Banks lead US stocks higher amid bailout optimism, as the ASX recovered most of yesterday's fall, with energy and mining companies leading. Follow it all as it happened with ABC specialist business reporters as these stories happened on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Here's where we are sitting at 5pm AEDT

By Emilia Terzon

- ASX 200: +0.8% to 6,955 points

- All Ords: +0.8% to 7,142 points

- Australian dollar: -0.3% at 66.96 US cents

- Nikkei (Monday close): -1.4% to 26,946 points

- Hang Seng: +0.7% to 19,140 points

- Shanghai: +0.3% to 3,245 points

- Dow Jones: +1.2% to 32,245 points

- S&P 500: +0.9% to 3,952 points

- Nasdaq: +0.4% to 11,676 points

- FTSE: +0.9% to 7,404 points

- EuroStoxx 600: +1% to 441 points

- Brent crude: -1% to $US73.08/barrel

- Spot gold: +0.2% to $US1,982/ounce

- Iron ore: -3.9% to $US125.70/tonne

- Bitcoin: -0.6% to $US27,898

ASX breaks its losing streak as RBA hints at rate pause

By Emilia Terzon

The top performing stock today was New Hope.

It's a tidy metaphor for the inkling of optimism in the ASX 200 today, after days of trading down on financial markets woe.

The benchmark closed 0.8 per cent higher.

Same with the All Ords.

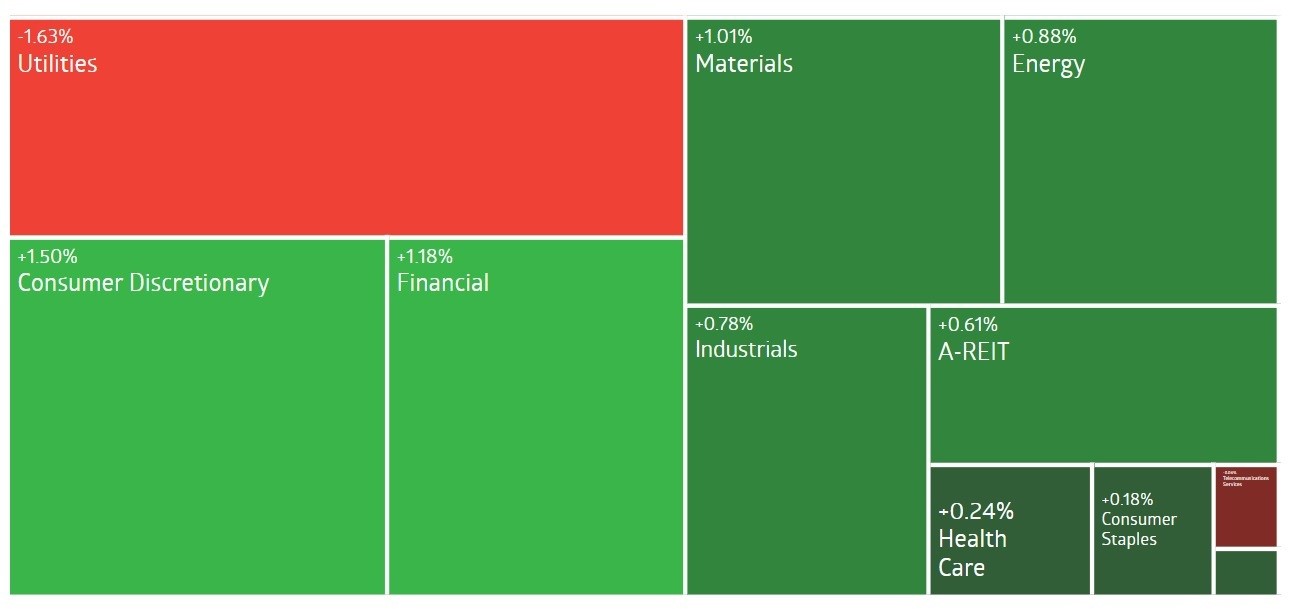

Nine of 11 sectors ended higher with consumer goods the best performing sector.

We'll see you all again tomorrow!

Andrew Forrest woos nickel shareholders

By Rachel Pupazzoni

Hello!

