/Semiconductor%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

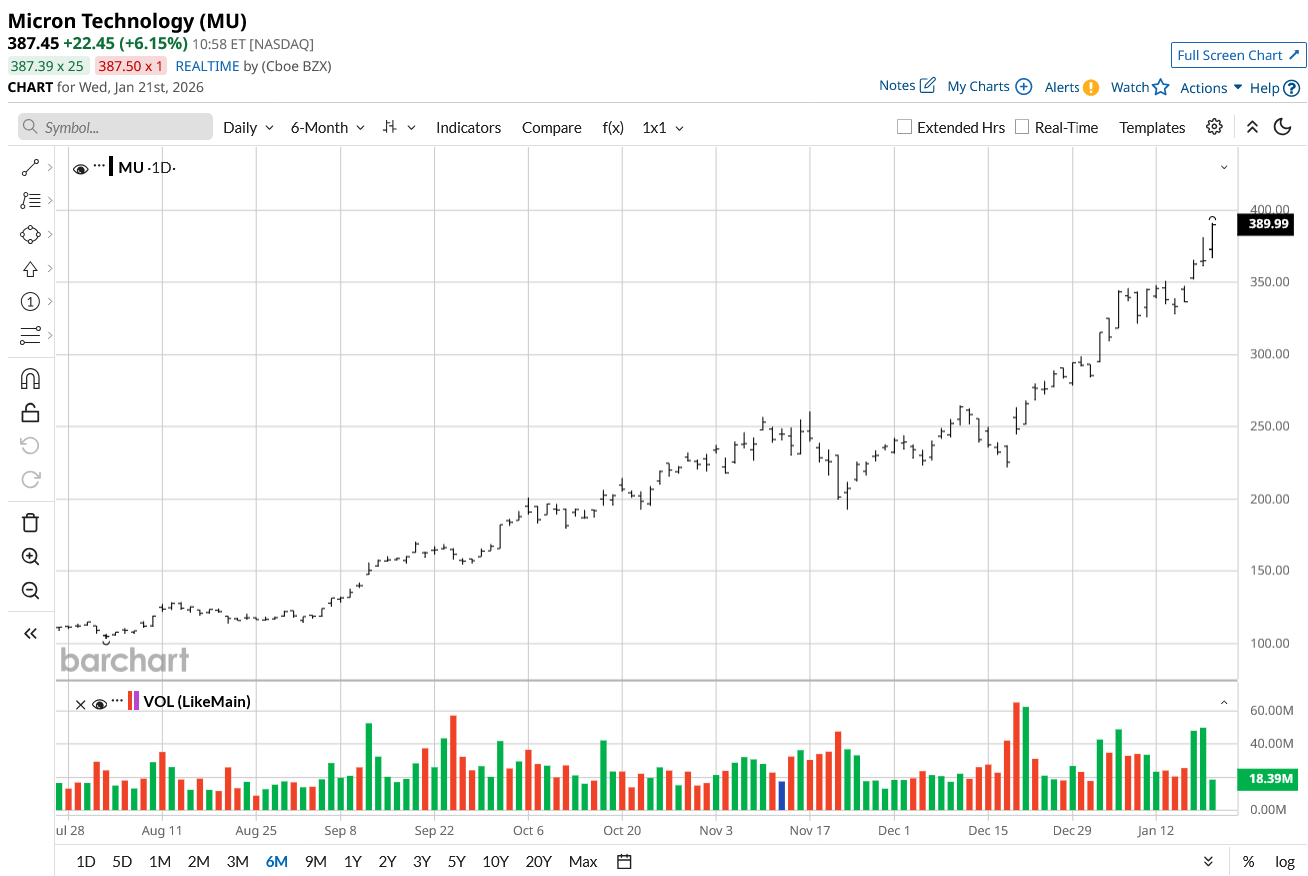

With AI-backed demand being the dominant factor, Micron Technology (MU) stock has surged by 234% in the last 52 weeks. The rally has shown no signs of fatigue, with Micron delivering strong numbers coupled with optimistic guidance. At the same time, the prospects of a shortage of AI memory chips beyond 2026 have kept MU stock firm at higher levels.

The flow of good news continues for MU stock investors. On Jan. 17, the company announced the acquisition of a chip fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corporation. The deal is for a total cash consideration of $1.8 billion and includes a “300mm fab cleanroom of 300,000 square feet.”

Stifel believes that the acquisition allows Micron to “leapfrog” competition and swiftly address the current DRAM shortage. The acquisition is expected to contribute meaningfully to the wafer output by the second half of CY27. Stifel also reiterated its “Buy” rating and increased MU stock price target to $360.

