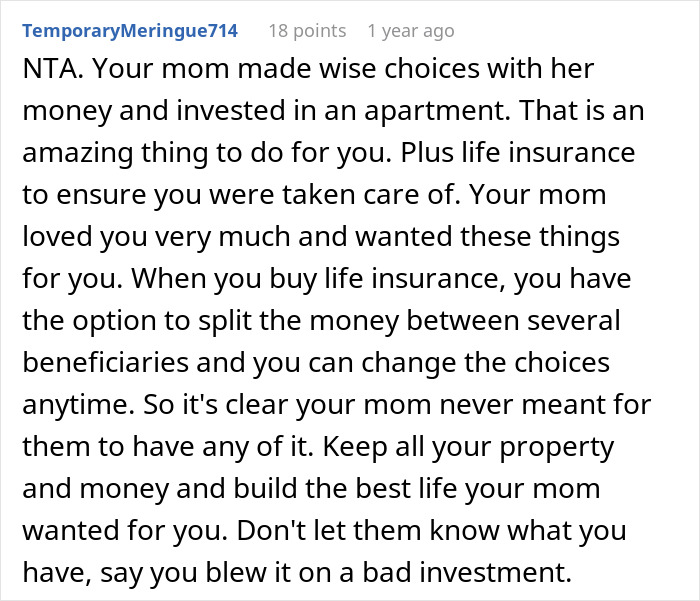

The death of a loved one, in theory, should bring the family together to support one another through such a trying time. However, when a substantial inheritance is in question, the opposite can happen, especially if some people feel wronged about the late one’s wealth distribution.

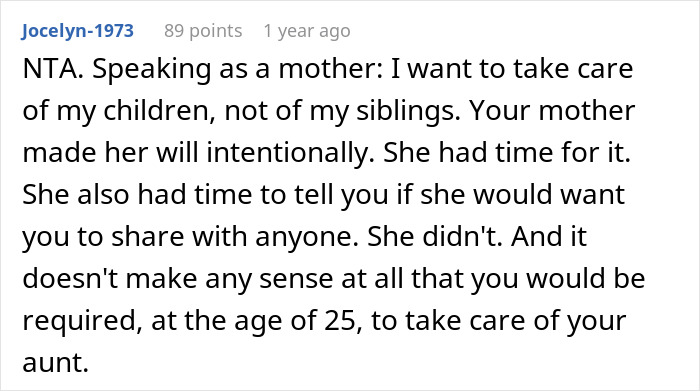

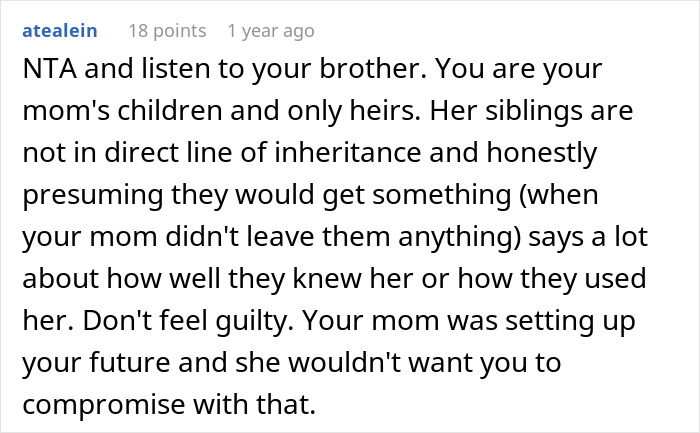

Unfortunately, the dissatisfaction over inheritance didn’t skip this family either. When redditor Ok_Oil_324’s mom passed away, she left everything to her children, which her sisters thought were unfair. So they tried guilt-tripping the siblings into sharing the money with them, which pushed the original poster to turn online for perspective.