It's Rachel Pupazzoni (resident hi-vis reporter with the business team) coming to you with some news on Andrew Forrest's bid to buy up a Western Australian nickel miner, Mincor Resources.

Andrew Forrest, the man who started one of our biggest iron ore miners, Fortescue Metals Group, has instructed his private investment business, Wyloo Consolidated Investments, to buy up Mincor's shares.

Wyloo is already the largest shareholder of Mincor, with 19.9 per cent of its shares.

Mr Forrest has had his eyes on nickel for a long time (avid business news followers and fellow sandgropers may remember his failed attempt to start Anaconda Nickel in the early 2000's).

He's also been eyeing off nickel more recently because it is kind of the metal du jour - it's used in so many things, notably electric vehicles, of which we're seeing a lot more demand for. (I wrote about the growing demand for nickel last year and I'll link that story below).

BHP Nickel West is the biggest producer of nickel in Australia, in fact Mincor supplies its nickel to BHP for processing and selling to overseas customers.

So this hostile attempt by Mr Forrest - where he is offering Mincor shareholders $1.40 a share - quite a reduction on the $2.79 Mincor shares topped out at in April last year, though an improvement on the value Mincor shares ended yesterday's trade (at $1.04 each), will have BHP Nickel West boss Jessica Farrell's eyes keenly tuned.

This could prompt a takeover offer from BHP for Mincor.

Speaking of takeovers, BHP is currently waiting on Oz Minerals shareholders to accept its takeover offer to buy that mining company (which has copper - a mineral in hot demand - and gold assets in South Australia and WA.)

The other big nickel player here, is IGO.

We could be on the cusp of a bidding war for Mincor.

Mincor has issued a statement to the ASX, with chief executive officer Gabrielle Iwanow advising shareholders not to take any action, until Mincor Directors make a formal recommendation.

Mincor shares closed today above the $1.40 Wyloo offer price.

Fewer homes for sale equals higher prices: CoreLogic

By Michael Janda

A new note from CoreLogic's research director Tim Lawless on the seller's strike in the residential property market.

"This year 8,721 new listings were added to the market in 'Week 11' (March 11-19), down 27.3% compared to the same time last year, and 21.3% below the previous five-year average.

"So far in 2023 new listings nationally have been tracking 18.0% below 2022 levels."

Ouch, that's bad news for real estate agents.

It's also not great news for those trying to find a place to buy — I was just speaking to someone on the weekend who had been looking in Sydney without success for the best part of a year.

But, according to Lawless, it's been good news for those who have decided to sell now.

"The lower than average flow of fresh stock added to the market is likely to be a key factor supporting housing values.

"For the past month, CoreLogic's Daily Home Value Index (HVI) has shown in some cities a lack of new stock has stemmed the decline in values.

"Sydney housing values in particular are up 0.9% over the past 28 days just as the volume of new listings falls almost 40% year-on-year. It's a similar story for Melbourne, Perth and Brisbane where housing values are edging slightly higher, or have steadied."

The same does not apply in Hobart, Darwin or Canberra, where listings are up on the five-year average.

Downer facing class action over allegedly misleading shareholders

By Emilia Terzon

Maurice Blackburn is investigating whether to lodge a class action lawsuit against ASX-listed company Downer EDI.

The company that manages leading infrastructure projects, including bridges, roads and energy, is being accused by the law firm of causing a share price plunge.

Maurice Blackburn says it is investigating whether Downer "engaged in deceptive and misleading conduct and breached its continuous disclosure obligations".

The case dates back to late December and then again in February, when the company informed the market of its performance and revenue.

Its stock dropped suddenly both times.

The law firm's principle Miranda Nagy says the company's disclosures appeared to shock the market, and they allege Downer didn't do enough to disclose issues.

"The market can only operate properly if investors know what they are buying," they said.

Downer's stock is actually trading currently up today in line with the broader market.

The company declined to comment.

Self-managed super becoming less popular even before latest tax change

By Michael Janda

Some interesting research on self-managed super funds (SMSFs) from Alex Dunnin at Rainmaker Information.

It seems that the $1.6 million (now $1.7 million, and probably soon to be $1.9 million) transfer balance cap is already having a major effect on limiting the amount of money going into SMSFs.

The cap limits the amount of super that can be transferred into a tax free retirement account.

