The Australian share market has gained despite heavy losses for the two biggest miners. Rabobank's global strategist Michael Every has warned of lingering inflation as Russia's Ukraine war drags on.

See how the day unfolded on the markets blog with insights from our specialist business and economics reporters.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:30pm AEDT

By Michael Janda

- ASX 200: +0.3% to 7,307

- All Ordinaries: +0.3% to 7,513

- Australian dollar: +0.1% at 68.12 US cents

- Nikkei: +1.2% to 27,406

- Hang Seng: -1.2% to 20,113

- Shanghai: 0.5% to 3,270

- Dow Jones: +0.3% to 33,154

- S&P 500: +0.5% to 4,012

- Nasdaq: +0.7% to 11,590

- FTSE: -0.3% to 7,908 points

- EuroStoxx 600: +0.1% to 463 points

- Spot gold: +0.1% at $US1,824/ounce

- Brent crude: +0.9% to $US82.92/barrel

- Iron ore: -0.3% to $US129.60/tonne

- Bitcoin: +0.1% to $US23,911

Michael Every warns inflation is here to stay and it may need recession to control it

By Michael Janda

I mentioned earlier that Rachel Pupazzoni was speaking to Rabobank global strategist Michael Every about the global geopolitical and economic situation.

Here's a couple of highlights.

When asked about what happens if, like the Korean or Vietnam wars, the Russia-Ukraine war either drags on or does not result in a clear resolution.

"Let's say it goes on for years it grinds on escalates so that more and more equipment has to be thrown into it. That is going to generate a lot more inflation.

"First of all, this war up until now has been fought largely with inventories, or the rundown of inventories of US military equipment. If it's going to grind on, we'll need to produce a lot more with military equipment, Europe will have to do it, Australia will have to do it, everyone will have to do it. And that's at a time of low unemployment, quite tight capacity and a lot of industries. And, as I said earlier on, this supply chain pressure in terms of commodity prices, so let's throw that in, and we'll see how inflationary it is.

"But, at the same time, the broad corollary to what we're seeing is more and more people saying we're vulnerable in terms of broader geopolitical pressures on supply chains. We need to have more jobs at home. We need to have supply chains that are shorter, nearer to us. Well, guess what? That's a great idea, but it's inflationary. It's going to be more expensive than having everything centered on China the way it has been up until now."

And what will that mean for Australia?

"I don't see how Australia is a special case ... if you look at the factors that you see in every developed economy, rising interest rates, high household debt, that high inflation, which has already crimping purchasing power, offset by very low unemployment, and now how does that result?

"Can you find this Goldilocks path where unemployment goes up a little bit, wage growth comes down a little bit, inflation comes down a lot, housing doesn't crumble, everyone's happy and everything goes back to normal?

"Can it be done? Yes. Is it the most likely outcome both in Australia and everywhere else? No."

You can watch the full interview on Close of Business on ABC News and iView at 9:30pm AEDT or search for it on YouTube.

Australian shares finish higher despite big miners falling

By Michael Janda

The ASX 200 and All Ordinaries have both finished the session 0.3 per cent higher, despite a significant drag from Ausralia's major miners.

The ASX 200 closed at 7,307 and the All Ordinaries finished at 7,513 points.

Gains were broad-based, with 134 of the top 200 companies gaining, while only 53 fell.

But two of those declining were global mining giants Rio Tinto (-3.6 per cent) and BHP Billiton (-1.6 per cent), amid a broader fall for resources stocks, placing a big drag on the market.

Five biggest gains:

- Star Entertainment: +8.6% to $1.52

- Bega Cheese: +7.5% to $3.57

- Brambles: +7.5% to $12.97

- Block: +5.9% to $115.31

- Smartgroup: +5.6% to $6.45

Five biggest losers:

- Regis Resources: -4.8% to $1.70

- Perpetual: -4.2% to $24.85

- Rio Tinto: -3.6% to $118.92

- Domino's Pizza: - 3.5% to $53.29

- Evolution Mining: -2.8% to $2.70

And that's your stocks for the week. I'll be back on Monday.

