Hong Kong (AFP) - Asian markets were mixed Tuesday as growing optimism over China's economic reopening was offset by warnings that US interest rates will continue to rise and stay elevated for some time.

After a torrid 2022, equities have enjoyed a broadly strong start to the new year thanks largely to Beijing's decision to throw off the shackles of its strict zero-Covid policy, which battered the economy.

And while there are concerns about the short-term impact of soaring infections across the country, investors are growing increasingly confident thanks to government pledges of support, including for the troubled property sector.

Signs that officials are taking a lighter approach to tech firms after a long-running crackdown have also provided support.

However, sentiment is still closely linked to the outlook for US monetary policy as the Federal Reserve battles to bring inflation down from four-decade highs.

A recent run of soft data suggesting the world's top economy is slowing has provided hope the bank will be able to decelerate the pace of rate hikes and avert a recession.

Still, policymakers remain determined to keep lifting borrowing costs until they achieve their goal of two percent inflation, from the current 7.1 percent.

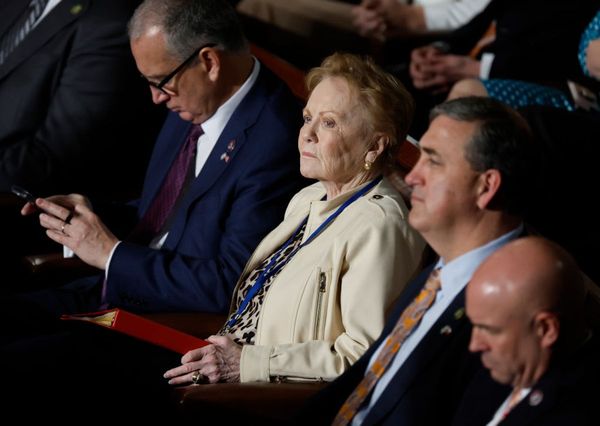

In the latest salvo, San Francisco Fed boss Mary Daly said rates would likely go above five percent before the policy board decides to stop lifting, while Atlanta Fed president Raphael Bostic tipped a similar level but added that they would not be changed for "a long time".

The comments dealt a blow to investors hoping for a change of tack later in the year.

"We are just going to have to hold our resolve," Bostic told the Atlanta Rotary Club."I am not a pivot guy.I think we should pause and hold there, and let the policy work."

All eyes are now on the release of consumer price index figures Thursday, which could play a key role in the Fed's next policy meeting at the end of the month.

Asian markets tracked a mixed performance on Wall Street.

Hong Kong, Sydney, Singapore, Manila, Mumbai, Bangkok and Jakarta all slipped while Tokyo, Shanghai, Seoul, Wellington and Taipei were in the green.

"After the sharp rally, Asian markets could see a bout of profit-taking amid headwinds from tighter financial conditions and no respite in Fed rate hike outlook," Nitin Chanduka at Bloomberg Intelligence said.

"Expectations for China are improving, but economic data may not lend validation until the country’s rampant Covid outbreak runs its course."

Key figures around 0710 GMT

Tokyo - Nikkei 225: UP 0.8 percent at 26,175.56 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 21,310.90

Shanghai - Composite: UP 0.4 percent at 3,169.51 (close)

Dollar/yen: UP at 131.87 yen from 131.80 yen on Monday

Euro/dollar: DOWN at $1.0731 from $1.0735

Pound/dollar: DOWN at $1.2167 from $1.2180

Euro/pound: UP at 88.19 pence from 88.11 pence

West Texas Intermediate: DOWN 0.2 percent at $74.48 a barrel

Brent North Sea crude: DOWN 0.3 percent at $79.43 a barrel

New York - Dow: DOWN 0.3 percent at 33,517.65 (close)

London - FTSE 100: UP 0.3 percent at 7,724.94 (close)