The death of a loved one should bring the family together so they could support one another

Image credits: freepik (not the actual photo)

However, for this family it had the opposite effect, as it was followed by quite a substantial inheritance

Image credits: freepik (not the actual photo)

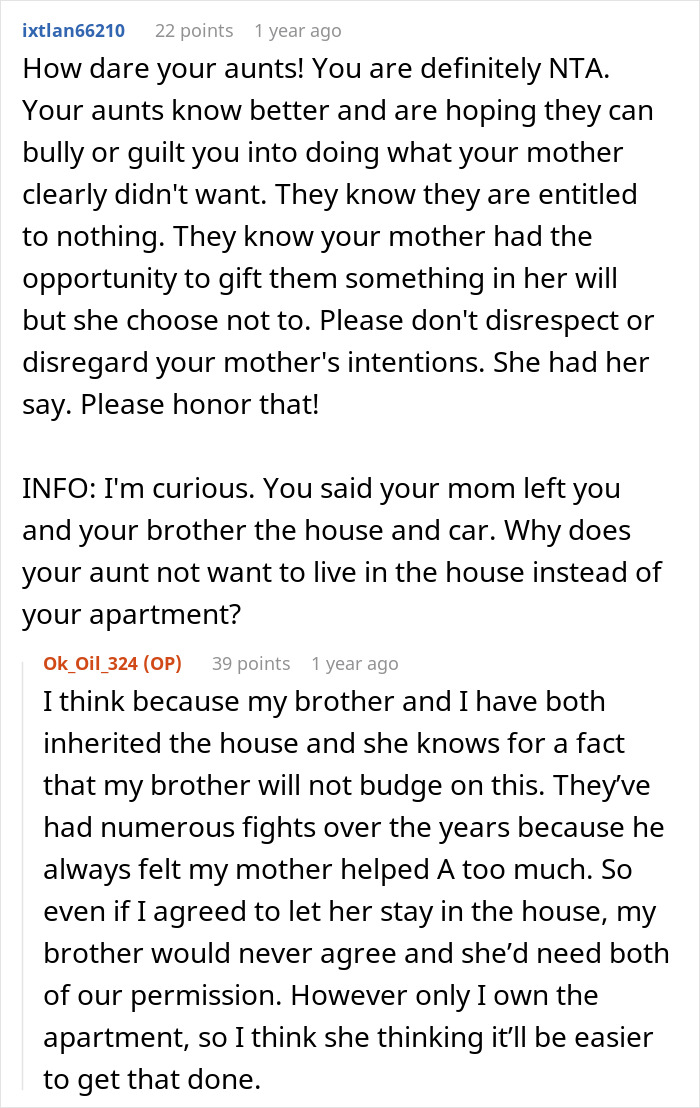

Image credits: Ok_Oil_324

The willingness to share inheritance with family often depends on their specific relationships and the amount of money that is bequeathed

Image credits: freepik (not the actual photo)

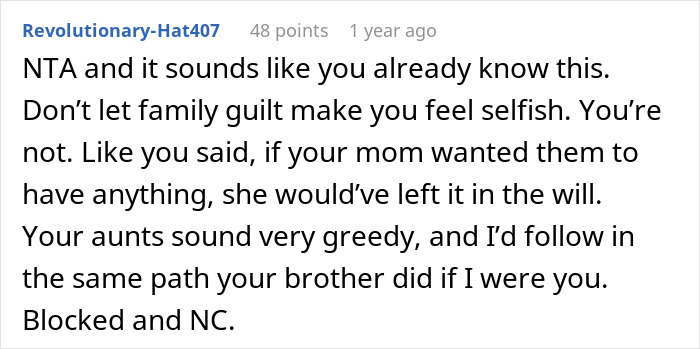

In a previous interview with Bored Panda, financial planner Justin Rush said that willingness to share inheritance with family often depends on their specific relationships and the amount of money that is bequeathed.

“In our line of work, we’ve personally seen many situations with families that have fought over inheritances, that have fought because things weren’t even or weren’t equal. On the flip side, we’ve seen the opposite as well, right? We’ve seen families that are very equitable. We’ve seen siblings who have redistributed some of the inherited funds to make sure that things were even. I think a lot of that just comes down to the specific relationships and the family.”

However, he believes that at the end of the day, it’s up to the person who left the inheritance to decide who they wish their assets to go to. Redistributing the wealth according to others’ wishes shouldn’t be the responsibility of the beneficiaries.