Brambles and Mineral Resources post profit results

By Michael Janda

Today has been a quieter day on the profit reporting front, with none of the household names out.

Two of the more notable results that have shifted share prices are Brambles and Mineral Resources.

Brambles profits rose 9 per cent to $US331.1 million ($486 million), a 20 per cent increase excluding currency changes.

Analyst Owen Birrell from RBC Capital Markets said the result was strong.

"Brambles (BXB) has delivered a strong 1H23 result – Adjusted EBIT +25% yoy (const. currency) to $549m, +5%/+8% beat vs RBC/consensus ($521m/$507m). Revenue, +14% yoy (const. currency) to $2,931m, was in line with RBC ($2,935m). Final dividend of US12.25cps, paid as A17.67cps (franked at 35%) slightly below RBC/consensus (US14.0/13cps)."

The market agreed, with Brambles shares surging 8.7 per cent to $13.115, the best gain on the ASX 200.

Iron ore and lithium miner Mineral Resources has had a yo-yo day on its results, plunging to be one of the ASX's worst performers before recovering to be just a little bit down.

It posted an 1,890 per cent increase in profit from $20 million to $390 million as it ramps up its lithium operations.

But RBC Capital Markets analyst Kaan Peker said the result was a little disappointing.

"A weaker than expected interim result, namely on higher costs and a large working capital build at Wodgina (lithium) relating to the toll treating/conversion of MIN's spodumene into lithium hydroxide. We see this mostly a timing issue, nevertheless, the EBITDA miss and working cap build has impacted cash generation, with MIN reporting a higher net debt number. As a positive the interim dividend of A$1.2/sh was better than expected, despite lower cash generation in 1H. FY23 guidance unchanged."

Mineral Resources shares were down 0.2 per cent to $84.87 at 3:25pm AEDT.

Analyst warns investors to brace for Russia-Ukraine war escalation

By Michael Janda

Rabobank global strategist Michael Every published a detailed report in January last year warning that Russia was preparing to invade Ukraine and that it would trigger severe global financial fallout.

Now he's warning that the conflict could get worse and, again, traders are underpricing the risk.

"We had predicted a month before the war began that it looked far more probable than markets were pricing, and it would trigger a 'metacrisis' if it started. (True, not every forecast made played out as we expected due to second order effects, but it was a far better call than 'peace now'!).

"Seven weeks ago, the same analysts implied the war was winding down via their 2023 forecasts. Today, all the signs are that it is about to escalate. In short, a year of experience has seen no improvement in the market's collective inability to understand the realpolitik outside its siloed, bean-counting expertise."

Michael Every is speaking with Rachel Pupazzoni this afternoon in an interview that will air on Close of Business on ABC News Channel and iView at 9:30pm AEDT tonight.

This is a reminder of what he warned about before the war began in 2022.

Jobs ads up, applications up more

By Michael Janda

There is still some life left in Australia's strongest jobs market in nearly five decades, with job ads posting their first monthly rise since May last year.

Seek reported a 2.8 per cent increase in ads on its platform in January, with the biggest rises in Tasmania (8.5 per cent) and Queensland (4.2 per cent).

However, job ads nationally were still down 8.1 per cent on the very high levels seen in January last year, although 26.3 per cent higher than pre-pandemic levels.

While there are still a fair number of jobs being advertised, there are also now more people applying for them, with re-opened international borders increasing the potential workforce.

Applications per job rose 9.2 per cent month-on-month — the seventh consecutive month that number has risen.

There was a 20 per cent increase in applications per job ad for hospitality and tourism jobs, with a 19 per cent rise in those applying for jobs for chefs/cooks and a 35 per cent jump in applications for bar/beverage staff roles.

Applications per job ad are now 35.5 per cent higher than they were a year ago, and down just 9.5 per cent on pre-pandemic levels.