Amounts above the cap have to remain in the accumulation phase and pay 15% tax on earnings (and possibly 30% for earnings on balances above $3 million from 2025-26 if the government's current proposals pass parliament).

But even the prospect of paying 15% tax seems to have spooked some people out of putting as much money in super.

In 2016-17, before then Treasurer Scott Morrison introduced the cap, SMSF members contributed $38 billion into their funds.

That's two-and-a-half times more than the $15 billion they put in last financial year.

"The TBC profoundly changed the nature of the SMSF superannuation segment. It took the segment two years to regain composure after the 2017 tax shock and start growing again," said Mr Dunnin, the executive director of research and compliance at Rainmaker Information.

Transfers out of SMSFs have also doubled over the period, from around $5 to $10 billion.

"Another major change within the SMSF sector was that, even though the amount of retirement benefits paid out of them has been remarkably stable at about $31 billion per annum, the way this money is paid has changed significantly as SMSF members switch from pension payments to lump sums," observed Mr Dunnin.

"In 2017 just 14% were paid as lump sums, but this ratio has tripled to 42% by 2022.

"SMSF members no longer seem to see their funds as the place to put their member contributions, but they clearly still see them as a very good place to store vast amounts of family-owned superannuation wealth."

Some analysts aren't buying the pause in interest rates

By Michael Janda

Even as the RBA flags the strong chance of a pause in rate rises next month, and the US Federal Reserve is tossing up between a pause and a quarter of a percentage point rise this week, some global analysts aren't buying the rate peak narrative.

One of the leaders of this cohort is Rabobank's Michael Every, who believes geopolitical tensions and the West's move to rearm itself against threats from Moscow and Beijing will keep inflation, and therefore interest rates, higher for longer.

"Covid-era inflation was never going to be "transitory". That's what happens if you finally use fiscal *and* monetary policy, having failed with only monetary, supply chains buckle, and entrenched oligopolies raise prices because they can. Oh, and war.

"Nominal wage inflation was always likely to rise. Covid saw excess deaths, long illnesses, early retirement, lifestyle changes, and labour hoarding in ageing societies where fewer younger workers must produce the same volume of goods and services, while immigration came to a halt. Workers needed pay rises to try to catch up to inflation: and firms can afford to let them to some degree because profits are so high. Governments have to for political reasons."

One of his conclusions?

"Raising rates in a financialised economy breaks things. Yet some things getting broken aren't useful to the Pentagon, and others are more useful broken."

$35 billion in dividends heading for shareholders

By Michael Janda

Corporate reporting season for most companies happened last month, now CommSec's Craig James and Ryan Felsman have tallied up the dividend payments shareholders can expect to see hitting their bank accounts.

- About $35 billion in dividends will be delivered between February and June 2023.

- That's down 17 per cent from the $42 billion paid in the August 2022 reporting period.

- Compared to the same time last year, when $36 billion in dividends were paid, it's about a 3 per cent decline.

"With the cost of living rising together with interest rates, some investors may use dividends to maintain their standard of living or meet higher loan repayments," the CommSec analysts noted.

"Of course there always are those investors that see longer-term opportunities – especially given recent volatility – choosing to channel the dividends into share market purchases. The performance of investment returns over time when dividends are included in the calculation is especially emboldening – that old saying that 'it is time in the market that is important rather than timing the market'.

"From an investor perspective, dividend payouts are incredibly important. Regular income payments to investors can cushion portfolios from the bouts of volatility in share markets, preserving capital. And the extra cash put 'back to work' in the share market could help stabilise or even support the ASX during the current bout of volatility."

Market snapshot at 1:45pm AEDT

By Michael Janda

ASX 200: +1.3% to 6,986 points

All Ords: +1.2% to 7,171 points

Australian dollar: -0.3% at 66.96 US cents

Nikkei (Monday close): -1.4% to 26,946 points

Hang Seng: +0.7% to 19,140 points

Shanghai: +0.3% to 3,245 points

Dow Jones: +1.2% to 32,245 points

S&P 500: +0.9% to 3,952 points

Nasdaq: +0.4% to 11,676 points

FTSE: +0.9% to 7,404 points

EuroStoxx 600: +1% to 441 points

Brent crude: -1% to $US73.08/barrel

Spot gold: +0.2% to $US1,982/ounce

Iron ore: -3.9% to $US125.70/tonne

Bitcoin: -0.6% to $US27,898

ASX extends gains after RBA reconfirms rate pause on the table at April meeting

By Michael Janda

The Australian share market has extended its early gains after minutes from the most recent (March 7) Reserve Bank board meeting reconfirmed a rate pause will be considered in April.

