If a rising tide lifts all boats, then Nvidia NVDA must be a freaking tsunami.

Nearly one week ago, the artificial intelligence chipmaker crossed the $3 trillion valuation mark, becoming the third company ever to reach this lofty position, and briefly overtaking Apple (AAPL) as the world's second-biggest company by market value.

Related: Analysts reset Nvidia stock price targets amid split, Dow entry talk

On Monday, the Santa Clara, Calif-based company marked its first trading day following a 10-for-1 stock split.

A year ago, Nvidia shares were selling for about $40 per share. At last check, 12 months later, they were up to nearly $126 each.

Analysts have been responding to Nvidia's outrageous growth.

On Wednesday, Evercore ISI analysts raised the firm's price target on Nvidia to $145 from $131 and kept an outperform rating on the shares.

Nvidia is up 146% year-to-date and crossed a milestone of $3 trillion in market cap last week, and analysts are increasing the firm's split-adjusted price target based on its 2030 base and bull case EPS power estimates of $7.80 and $10, respectively.

Argus analyst Jim Kelleher raised the firm's price target on Nvidia to $150 from $110 while maintaining a buy rating on the shares.

Following a “highly successful” FY24, Nvidia is positioned for “continued momentum in FY25,” and shares “have much further to go,” Kelleher noted, and cited the recent stock split.

The analyst said he is looking for growth beyond data center and AI as the company's other gaming, professional visualization, and automotive end-markets also accelerate.

Report: more companies using AI

And Oppenheimer raised the firm's price target on Nvidia to $150 from $110, while keeping an outperform rating on the shares following stock split.

The firm sees Nvidia as best positioned in AI, benefiting from its full-stack AI hardware, networking, and software solutions.

Related: Analysts adjust Apple stock outlook after Developers Conference

AI is taking the tech world for a wild ride as companies look to artificial intelligence to AI to save time and money, increase productivity, and predict customer preferences, mine data, and boost revenue, among other tasks.

"If 2023 was the year the world discovered generative AI (gen AI), 2024 is the year organizations truly began using—and deriving business value from—this new technology," the consulting firm McKinsey said in a recent report.

Gen AI is capable of generating text, images, videos, or other data. In the latest McKinsey Global Survey on AI, the firm said that 65% of respondents reported that their organizations are regularly using Gen AI, nearly double the percentage from a previous survey just ten months ago.

"Respondents’ expectations for gen AI’s impact remain as high as they were last year, with three-quarters predicting that gen AI will lead to significant or disruptive change in their industries in the years ahead," McKinsey said.

Nvidia isn't the only stock benefiting from the AI boom

Nvidia gets the headlines, but "old school tech" companies are seeing their stocks rise as AI reaches for the sky, too.