So, while demand for workers remains strong, it is clear that the return of students, backpackers and work visa holders from overseas is increasing the supply of labour substantially.

Earlier this week, CBA's head of Australian economics Gareth Aird wrote:

"Peak tightness in the labour market is now behind us.

"The labour market was at its tightest point in the September quarter 2022. The WPI increased by 1.1%/qtr in Q3 22 (revised up from the original 1.0%), helped by the big lift in the Annual Wage Review of between 4.6% and 5.2% by the Fair Work Commission).

"Since then the flow of migrants and foreign workers into the country has accelerated. At the same time, job advertisements have fallen and the number of applicants per job ad has risen. This dampens wages growth."

These comments were in response to the Wage Price Index released on Wednesday, and covered in detail by my colleague Gareth Hutchens here.

Market snapshot at 12:40pm AEDT

By Michael Janda

- ASX 200: +0.2% to 7,303

- All Ordinaries: +0.2% to 7,507

- Australian dollar: Flat at 68.06 US cents

- Nikkei: +1.3% to 27,450

- Hang Seng: -0.6% to 20,224

- Dow Jones: +0.3% to 33,154

- S&P 500: +0.5% to 4,012

- Nasdaq: +0.7% to 11,590

- FTSE: -0.3% to 7,908 points

- EuroStoxx 600: +0.1% to 463 points

- Spot gold: +0.1% at $US1,825/ounce

- Brent crude: +0.8% to $US82.85/barrel

- Iron ore: -0.3% to $US129.60/tonne

- Bitcoin: +0.7% to $US24,052

Australian shares climb further midway through Friday's session

By Michael Janda

After a very, very subdued start to trade, the ASX has found some mojo.

The ASX 200 index is up 0.3 per cent to 7,306, while the All Ords is a quarter of a per cent higher at 7,510.

Despite the modest gains, twice as many stocks are gaining ground as losing it, with strong gains for industrials leading the way.

A big 2.4 per cent fall for Rio Tinto was a key drag on the major indices, with a 0.9 per cent slide for BHP not helping either, given the size of those companies.

Here are the biggest movers:

Former RBA deputy governor Guy Debelle says Australia risks lagging on green hydrogen

By Michael Janda

Former Reserve Bank deputy governor Guy Debelle left the RBA last year to go and work with Andrew Forrest's Fortescue Future Industries (FFI) as chief financial officer.

He also left that role late last year after a serious bike crash, but moved onto the FFI board of directors.

Dr Debelle revealed his passion to address the challenges of climate change prompted his decision to leave the RBA.

But now he has warned that Australia risks being left behind, as countries such as the US encourage large investments in green hydrogen.

Dr Debelle spoke to Patricia Karvelas about the issue on RN Breakfast. (And for any of you hopefully of hints about the direction of interest rates or commentary on the RBA, you'll be disappointed).

Market snapshot at 10:40am AEDT

By Michael Janda

- ASX 200: Flat at 7,288

- All Ordinaries: +0.1% at 7,498

- Australian dollar: Flat at 68.1 US cents

- Dow Jones: +0.3% to 33,154

- S&P 500: +0.5% to 4,012

- Nasdaq: +0.7% to 11,590

- FTSE: -0.3% to 7,908 points

- EuroStoxx 600: +0.1% to 463 points

- Spot gold: Flat at $US1,822/ounce

- Brent crude: +2.3% to $US82.43/barrel

- Iron ore: -0.3% to $US129.60/tonne

- Bitcoin: +0.1% to $US23,908

ASX edges higher in early trade

By Michael Janda

The Australian share market has edged higher in early trading, with the benchmark ASX 200 index up 2 points to 7,288 by 10:15am AEDT.

The broader All Ordinaries was a little stronger at the open, rising 6 points to 7,499.

The weak rise was despite around twice as many companies on the ASX 200 gaining ground as losing it.

