/AI%20(artificial%20intelligence)/AI%20Infrastructure%20by%20FOTOGRIN%20via%20Shutterstock.jpg)

Astera Labs (ALAB) reported a strong Q4 and issued encouraging guidance on Wednesday. Shares still crashed over 20% as the company confirmed it has issued new warrants for Amazon (AMZN).

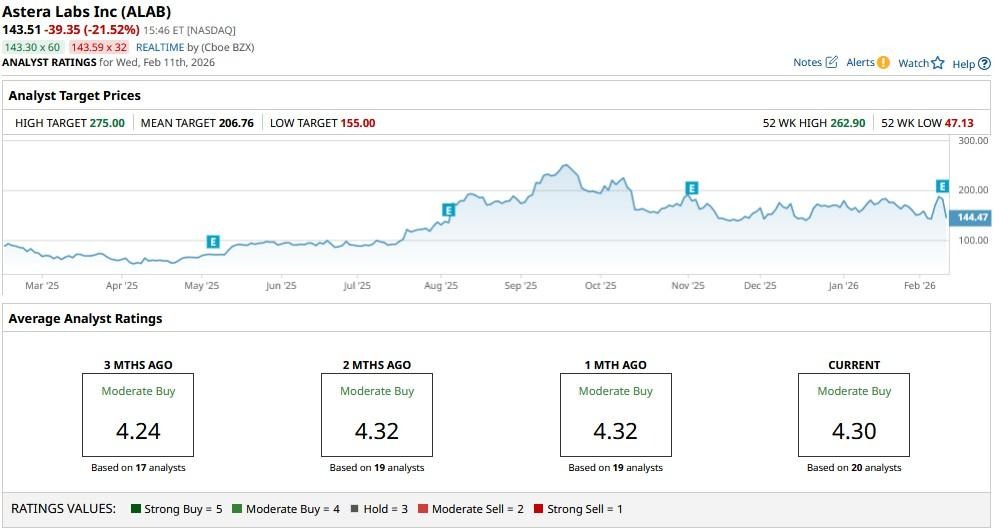

The selloff on Feb. 11, saw ALAB slip below its key moving averages (50-day, 100-day, 200-day), indicating downward pressure could sustain now that bears are firmly in control.

Versus its 52-week high, Astera Labs stock is now down more than 40%.

Does Amazon News Warrant Selling ALAB Stock?

Investors bailed on ALAB stock today primarily on dilution concerns after the semiconductor firm issued new warrants for Amazon to buy about $466 million worth of its shares.

However, the disclosed agreement represents a significant revenue opportunity as well, given it’s contingent on product purchases reaching $6.5 billion.

Meanwhile, Jitendra Mohan, chief executive of Astera Labs, said “artificial intelligence (AI) is still in its early innings,” in a post-earnings CNBC interview.

In fact, AI tailwinds helped management guide for up to $297 million in revenue for the current quarter — miles ahead of the $259 million consensus — offering long-term investors to buy this dip in Astera Labs.

Why Else Are Astera Labs Shares Worth Buying?

Astera Labs shares are attractive also because the company holds an increasingly valuable position within the AI infrastructure ecosystem.

It’s become a critical bottleneck in bringing data center capacity online, as hyperscalers competing intensely for AI infrastructure dominance must secure reliable connectivity solutions.

With the Magnificent 7 expected to spend over $650 million on artificial intelligence infrastructure this year, it’s reasonable to assume that demand for “pick-and-shovel providers” like ALAB will remain strong in 2026.

While the AI stock looks expensive at a price-to-sales (P/S) multiple of about 44x, the premium is justified given its remarkable 92% revenue growth in Q4 and an adjusted gross margin of nearly 76%.

Wall Street Remains Bullish on Astera Labs

What’s also worth mentioning is that Wall Street analysts recommend buying ALAB shares on the post-earnings decline as well.

According to Barchart, the consensus rating on Astera Labs remains at a “Moderate Buy,” with the mean target of roughly $207 indicating potential upside of 45% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.