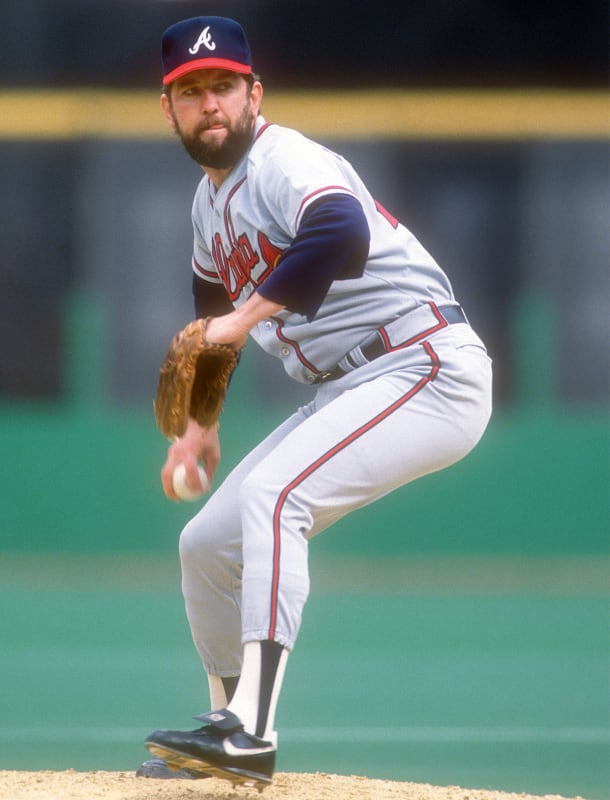

In December 1984, National League club owners gathered at the MLB winter meetings in Houston. They had something important to discuss. One of their own had drawn up a shocking, unprecedented contract for a free agent: Atlanta owner Ted Turner had offered six years and more than $9 million to reliever Bruce Sutter.

This could have been perfectly fine, except that roughly half of that money would be deferred, scheduled to be paid out with interest in annual installments from 1991 to 2021.

It was unheard of. (Though, to be fair, plenty was unheard of: Free agency was still less than a decade old.) There was nothing to forbid deferring a large portion of a contract. But it didn’t sit right with the other owners. With the high interest rates of the time, Sutter’s final payout would be much, much more than $9.1 million—some $45 million. That was the figure that had originally been reported, splashed across headlines, declaring it the biggest sports contract in the world. (Sutter would take the title of highest-paid athlete from quarterback Steve Young of the USFL.) What kind of precedent did Sutter’s deal set? The practice made other baseball clubs nervous.

Mitchell Layton/Getty Images

So the NL owners voted, 11–1, to censure Turner. (The lone vote against came from … Atlanta. Turner himself was not in the room but was allowed to send a representative.) This kind of vote was exceedingly rare. But such was the owners’ fear about large deferred payments.

“There is substantial deferred money that didn’t look like it would be funded,” an anonymous owner told The New York Times a week after the vote. “We wondered about the long-term liability—would the league or other teams be liable if something happened with Turner and the Braves?”

Sutter’s time in Atlanta did not go as planned, with injuries and age catching up to him, and he retired before the contract was through. But the deal held up. For 30 years after his retirement, Atlanta cut Sutter an annual check for $1.12 million, a steady payment even as ownership changed hands and the baseball landscape changed drastically.

A record-setting contract, much of it deferred, with questions about how a team could do this in the first place … sound familiar?

Shohei Ohtani’s 10-year, $700 million deal with the Dodgers stunned the baseball world last week. The Dodgers had long been considered favorites for the two-way star, and it had long been assumed the deal could break records, but no public contract estimates had been this high. It made Ohtani the highest-paid athlete not just in MLB, but in the world, topping Lionel Messi’s $674 million deal with FC Barcelona.

Then some key additional details came out: 97% of Ohtani’s pay will be deferred. For the duration of the contract, he will make $2 million per year in salary, meaning the most talented player in the game will get less than the average backup catcher. Starting in 2034, however, Ohtani will receive annual installments of $68 million. (There is no interest on the deferred payments.) The unique structure reduces the Dodgers’ luxury tax burden and creates more payroll flexibility. It also significantly reduces the real value of the contract to Ohtani.

