/Arista%20Networks%20Inc%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at $164 billion by market cap, Arista Networks, Inc. (ANET) is a leading provider of high-performance cloud networking solutions, specializing in Ethernet switches, software, and automation platforms for large data centers and enterprise networks. Headquartered in Santa Clara, California, the company primarily serves hyperscale cloud providers, financial institutions, and large enterprises.

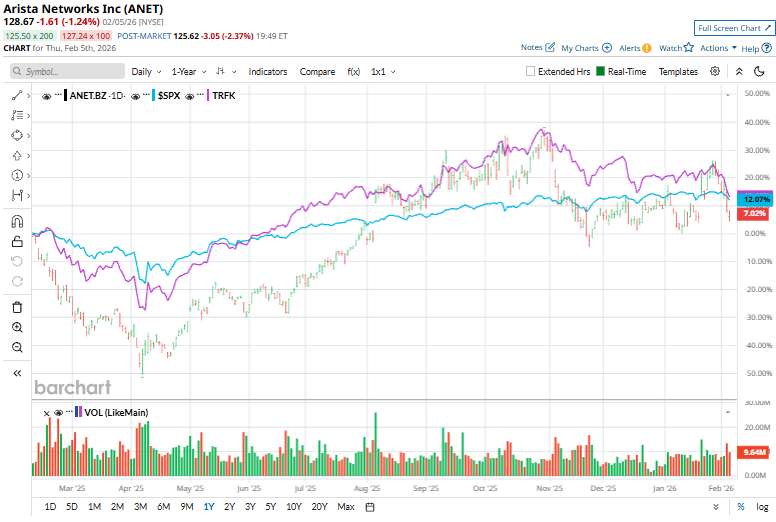

Shares of this cloud networking giant have outperformed the broader market slightly over the past year. ANET has gained 11.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.2%. In 2026, ANET stock is down 1.8%, trailing SPX’s marginal fall on a YTD basis.

Narrowing the focus, ANET has trailed the Pacer Data and Digital Revolution ETF (TRFK). The exchange-traded fund has gained 15.6% over the past year.

On Dec. 10, shares of Arista Networks rose 1.8% after the company unveiled major upgrades to its Cognitive Campus platform, including the launch of Arista VESPA for large-scale WLAN mobility, an expanded AVA agentic AI system for streamlined AI Ops, and new outdoor-ready campus switches powered by EOS. The announcements highlighted Arista’s growing momentum in enterprise networking and reinforced its strategy of delivering a unified, AI-driven network experience across data centers, cloud, campus, and WAN environments.

For FY2025 that ended in December, analysts expect ANET’s EPS to grow 26.2% to $2.60 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

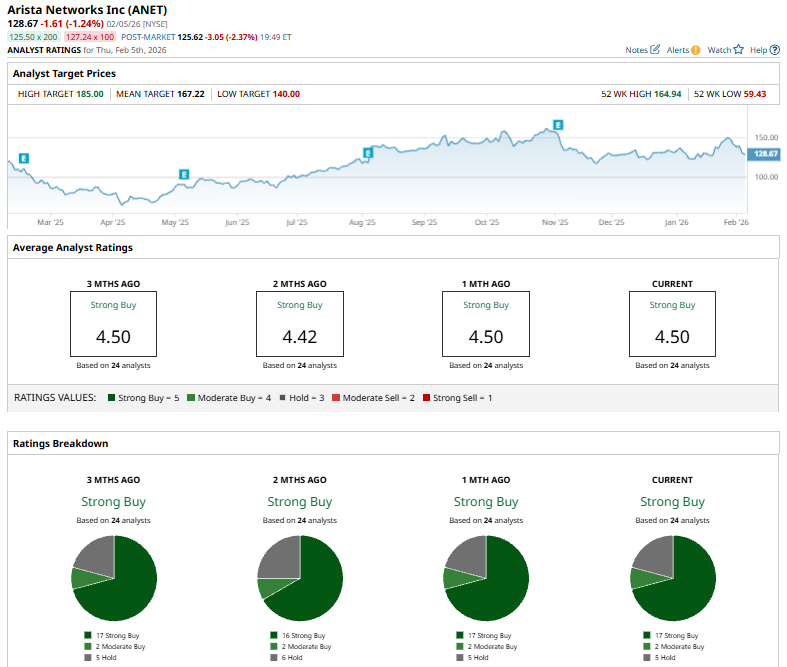

Among the 24 analysts covering ANET stock, the consensus is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, two “Moderate Buys,” and five “Holds.”

The configuration is bullish than two months ago, when 16 analysts had suggested a “Strong Buy,” rating for the stock.

On Jan. 6, Arista Networks received an upgrade from Piper Sandler analyst James Fish, who raised the stock’s rating from “Neutral” to “Overweight.” At the same time, the firm increased its price target from $145 to $159, reflecting a 9.7% upside and growing confidence in Arista’s outlook.

The mean price target of $167.22 represents a 30% premium to ANET’s current price levels. The Street-high price target of $185 suggests an ambitious upside potential of 43.8%.