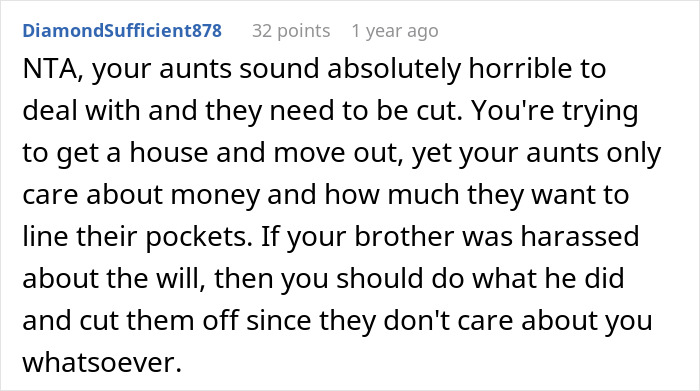

“That’s kind of part of that broader estate planning process where older couples and even younger couples that may have amassed a large number of assets or money should have a very well thought out and well-written plan that distributes those assets how they want and to whom they want them to go,” he explains.

“That itself can really help with resolving conflict down the road,” he adds. “If there’s a very clear plan in place about who they wanted this money to go to or who they wanted to get a house or a vacation home, that clear communication can help the families down the road.”

The unwillingness to share the inheritance should be communicated by being open and just having the conversation

Image credits: lookstudio / freepik (not the actual photo)

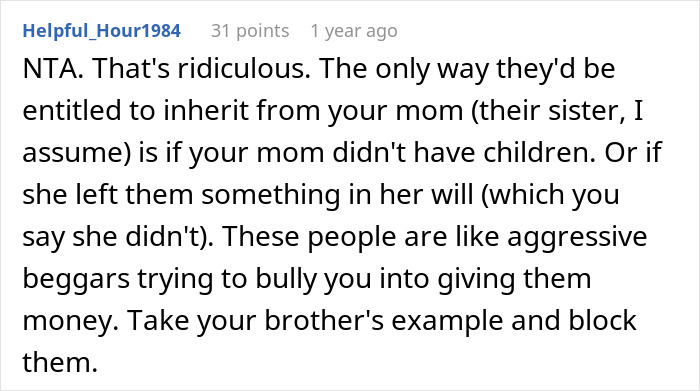

When it comes to communicating the unwillingness to share the inheritance with others, Rush suggests being open and just getting the conversation over with.

Of course, he admits that such a talk isn’t the most pleasant one to have, as money is still a big taboo topic, but it can really prevent further conflict from arising. “It only makes it harder when some of this fighting starts happening over money, assets, and estates,” he says.

Another tip to maintain harmony and prevent family disputes that senior estate planner and shareholder David Bross provides is for inheritance providers to review their estate plan every 3–5 years.

“Circumstances change and a periodic review will ensure your estate plan is consistent with your current wishes. [Also], review beneficiary designations on all retirement plans, annuities, and life insurance. These assets are not part of the probate process, so they are not subject to the terms of your last will and testament. Often these designation are forgotten about and not reviewed, so they may name beneficiaries that are not consistent with the current estate plan.”