However, Rio Tinto (-2 per cent) and BHP (-0.9) were pretty big weights on any prospect of stronger gains, given their size relative to most of the other companies on the index.

The basic materials sector was down 0.7 per cent overall, while the other big sector (financials) was only up 0.1 per cent and doing little to boost the index.

Industrials, real estate, energy and technology all had strong gains, reflecting some of the trends on Wall Street overnight.

Five biggest gains:

- Bega Cheese: +7.2% to $3.56

- Block: +6.9% to $116.44

- Smartgroup: +5.2% to $6.43

- Brambles: +4.7% to $12.64

- New Hope: +3.7% to $5.55

Five biggest losses:

- Mineral Resources: -5.2% to $80.60

- Perpetual: -3.8% to $24.96

- Qube: -3.4% to $3.14

- Deterra Royalties: -3% to $4.52

- PEXA Group: -2.9% to $12.00

Westpac lifts cash rate forecast to 4.1 per cent

By Michael Janda

Westpac has followed NAB and ANZ in raising its forecast for the Reserve Bank's peak cash rate to 4.1 per cent in May.

Westpac was previously forecasting a peak of 3.85 per cent.

The bank expects the RBA to have to start cutting rates from that level, but not until March 2024.

That is despite this week's wages numbers coming in below expectations and prompting Westpac to slash its peak wages growth forecast from 4.5 to 4 per cent.

It is also despite the bank's own consumer confidence survey showing household sentiment is at recessionary levels, and has been for many months.

Moreover, Westpac's chief economist Bill Evans believes the risks are to the upside on rates, not the downside.

"The RBA seems locked in to further hikes in the cash rate in both March and April. The revised forecasts and March quarter inflation report are likely to require a further hike in May.

"With the concerns about a wage-price spiral easing following the December quarter Wage Price Index report; demand slowing; and the cash rate deeply contractionary, at 4.1%, the case for a pause in June is credible. Further out the next move is likely to be a rate cut beginning in the March quarter 2024.

"But risks to this scenario are to the upside – COVID legacy factors that could boost demand and slow the disinflation process; the extension of the US tightening cycle; and recent recognition that Australia's cash rate is below other countries will keep markets alert to those upside rate risks."

CBA is the odd big bank out in forecasting a cash rate peak of 3.85 per cent by April, and its head of Australian economics Gareth Aird has consistently argued even that is too high and likely to lead to recession unless rate cuts start in the second half of this year.

DJs and Politix latest big firms pinged for worker underpayments

By Michael Janda

This from a Fair Work Ombudsman media release just out:

"Department store company David Jones Pty Ltd and men's fashion company Cicero Clothing Pty Ltd (trading as Politix) will back-pay about $1.9 million and $2.1 million respectively, including superannuation, to more than 7,000 underpaid employees, and have each signed an Enforceable Undertaking (EU) with the Fair Work Ombudsman.

"Both retail entities are part of South African-based Woolworths Holdings Limited's Australian operations. Politix is part of the Country Road Group.

"Underpayments by David Jones and Politix, as well as more broadly in the Country Road Group, were reported by the companies to the Fair Work Ombudsman in September 2020.

"Underpayments at David Jones and Politix were caused by failures in manual payroll processes; payroll system set-up errors; annual salaries insufficient to cover all General Retail Industry Award 2010 entitlements; and the failure to compensate training and classification secondments.

"As a result of these failures, employees were underpaid their minimum wages, evening, weekend and public holiday penalties, overtime rates, and entitlements arising where they did not receive a 12-hour break between shifts, as owed under the Fair Work Act, Retail Award and multiple enterprise agreements.

"David Jones also did not correctly pay superannuation as required under its enterprise agreements.

"Politix underpaid about 850 employees a total of around $2.06 million in wages, plus around $45,000 in superannuation, between November 2016 to September 2020. David Jones underpaid about 2800 employees a total of around $480,000 in wages, plus around $1.4 million in superannuation to about 6100 employees, between April 2014 and September 2020. The large majority of backpayments have been made."

