4 analysts have shared their evaluations of Anglogold Ashanti (NYSE:AU) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

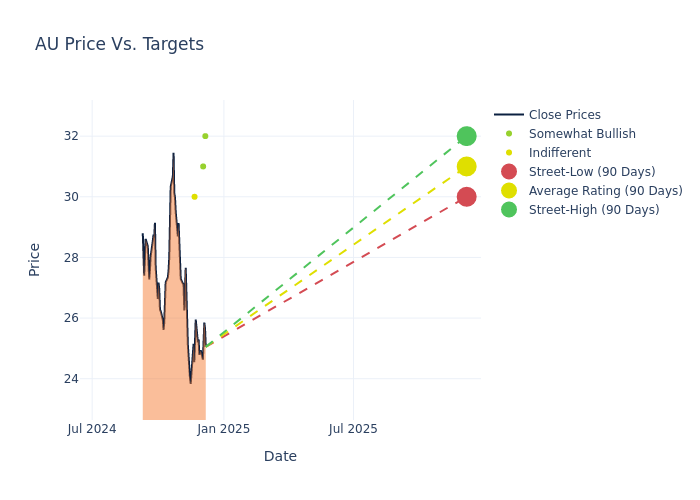

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $32.5, with a high estimate of $37.00 and a low estimate of $30.00. Staying constant with the previous average price target, the current average remains unchanged.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Anglogold Ashanti among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Patrick Jones | JP Morgan | Lowers | Overweight | $32.00 | $37.00 |

| Josh Wolfson | RBC Capital | Maintains | Outperform | $31.00 | $31.00 |

| Tanya Jakusconek | Scotiabank | Maintains | Sector Perform | $30.00 | $30.00 |

| Patrick Jones | JP Morgan | Raises | Overweight | $37.00 | $32.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Anglogold Ashanti. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Anglogold Ashanti compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Anglogold Ashanti's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Anglogold Ashanti's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Anglogold Ashanti analyst ratings.

Discovering Anglogold Ashanti: A Closer Look

Anglogold Ashanti PLC is one of the gold miners. The company also produces silver and sulphuric acid as by-products. Its operating divisions are Africa, Australia, and the Americas. The firm generates a majority of its revenue from the Africa region which includes its operations of the Kibali, Iduapriem, Obuasi, Siguiri, and Geita mines.

Financial Milestones: Anglogold Ashanti's Journey

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Positive Revenue Trend: Examining Anglogold Ashanti's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 30.79% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Anglogold Ashanti's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 14.96%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Anglogold Ashanti's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.52% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Anglogold Ashanti's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.6% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Anglogold Ashanti's debt-to-equity ratio stands notably higher than the industry average, reaching 0.56. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.