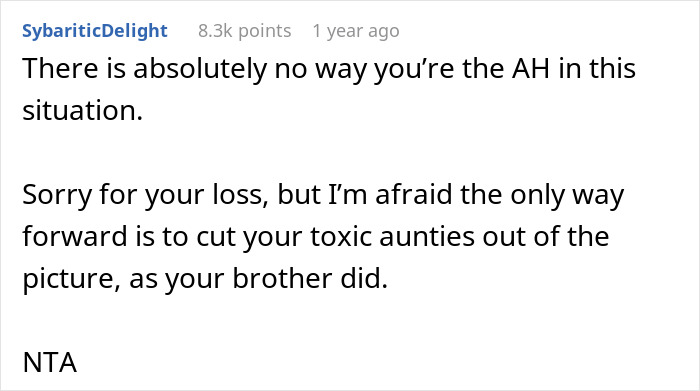

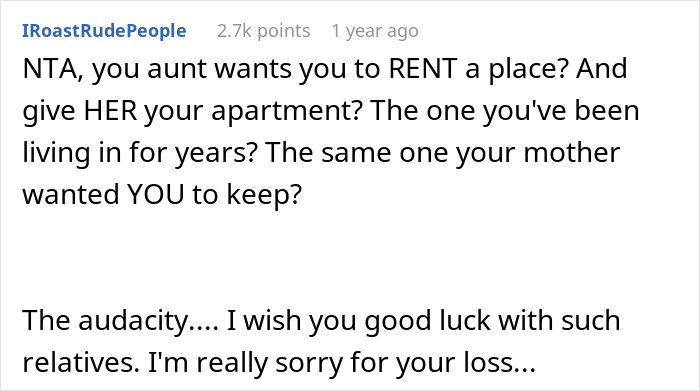

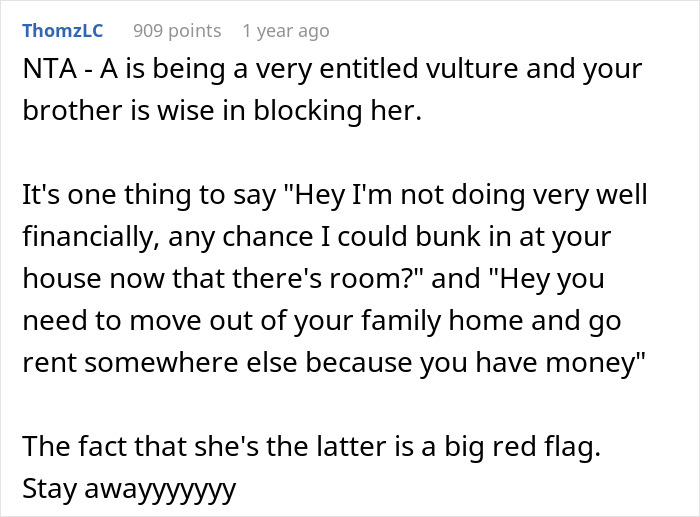

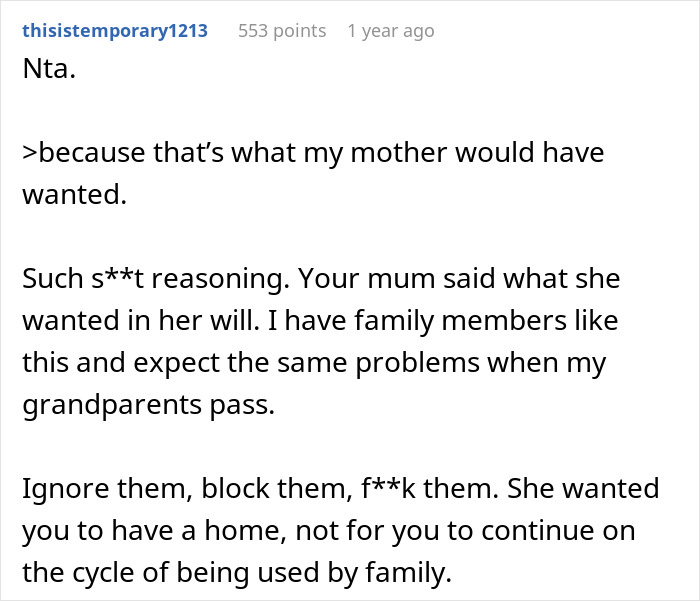

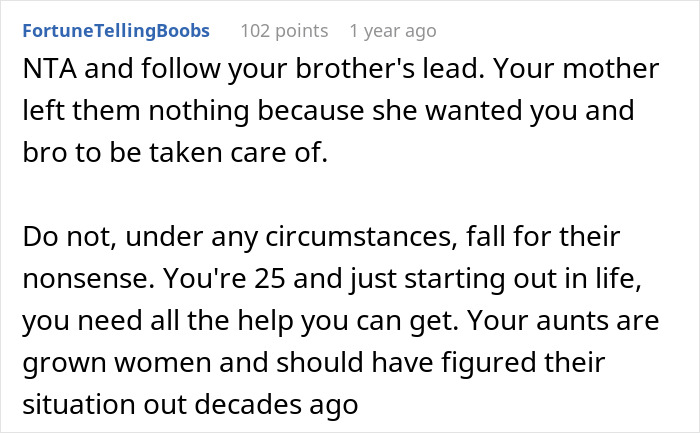

Readers concluded that the author definitely wasn’t the jerk in this situation