The companies join many others, including Qantas, Coles, Wesfarmers, Woolworths, CBA, Westpac, NAB, 7-Eleven, Super Retail Group and the ABC itself that have been caught up in underpayment scandals.

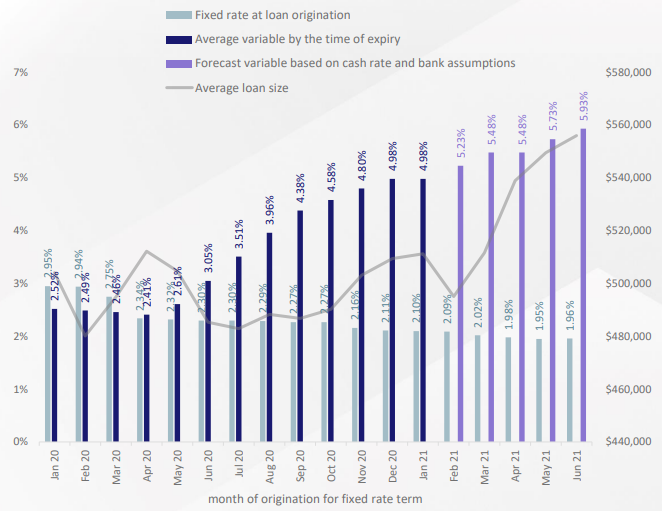

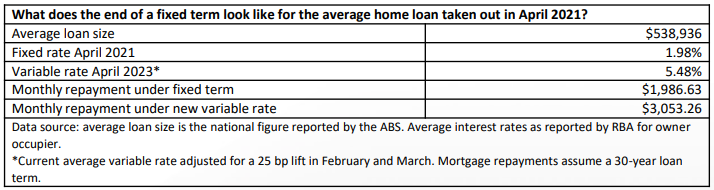

True test of the housing market in 2023 as we go over the fixed mortgage 'cliff'

By Michael Janda

CoreLogic's head research Eliza Owen has published an interesting report on the fixed mortgage "cliff".

Here's some highlights.

"The RBA noted in the Financial Stability Review that around two thirds of the 35% outstanding fixed mortgage debt would expire in 2023," she noted.

"Hence the 'cliff': around 23% of all outstanding mortgage debt will be re-priced over the course of the year, and re-priced at a much higher rate."

"As more fixed loans revert to variable rates, there is likely to be some challenge to serviceability.

"Interest rates have risen beyond 3 percentage points for many borrowers, which is the minimum serviceability buffer recommended by APRA in assessing whether someone can repay their debt.

"Stretched serviceability could be compounded by an increase in the unemployment rate this year along with higher than budgeted household costs due to high inflation.

"A rise in distressed sales could also put added downward pressure on property values. If people are forced to sell their home in a declining market, there is the added risk of being unable to recover mortgage debt from the sale of a home."

However, Ms Owen says the early indicators show no cause for panic, at least so far.

"The majority of outstanding mortgage debt has already been subject to steep rate rises and, yet, housing market measures show resilience in mortgaged households.

"The volume of new advertised properties hitting the market for sale nationally remains contained, trending 14.8% below the previous five-year average.

"As of December, borrowers were still dedicating 15.7% of housing payments to offset and redraw accounts. However, these contributions are declining, and are below the pre-COVID average of 20.1%.

"If variable rate holders are coping with rising mortgage rates, will fixed-rate borrowers cope any less?"

Ms Owen also says there are likely to be relatively few borrowers in the position of both negative equity and unable to pay their loans.

"CoreLogic estimates only 2.9% of suburbs across the country have seen home values fall more than 20% from a recent peak.

"Large deposits also help to strengthen the equity position of mortgage holders. RBA assistant governor Brad Jones recently noted that around 0.5% of home loans were in negative equity amid current price falls. If home values were to fall a further 10%, the RBA estimates the rate of loans in negative equity would only rise to around 1%."