The benchmark ASX 200 was 1.3 per cent higher at 6,988 points by 1:30pm AEDT, while the broader All Ordinaries was 1.2 per cent up at 7,172 points.

The energy (+2%) and financial (+1.8%) sectors, which had been hit by major sell-offs in recent days, are the biggest gainers today.

Coal miners in particular have posted strong gains, while gold miners fell back somewhat after huge gains yesterday.

The Australian dollar has eased back just below 67 US cents.

Reserve Bank board to consider interest rate pause at next meeting

By Michael Janda

The minutes from the Reserve Bank's meeting on March 7 are out, and confirm that a pause in rate rises was discussed and will be a live option at the next meeting in April.

"Members agreed to reconsider the case for a pause at the following meeting, recognising that pausing would allow additional time to reassess the outlook for the economy.

"At what point it will be appropriate to pause will be determined by the data and the Board's assessment of the outlook."

It seems that RBA board members were spooked by a run of disappointing data, although they then downplayed those concerns and went ahead with a 0.25 percentage point increase, taking the cash rate to 3.6%.

"Members noted that the most important data released over the prior month – covering GDP, the labour market, wages and inflation – had all been a little softer than expected.

"They discussed the extent to which this should be interpreted as a signal that demand was weaker than previously assumed.

"Members noted that the shortfalls to expectations generally were not large and that there were various considerations suggesting it would be prudent not to place too much weight on one period's data.

"They also observed that there had been a few months of softer data in some other countries around mid-2022 that had been followed by stronger data, and that the same pattern could emerge in Australia.

"However, members agreed that it was appropriate to take some signal from the consistent pattern across recent data releases."

The minutes largely reiterate what RBA governor Philip Lowe told us in a speech the day after the rates decision.

Rupert Murdoch to hear wedding bells for a fifth time

By Michael Janda

Age is no barrier to love, certainly not for 92-year-old media mogul Rupert Murdoch.

He has announced his engagement to latest partner Ann Lesley Smith, a 66-year-old widow.

According to the Reuters report (below) the latest marriage is not expected to change the ownership structure of Mr Murdoch's News Corp and Fox Corp empires.

