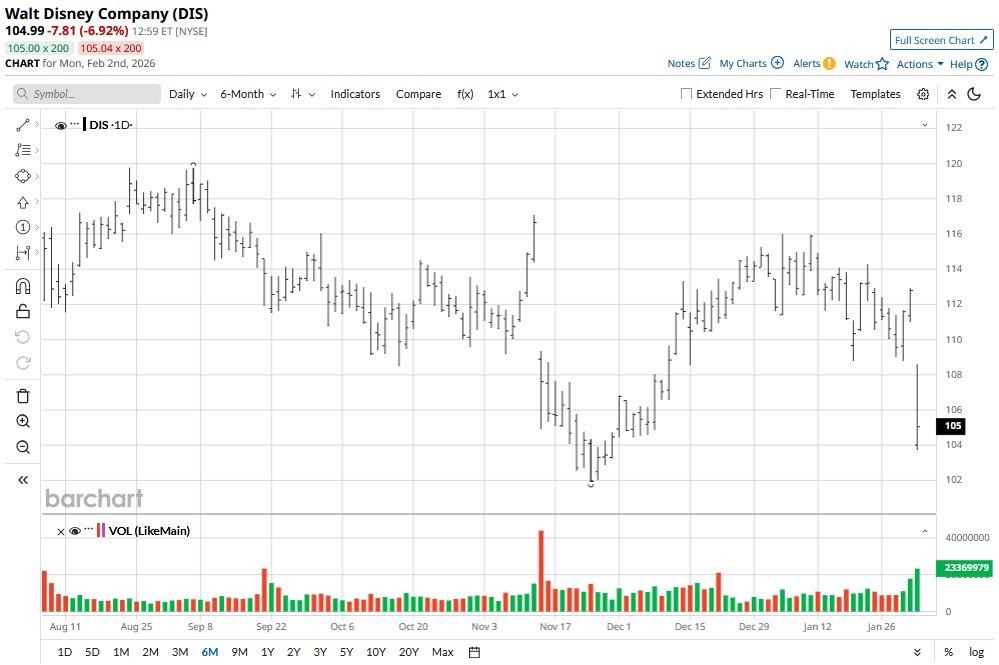

Disney (DIS) shares are inching down this morning after the entertainment giant said its per-share earnings declined by 7% on a year-over-year basis in its fiscal Q1. The selloff pushed DIS decisively below its major moving averages (50-day, 100-day, 200-day), indicating downward momentum could sustain — at least in the near-term.

Still, a senior Citi analyst, Jason Bazinet, recommends buying Disney stock on the post-earnings plunge. At the time of writing, the mass media behemoth is down nearly 10% versus its YTD high.

Should You Load Up on Disney Stock Today?

Investors are also bailing on DIS stock because management failed to impress with its second-quarter guidance on Feb. 2, mostly due to muted expectations from the entertainment business.

However, the market is overreacting, as the cost of producing and marketing movies is known to skew short-term estimates, Bazinet told CNBC today.

According to him, the healthy beat on the top and bottom lines in Q1 suggests the underlying business remains healthy.

All in all, this post-earnings dip offers an attractive entry point for long-term investors who can look past quarterly noise, the analyst added.

DIS Shares Are Trading at an Attractive Valuation

Bazinet also remains positive on Disney shares because they’re currently trading at an attractive valuation.

“If they deliver on double-digit growth, it’s 14 times earnings — that’s a great entry point,” he said, adding that the multiple will expand as the company slowly but surely gains traction in streaming.

On Monday, the Citi analyst maintained his “Buy” rating on DIS with a $140 price target, indicating potential upside of more than 30% from current levels.

A 1.41% dividend yield makes Disney all the more attractive to own in 2026 — at least for income-focused investors.

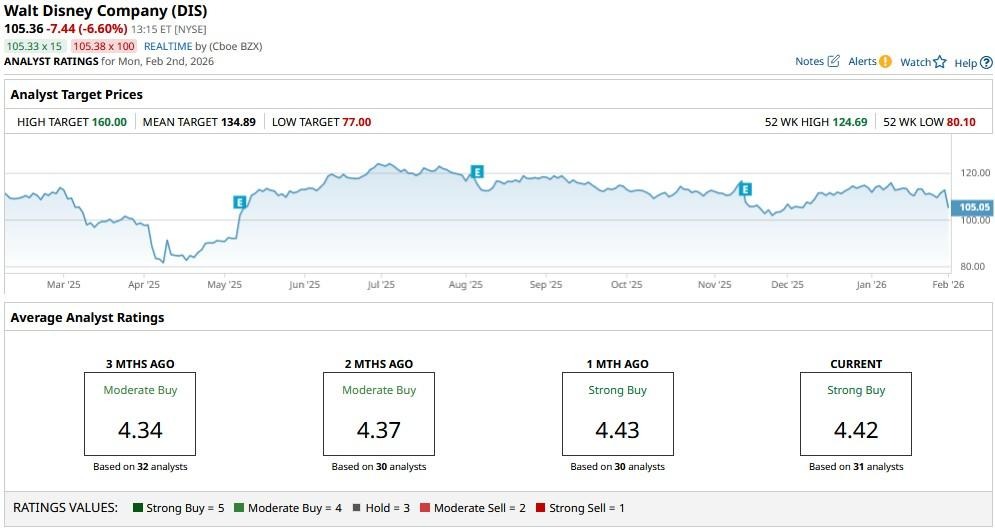

How Wall Street Recommends Playing Disney

While not as bullish as Citi, other Wall Street firms remain optimistic as ever on DIS shares following the NYSE-listed firm’s Q1 earnings on Monday.

The consensus rating on Disney sits at “Strong Buy” currently, with the mean target of about $135 indicating potential upside of about 29% from here.