About Micron Stock

Headquartered in Boise, Idaho, Micron is a global provider of memory and storage solutions. The company’s portfolio includes DRAM, NAND, and NOR memory and storage products. With 13 manufacturing sites globally, Micron is well positioned to cater to the incremental demand for storage solutions on the back of the growth in AI.

For Q1 2026, Micron reported revenue growth of 56.8% on a year-on-year (YoY) basis to $13.6 billion. For the same period, the company’s GAAP EPS was $4.6. Strong results were on the back of AI demand acceleration.

Further, as the company undertakes significant expansion amidst industry tailwinds, MU stock has surged by 238% in the last six months.

Capital Investments to Trigger Robust Growth

Before discussing the capex-driven growth potential, it’s important to highlight Micron’s financial flexibility. As of Q1 2026, the company reported a cash buffer of $10.3 billion. Further, operating cash flow for the quarter was $8.4 billion. This implies an annual OCF potential of $33.6 billion. With robust growth, it’s likely that cash flows will swell further. Therefore, financial flexibility is high for organic investments and acquisition-driven growth.

On Jan. 7, Micron announced the commencement of construction of the largest semiconductor manufacturing facility in the United States. With an investment of $100 billion, the site will help in meeting the growing demand of the AI systems globally. It’s worth noting that Micron has committed $50 billion towards R&D in the U.S. These investments will ensure that the company maintains a competitive edge.

Recently, Micron indicated that the AI-driven memory chip shortage is “unprecedented.” It’s likely to last beyond 2026. Therefore, strong top-line growth visibility coupled with robust EBITDA margin is likely for the next 24 months. Even beyond this period, AI investments will ensure steady demand and value creation.

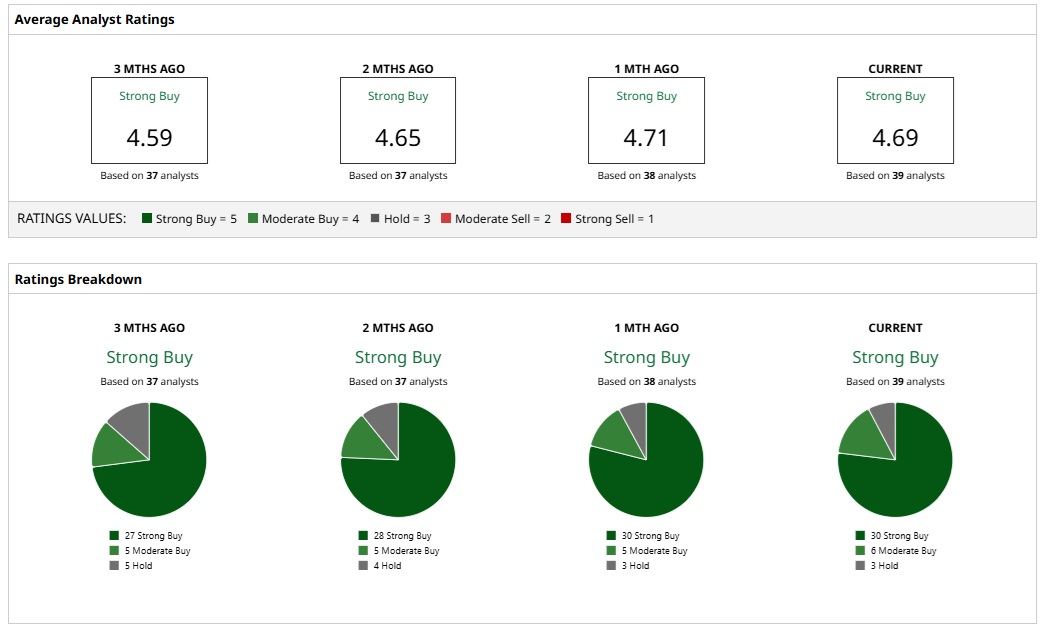

What Analysts Say About MU Stock

Based on the ratings of 39 analysts, MU stock is a consensus “Strong Buy.” While 30 analysts assign a “Strong Buy” rating to MU, six analysts have assigned a “Moderate Buy” rating. Further, three analysts believe that the stock is a “Hold.”

Based on these ratings, analysts have a mean price target of $329.92 currently, which would imply a downside potential of 15%. However, with the most bullish price target of $500, the upside potential for MU stock is 29%.

It’s worth noting that even after a significant rally, MU stock trades at an attractive forward price-earnings ratio of 11.27. With a healthy earnings growth outlook for the next two fiscal years, the uptrend is likely to sustain.

Recently, RBC Capital Markets opined that the “semiconductor revenue stemming from artificial intelligence applications” is expected to grow from $220 billion in 2025 to $550 billion in 2028. RBC has also assigned an “Outperform” rating to MU stock. Importantly, the industry growth projection underscores the robust earnings growth visibility for Micron in the next few years.