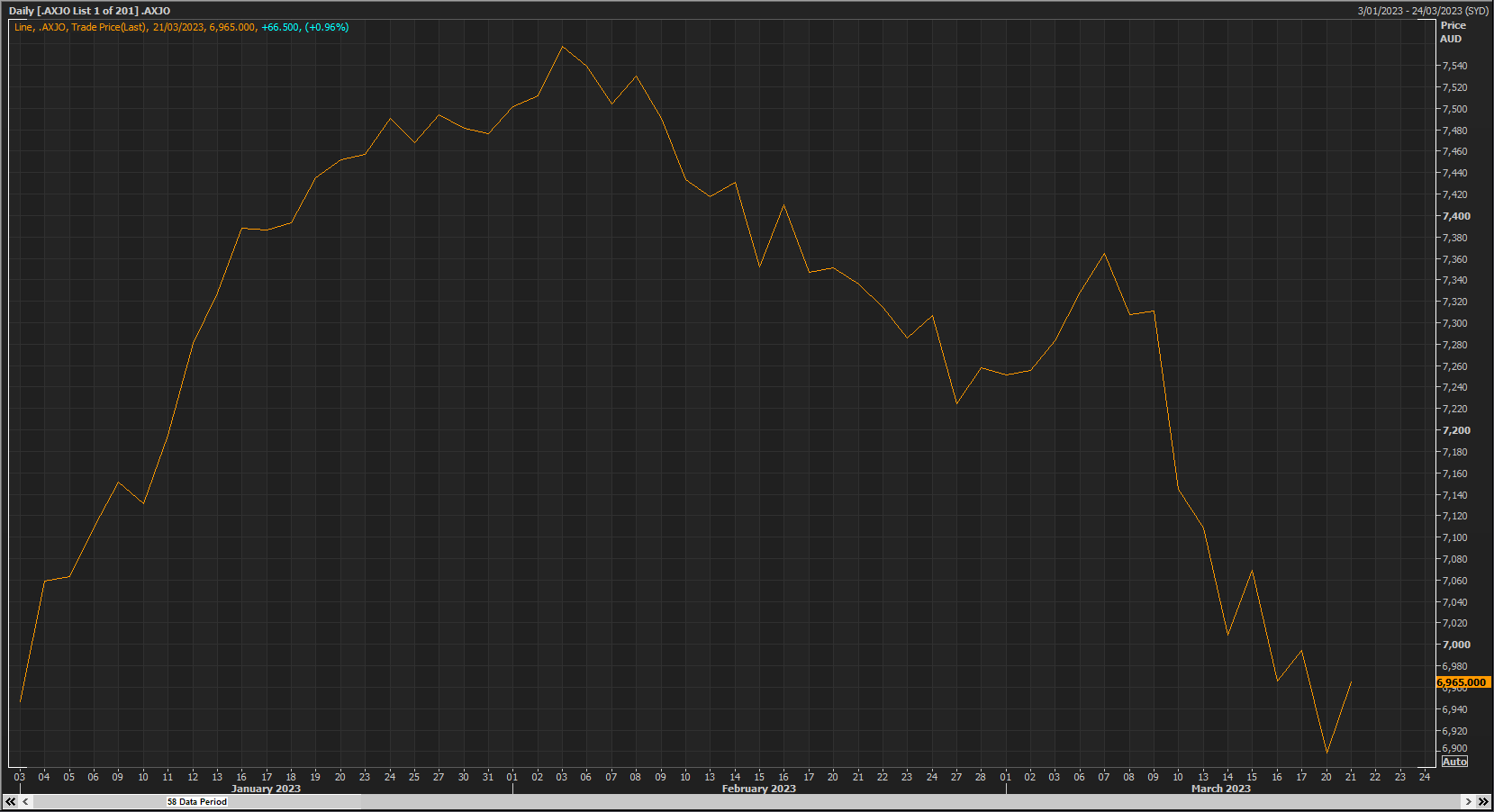

ASX back where it started 2023

By Michael Janda

This is how bad things are at the moment: I just looked at my portfolio, expecting to see an increase, and my initial reaction was, "What? It's fallen again?" It actually hadn't - but yesterday's falls were so extreme, today's gains - which would be really good on pretty much any other day - still leave me so far behind where I was this time last week, it doesn't really feel like I'm gaining at all.

- Rebecca

Great point Rebecca.

We generally focus on the daily ups and downs of the market, but its often good to take a step back and look at a longer view.

The view for this year, so far, is that the ASX 200 has gone basically nowhere.

Then again, the market value of Australia's top 200 companies has more than doubled over the past couple of decades, and that doesn't include all the dividends paid out to shareholders along the way.

Looking at the longer term, highlights the occasional wild ride (the GFC and pandemic plunges stand out), but also the general trend higher.

Market snapshot at 10:40am AEDT

By Michael Janda

ASX 200: +1% to 6,965 points

All Ords: +1% to 7,153 points

Australian dollar: Flat at 67.15 US cents

Nikkei (Monday close): -1.4% to 26,946 points

Hang Seng (Monday close): -2.7% to 19,001 points

Shanghai (Monday close): -0.5% to 3,235 points

Dow Jones: +1.2% to 32,245 points

S&P 500: +0.9% to 3,952 points

Nasdaq: +0.4% to 11,676 points

FTSE: +0.9% to 7,404 points

EuroStoxx 600: +1% to 441 points

Brent crude: +1.2% to $US73.79/barrel

Spot gold: +0.1% to $US1,978/ounce

Iron ore: -3.9% to $US125.70/tonne

Bitcoin: -0.8% to $US27,841

Australian shares open higher following overseas gains

By Michael Janda

The Australian share market is mirroring gains seen on Wall Street and in Europe overnight.

The benchmark ASX 200 index was up 0.9 per cent to 6,963 points shortly after 10:20am AEDT.

