Upwork (UPWK) closed down roughly 19% on Feb. 10, after its disappointing Q1 outlook eclipsed an otherwise strong fourth-quarter earnings report.

UPWK now sits decisively below its 200-day moving average (MA), signaling a bearish technical setup and waning investor confidence in the near term.

Versus its year-to-date high, Upwork stock is now down more than 30%.

AI Tailwinds Could Help Upwork Stock Recover

According to Upwork, its revenue will fall between $192 million and $197 million in Q1, with up to $0.28 of earnings on a per-share basis. Analysts, in comparison, had called for $200.5 million in revenue and $0.34 in earnings per share (EPS).

However, this guidance may prove conservative, given the management’s commitment to artificial intelligence (AI) represents a material growth driver that’s being undervalued in the current risk-off environment.

In Q4, gross services value derived from AI-related work surpassed $300 million, up 50% year-over-year, reinforcing the marketplace’s ability to capture substantial value from the evolving AI economy.

Notably, nearly 70% of all job posts on the platform are now touched by Uma, the company's proprietary artificial intelligence tool, indicating deep penetration of AI capabilities across its user base.

This positioning as a foundational platform for AI-era work suggests notable long-term optionality that warrants investing in UPWK stock on the post-earnings plunge.

UPWK Shares Are Now Trading at a Discount

While a 6% decline in active clients seems like a headwind, gross services value per active client went up 7% in the fourth quarter, suggesting the firm is better monetizing its remaining user base.

What it signals is a qualitative shift toward higher-value engagements and more profitable client relationships.

Additionally, Upwork shares are now trading at a compelling valuation, with a forward price-to-earnings (P/E) multiple of about 13x only indicating they’re trading at a discount to both historical norms and peer valuations.

Note that UPWK’s relative strength index (14-day) is now hovering around 30, indicating dovish momentum is approaching exhaustion.

How Wall Street Suggests Playing Upwork

Wall Street analysts also seem to believe Upwork’s year-to-date decline is rather overdone, given the company maintains solid financial health with $673 million in cash and marketable securities.

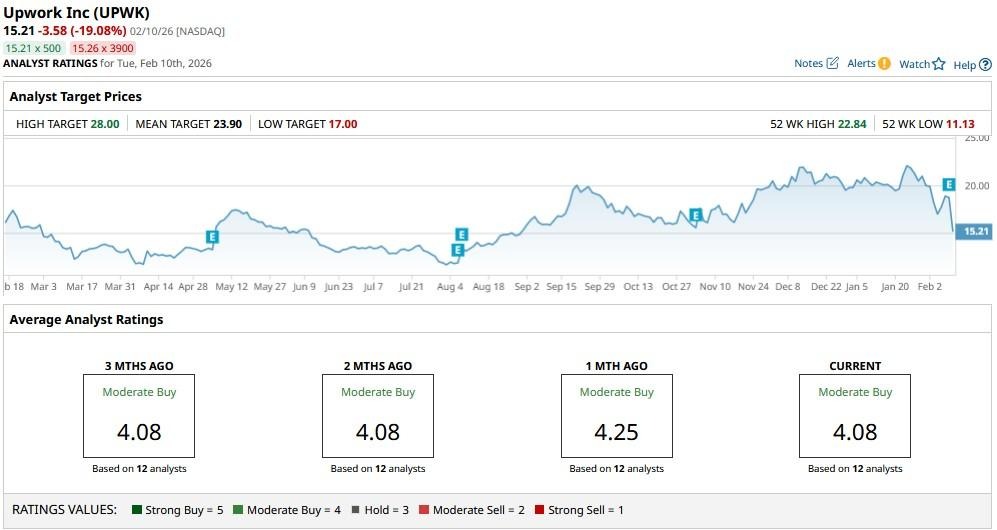

The consensus rating on UPWK shares sits at a “Moderate Buy” currently, with the mean target of roughly $24 indicating potential upside of some 60% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.