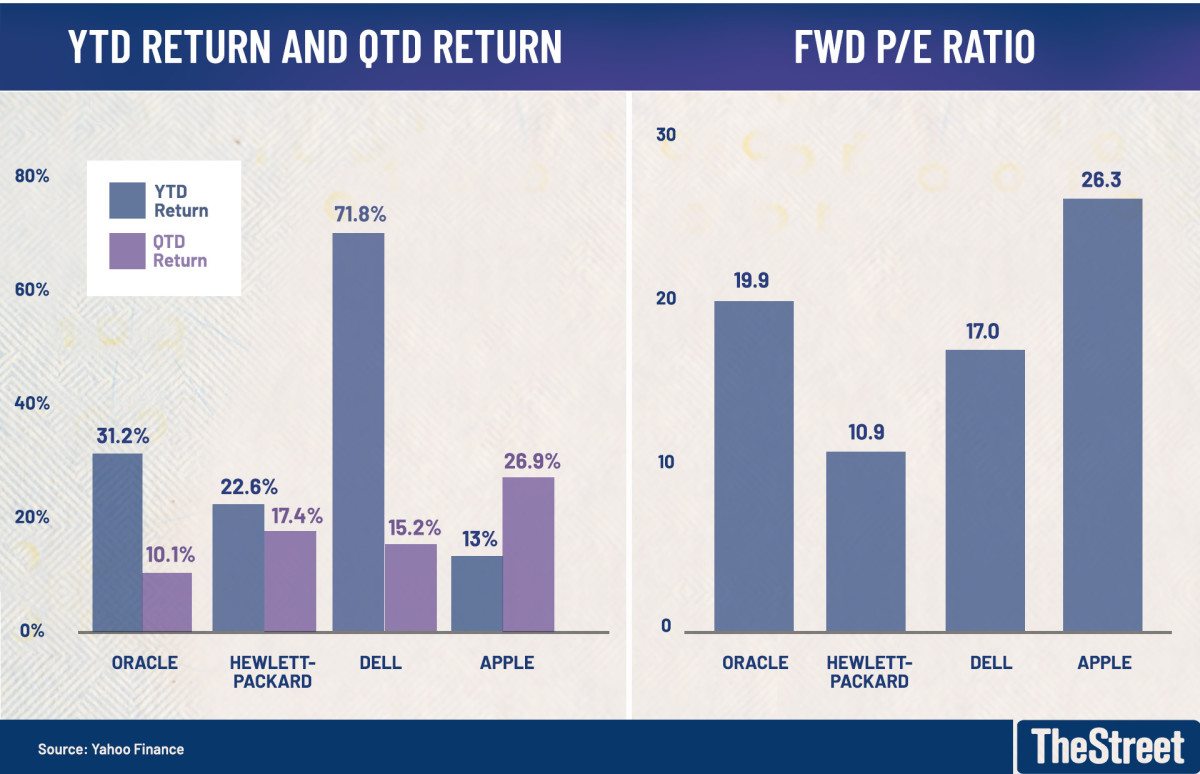

For example, Oracle (ORCL) shares are up 31.21% year-to-date and 10.13% for the quarter so far. The software company's stock surged more than 13% on Wednesday, June 12, after reporting fourth-quarter results.

Several analysts raised their price targets for Oracle shares, including TD Cowen analyst J. Derrick Wood, who boosted the firm's price target to $165 from $145 and kept a buy rating on the stock.

Wood said Oracle's 4Q print was mixed, but the backlog once again inflected higher, driven by large AI contract wins and an initial FY25 guide of double-digit growth that was above Wall Street's guidance.

Not only has Oracle rallied significantly, it's also much cheaper than Nvidia. Nvidia's one-year forward price-to-earnings ratio is nearly 50. Oracle's is only 23.

Yahoo Finance

Shares of Hewlett-Packard Enterprise (HPE) are up 22.56% year-to-date and 17.37% so far this quarter. Its forward P/E ratio is just 10.

More AI Stocks:

- Apple's AI launch at WWDC could hinge on something it hates to do

- Analyst revamps Microsoft stock price target despite controversy

- Analysts race to reset HPE stock price targets as AI powers earnings

Last week, Argus upgraded HP Enterprise to buy from hold with a $26 price target after its second-quarter earnings beat and “positive guidance.”

The firm noted the company's strong positioning and growing opportunity in the AI space. It generates revenue from AI servers, and its overall computing business shows signs of recovery.

Related: Analysts race to reset HPE stock price targets as AI powers earnings

Let's also take a look at Dell Technologies (DELL) , which is up a staggering 71.82% year-to-date and 15.2% for the quarter.

Again, its shares are arguably cheaper than Nvidia, given its forward P/E ratio is 16.

Earlier this month, Argus raised Dell's price target to $150 from $130 and kept a buy rating on the shares after the company posted an above-consensus quarterly revenue performance but missed Wall Street’s EPS forecast.

However, the firm sees strong momentum in AI servers in fiscal 2025 and believes Dell is “well-positioned in the just-emerging AI PC market,” the firm said.

Related: Analysts reboot Dell stock price targets ahead of earnings

And then there's Apple (AAPL) , the tech giant that briefly had to choke on Nvidia's dust and probably spent a lot of time looking over its massive shoulder at the AI upstart.

Apple is up 13.03% so far this year and roaring nearly 27% in the quarter.

It's pricier than these other old tech stocks, but it's trading at 31 times next year's earnings, a relative bargain compared to Nvidia.

On June 10, the company unveiled Apple Intelligence, its suite of AI features for select iPhones, Macs, and iPads, at the Worldwide Developers Conference.

TheStreet Pro's Chris Versace said, "Bank of America (BofA) echoes our thinking about the iPhone install base and the volume of folks who have not updated their devices in the last few years."

Based on a proprietary survey, BofA finds that 77% of iPhone users in the U.S. own either the iPhone 11, 12, or 13 models.

"Granted, the sample size was on the smaller side at less than 8,000 respondents, but this does reinforce our thoughts about the coming upgrade cycle that will benefit not only Apple but Qualcomm (QCOM) and Universal Display (OLED) ," Versace said.

BofA sees calendar years 2025 and 2026 iPhone unit shipment forecasts of 241 million units and 238 million units as too low, he said, adding that, for context, Apple shipped 231.8 million iPhones in 2023.

Related: Veteran fund manager picks favorite stocks for 2024