Energy and mining are the two leading sectors, up 2.1 and 1.5 per cent respectively.

Coal miners were among the leading gains, although gold miners were giving up some of yesterday's steep rally.

However, the rally is broad based, with 160 of the top 200 firms gaining ground and all but two sectors higher.

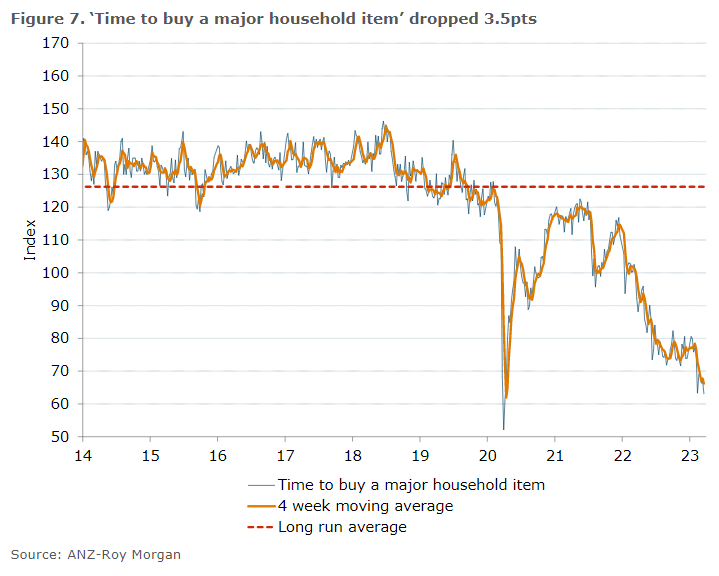

No time to buy

By Michael Janda

Or, to hijack another Bond title, buy another day.

That's a key finding of the latest weekly consumer confidence survey from ANZ and Roy Morgan.

The only time in recent history when Australians thought it was a worse time to buy a major household item was when we were unsure how many of us would stay alive to use it, as COVID-19 swept the world in early 2020 causing widespread panic and lockdowns.

Of course, there was also the brief, but sharp, recession caused by those lockdowns.

Commentary from ANZ senior economist Adelaide Timbrell:

"The index, in four of the past five weeks, was among the ten worst results since the COVID outbreak. Confidence among those paying off their mortgages fell 4.3 percentage points and are at their lowest since the beginning of the monetary tightening cycle. Confidence among renters and outright homeowners rose a little.

"The proportion of people saying it is 'a bad time to buy a major household item' rose to 55%, its highest since early April 2020. Confidence about current finances increased 0.9pts but was still at its second lowest level since the initial COVID outbreak in Australia."

Despite this professed reticence to spend money, somehow retail sales, including of some major household purchases, are holding up.

Cars were a good example last year.

"A total of 1,081,429 vehicles were delivered during an unusual year when demand exceeded supply," noted the Federal Chamber of Automotive Industries (FCAI).

And the strength in sales has continued so far this year.

Australia's automotive industry delivered 86,878 vehicles during February 2023, a 1.8 per cent increase on the same period in 2022.

"This is the best February result since 2019. It is particularly pleasing given global and domestic supply constraints," FCAI Chief Executive Tony Weber said.

Perhaps, in this case, it's a unique situation where supply delays meant people are finally getting cars they wanted six months or a year ago.

But ABS retail sales also don't yet tally with a household sector totally shutting their wallets.

Former Tesla Australia director sentenced for insider trading

By Michael Janda

ASIC has just sent out a media release on the sentencing of one of Tesla Australia's former directors, who pleaded guilty to insider trading.

Here's what the corporate regulator had to say:

"On 17 March 2023, former Tesla Motors Australia Pty Ltd (Tesla Australia) director Kurt Schlosser, of Sydney, New South Wales, was sentenced in the Sydney District Court following his guilty pleas to two insider trading offences.

"Mr Schlosser was sentenced to two years and six months imprisonment, to be released immediately upon entering into a recognizance, on the condition that he be of good behaviour for two years and six months.

"In his role as country director of Tesla Australia, Mr Schlosser was informed of a confidential, in-principle agreement to be entered into by Tesla Inc in the United States of America. The agreement related to the supply of lithium to Tesla Inc by Piedmont Lithium Ltd, a company listed on the Australian Securities Exchange (ASX).

