Kyndryl (KD) shares crashed more than 50% this morning, after the IT infrastructure firm said the U.S. Securities and Exchange Commission (SEC) was looking into its financial reporting practices. On Monday, the company lowered its full-year guidance and announced a string of top-level ousters as well, which pushed KD’s relative strength index (RSI) into deeply oversold territory.

At the time of writing, Kyndryl stock is down nearly 60% versus its year-to-date high.

Is Kyndryl Stock Poised for a Rebound?

While an RSI in the mid-teens often precedes a rebound, KD stock remains rather unattractive as the company has already said it expects to report material weaknesses in its internal controls.

This means Kyndryl may have to restate its prior financials, which raises the risk of continued volatility in its share price through the remainder of 2026.

These expected financial discrepancies are particularly significant given the forced exits of David Wyshner (chief of finance) and Edward Sebold (general counsel), suggesting they may extend beyond clerical errors.

Note that KD now sits miles below its major moving averages (MAs), reinforcing that bears have firmly taken control across multiple timeframes.

Why KD Shares Aren’t Worth Buying on the Dip

Investors are also cautioned against buying Kyndryl shares today because the NYSE-listed firm now sees its revenue declining by 3% on a constant currency basis in 2026. This means the AI buzzword it’s been using on earnings calls isn’t really translating into top-line strength.

In fact, the company’s margins are shrinking, and its looming debt obligations suggest it isn’t well-positioned to hit its ambitious 2028 targets.

Finally, since its spinoff from IBM (IBM), Kyndryl has ended both February and March deeply in the red, a seasonal pattern that dampens hopes of a near-term rebound.

How Wall Street Views Kyndryl in 2026

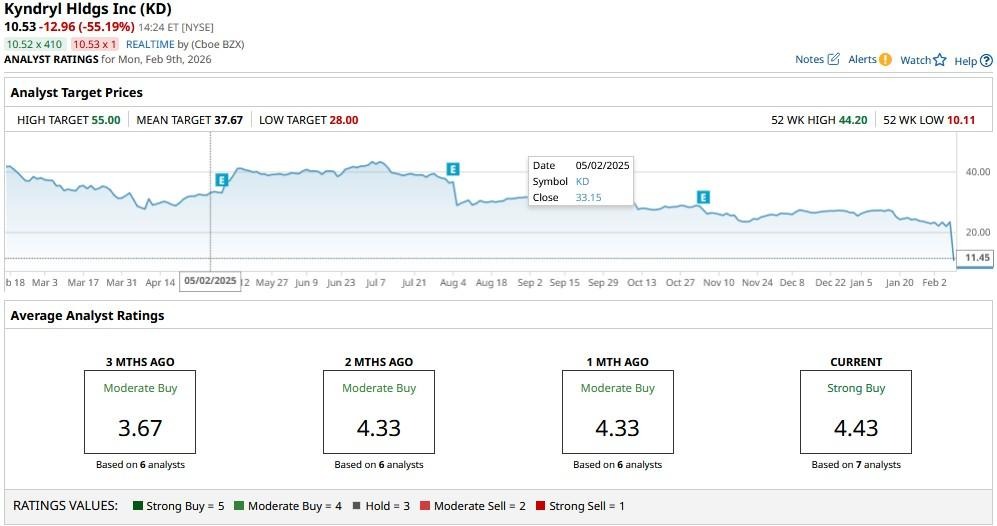

Heading into Monday, Wall Street analysts had a consensus “Strong Buy” rating on KD shares, with an average price target of nearly $38.

However, it’s well within reason to assume that at least some of them will downwardly revise their estimates for Kyndryl following today’s update, making it that much difficult for its stock to regain momentum in 2026.