With the SPDR S&P 500 (NYSE:SPY) down roughly 22.5% year-to-date, investors may want to turn to blue chip dividend kings. These stocks typically lose less of their value than other stocks in the S&P 500 and increase dividends for 50 consecutive years.

For instance, the SPDR Series Trust SPDR Portfolio S&P 500 High Dividend ETF (NYSE:SPYD) is designed to track the performance of the 80 highest yield dividend equities in the S&P 500, which is only down roughly 13.13% year-to-date.

Check Out: The Best Decentralized Exchanges And Learn How They Work

Stocks such as PepsiCo Inc. (NASDAQ:PEP) and Kimberly-Clark Corporation (NYSE:KMB) are down roughly 4.81% and 20.2% year-to-date, respectively. Target Corporation (NYSE:TGT), meanwhile, is down roughly 34.2% year-to-date. Here's a deeper look:

- Kimberly-Clark offers a dividend yield of 4.06% or $4.64 per share annually, through quarterly payments, with an amazing track record of increasing its dividends for 50 consecutive years. The Irving, Texas-based company specializes in hygiene brands, including Huggies, Pull-Ups, Kotex, Depend, Kleenex, and Cottonelle. Kimberly-Clark generates just over half of its sales in North America and more than 10% in Europe, with the rest primarily concentrated in Asia and Latin America. At least 25% of the world population uses a Kimberly-Clark product everyday as its 175 brands are sold in more than 175 countries. As of the second quarter, share repurchases were at 173,000 shares at a cost of $23 million.

- Target offers a dividend yield of 2.84% or $4.32 per share annually, making quarterly payments, with a stellar track record of increasing its dividends for 53 consecutive years. Most Target stores, which average more than 125,000 square feet, offer a variety of departments, including beauty and household essentials, food and beverage, home furnishings, and apparel and accessories. The Minneapolis-based company recorded the repurchase of $2.6 billion worth of its shares through the accelerated share repurchase (ASR) arrangement in 2021, reflecting the retirement of 12.5 million shares of common stock at an average price of $211.58. As of the second quarter, Target had approximately $9.7 billion of remaining capacity under the repurchase program approved by Target’s board in August 2021.

- PepsiCo Inc. (NASDAQ:PEP) is offering a dividend yield of 2.78% or $4.60 per share annually, utilizing quarterly payments, with a fantastic track record of increasing its dividends for 50 consecutive years. The food and beverage manufacturer markets and sells a portfolio of big-name brands (Pepsi, Mountain Dew, Gatorade, Doritos, Frito-Lay, and Ruffles). In the second quarter, total cash returns to shareholders were about $7.7 billion, with dividends of $6.2 billion and share repurchases of $1.5 billion. PepsiCo expects to deliver 10% organic revenue growth compared to its previous guidance of 8% for the fiscal year 2022.

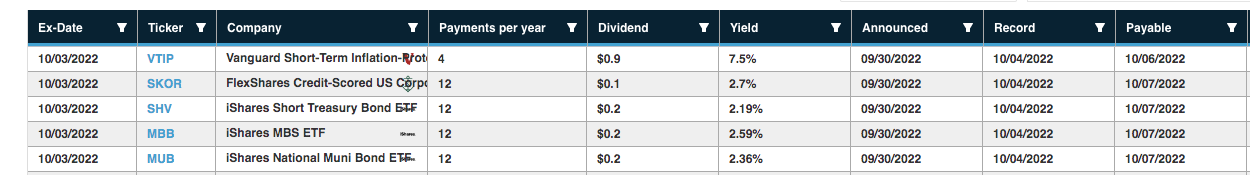

Benzinga's Dividend Calendar: Get Up To Date Dividend Announcements

Photo By: Jason Train From Flickr