However, the fixed rate cliff hasn't hit yet, so things could change.

"So far, listings data and arrears data suggest there is minimal impact on the housing market from defaults. However, the true test of the market will be over the next ten months," Ms Owen concluded.

Watch this space.

Market snapshot at 8:00am AEDT

By Michael Janda

- ASX 200 futures: +0.1% to 7,227 points

- Australian dollar: +0.1% to 68.12 US cents

- Dow Jones: +0.3% to 33,156 points

- S&P 500: +0.7% to 4,018 points

- Nasdaq: +0.9% to 11,612 points

- FTSE: -0.3% to 7,908 points

- EuroStoxx 600: +0.1% to 463 points

- Brent crude: +2.1% to $US82.29/barrel

- Spot gold: -0.1% to $US1,823/ounce

- Iron ore: -0.3% to $US129.60/tonne

- Bitcoin: +0.5% to $US23,931

Corporations responsible for more than two-thirds of Australia's inflation crisis: report

By Michael Janda

A new report out today from the Australia Institute estimates that corporations are responsible for nearly 70 per cent of inflation above the Reserve Bank's target over the past three years.

Workers are pinned for less than a fifth of the excess inflation impulse, while small unincorporated businesses account for about 14 per cent.

The estimates by economist Dr Jim Stanford are based on ABS National Accounts data from the December quarter of 2019 (pre-pandemic) to the September quarter of 2022 (the most recent results available).

"Without excess profits, the course of price inflation since the pandemic would have been considerably moderated — even with the supply disruptions and other shocks which have affected price levels in this period," he wrote.

"Even if we accepted that nominal profit margins (on a unit basis) should be allowed to increase in line with an accepted target rate of inflation since end-2019, annual GDP inflation would then have averaged only 3.3 per cent in the period since December 2019. That is well below actual realised inflation, and only slightly above the RBA's target band."

If Dr Stanford is correct, that means surging corporate profits have been the key cause of rising interest rates, hitting indebted households from both directions — higher prices and rising mortgage costs.

We'll get the latest update on profits and wages in ABS data releases from the December quarter National Accounts next week. In the meantime, you can read more of Dr Stanford's analysis here.

Wall Street does a U-turn

By Michael Janda

Good morning, time to smell the coffee.

With a little trading left in New York, it looks like US traders have spent the night making a big U-turn.

After initial gains based on some general optimism that rates wouldn't climb too much higher, and a stonking outlook from graphics chip maker NVIDIA, the benchmark S&P 500 index dropped quite steeply ... only to revive again around the middle of the session.

Edward Moya from OANDA said strong jobs data caused the dip (good economic news is bad market news again, because rates).

"The labor market does not want to loosen. First-time claims for weekly unemployment benefits edged lower from 195,000 to 192,000, below the consensus estimate of 200,000. Continuing claims decreased from 1.691 million to 1.654 million, well below the 1.70 million estimate," he wrote in a note.

"Wage pressures won't be easing anytime soon as weekly claims this year remain below the pre-pandemic average of ~220,000.

"The second look at Q4 GDP showed the economy grew 2.7%, lower than the advance reading of 2.9% as personal consumption was significantly lowered from 2.1% to 1.4%. When you remove trade, government spending, and inventories, final sales to private domestic purchasers posted a 0.1% rise, the weakest reading since the start of the pandemic."

So, you have a weakening US economy but a, so far, stable jobs market. This doesn't actually sound very unusual as employment is a lagging indicator — it takes a long time to hire people and sometimes even longer to fire them.

For those interested, NVIDIA shares were up 14.2 per cent to $236.91 by 7:30am AEDT.

With strong gains for energy and tech leading the S&P 500 index 0.6 per cent higher shortly before the US close.

The tech-heavy Nasdaq was up 0.8 per cent and blue chip Dow Jones up 0.4 per cent.

Follow the blog today to keep up with the latest market moves and economic and financial news.