"Mr Schlosser then purchased 86,478 shares in Piedmont Lithium Ltd in two transactions and also communicated that inside information to a friend in circumstances where it was likely that person would also acquire Piedmont Lithium Ltd shares. Mr Schlosser, shortly after the announcement was made public, sold the shares for a realised profit of $28,883.53.

"An order was also made by consent for Mr Schlosser to forfeit the profit of $28,883.53 to the Commonwealth.

"As a result of his conviction, Mr Schlosser is also automatically disqualified from managing corporations for five years."

Bank losses are tech's gain

By Michael Janda

Rather than pull money out of the stock market altogether, IG's Tony Sycamore says there has been something of an asset allocation shift taking place amid the banking crisis of the past couple of weeks.

"Despite the wealth destruction across the global banking sector, estimated to be worth around $453 billion in market cap over the past seven trading sessions, the S&P500 is broadly flat, and the Nasdaq is up almost 6% in the same period.

"As interest rate markets have gone from pricing in rate hikes to pricing in rate cuts, there is now a tailwind supporting rotation into tech giants such as Apple, Microsoft, Google, Meta, Amazon and Nvidia. Those five stocks alone have gained approximately $440bn in market cap in the same period."

Of course, tech has been one of the hardest hit sectors as surging interest rates have hammered the valuations of more speculative assets.

So, it stands to reason that, as traders bet rate rises may be about to stop, there is something of a relief rally.

Market snapshot at 8:30am AEDT

By Michael Janda

ASX SPI 200 futures: +0.7% to 6,969

ASX 200 (Monday close): -1.4% at 6,899 points

All Ords (Monday close): -1.4% to 7,085 points

Australian dollar: -0.1% to 67.1 US cents

Nikkei (Monday close): -1.4% to 26,946 points

Hang Seng (Monday close): -2.7% to 19,001 points

Shanghai (Monday close): -0.5% to 3,235 points

Dow Jones: +1.2% to 32,245 points

S&P 500: +0.9% to 3,952 points

Nasdaq: +0.4% to 11,676 points

FTSE: +0.9% to 7,404 points

EuroStoxx 600: +1% to 441 points

Brent crude: +1.2% to $US73.84/barrel

Spot gold: -0.5% to $US1,979/ounce

Iron ore: -3.9% to $US125.70/tonne

Bitcoin: +0.3% to $US28,148

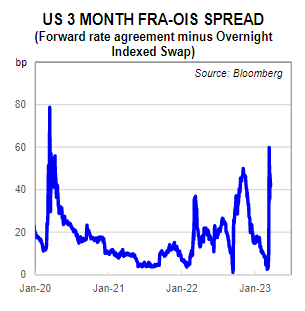

Banking system stress has eased, but remains elevated

By Michael Janda

Global stock markets indicate that the weekend moves to calm banking nerves are having a positive effect.

Credit Suisse's takeover by UBS and central banks providing extra US dollar funding to banks have eased stresses in the markets.

This is the latest from CBA associate director of international economics and currency strategy Carol Kong:

"USD eased against most major currencies overnight amid better risk sentiment. US Treasury yields and bank shares rose.

"Yesterday, the Fed and five other major central banks announced a coordinated action to enhance US dollar liquidity. The central banks started offering the chance to secure dollars via the US dollar swap lines on a daily (rather than weekly) basis from yesterday. However, demand for dollars at the swap lines appears modest so far.

"That said, there remain signs of stress in the dollar funding markets. Bloomberg reported the Federal Home Loan Bank System (or known as 'lender of next-to-last resort') has aggressively issued debt to provide liquidity to regional banks.

"The FRA-OIS spread also widened to levels that indicate stress in the banking system."

This is the spread, or gap, between two key interest rates, that shows banks are reluctant to lend to each other for even slightly longer terms, preferring to park their cash overnight.

"The three month spread between the forward rate agreement and the overnight indexed swap widened to levels last seen at the onset of the 2020 pandemic last week.

"The stress level has since come off last week's high amid regulators' efforts to shore up confidence in the global financial system.

"Nevertheless, we consider it is too early to conclude the worst of the banking issues is in the rear-view mirror. A crisis can quickly develop if banks refuse to lend to each other."