Jayne Kamin-Oncea/USA TODAY Sports

This is not a gray area or a loophole. The collective bargaining agreement is explicit about there being no limits on deferrals in contracts. But Ohtani’s deal blows previous examples of deferred payments out of the water.

The most oft-cited example is Bobby Bonilla, who retired more than two decades ago but still receives $1.19 million from the Mets every July 1, now known in some circles of baseball fandom as “Bobby Bonilla Day.” But there are many others. The Red Sox are still paying Manny Ramirez, the Orioles are still paying Chris Davis and the Reds are still paying Ken Griffey Jr. The largest deferral in recent years came in 2015, when Max Scherzer agreed to defer 50% of his $210 million, seven-year deal with the Nationals.

But the practice was first in the spotlight with Sutter. And his example remains illuminating almost 40 years later.

Nothing came of the NL owners’ censure vote against Turner. (If there had been a pathway to action, of course, there wouldn’t have been reason to resort to a censure.) But it sent a message all the same.

The other club owners were extremely nervous about what might happen to a contract with such heavy deferred payments. What if Turner went bankrupt? What if he had to sell the team? The league did not do anything to block the deal, but officials indicated they were not exactly thrilled about it.

“Peter Ueberroth, the commissioner of baseball, expressed another concern,” wrote the Los Angeles Times. “He said he is worried about contracts that deal in unfunded liabilities and hinted that further action might be taken to restrict such deals.”

The players union did not share that perspective. If a club was prepared to offer a contract, the assumption should be that it would honor the terms of the deal, argued the MLBPA. If players wanted to defer significant portions of their contracts for whatever reason—even if it meaningfully lowered the present value of the money—they could do that.

“We assume that when clubs undertake these obligations they are making reasonably prudent investments,” MLBPA chief Donald Fehr told the Los Angeles Times. “If we were to become convinced otherwise, then we’d probably recommend to the players that they make deals for current payments only.”

Sutter’s deal sparked plenty more debate. There was first an argument over whether he was really the highest-paid athlete in the world if so much of his contract would come via interest on payments he would not receive for decades. Today, it’s not unusual to see discussion of long-term contracts in terms of present value and future value. But that was something new for baseball in the ’80s.

“It says here Bruce Sutter is worth $40 million to the Braves,” Dave Kindred wrote in an explainer for the Atlanta Constitution. “First, it’s not a real $40 million. Maybe $30 million will be paid out over the next 30 years. And it won’t be $30 million out of Ted Turner’s billfold. He’ll put up maybe $3 million in real cash over five years to buy an annuity.”

The contract became a hot topic among sports agents. Would you accept a deal like this? There was considerable talk over whether it was safe.

“If someone said to me, ‘We want to defer 55% of the contract into an account over which you have no control’ [a precise description of the Sutter deal], I don’t think I could live with that,” agent Bob Woolf, who represented basketball stars including Larry Bird and Julius Irving, told the Los Angeles Times. “Fifteen or 20% would be a different story.”

Woolf went on to call Sutter’s contract “dangerous … obviously dangerous. … I’m not trying to denigrate Ted Turner or anybody, but it’s extremely dangerous.”

Others weren’t nearly so anxious.

“The Atlanta Braves would literally have to disappear from the earth for Sutter not to get paid,” agent Richman Bry told the St. Louis Post-Dispatch.

(A year later, Bry negotiated a big deferred contract of his own: He represented Darryl Strawberry on a deal with the Mets that included decades of deferred payments.)

Screenshot from Sacramento Bee

Obviously, these conversations were taking place in a different context from today, both in terms of finance and baseball. The concerns around taxation, interest rates and inflation were different. The model of free agency was different. (And it doesn’t have to be said that Sutter and Ohtani are different: The former set the standard for relievers and would become a Hall of Famer, but still, he was not exactly a two-way superstar with the ability to tap into an international advertising market.) Yet some of the critiques about Sutter’s deal from 1984 read just like the ones about Ohtani’s deal from 2023.

“It’s better to take the money now, even with paying taxes, and make prudent investments,” Dick Moss, who represented Nolan Ryan and Fernando Valenzuela, told the Los Angeles Times. “I happen to believe that. I felt a little differently seven or eight years ago when inflation wasn’t so bad.”

Some agents shared more existential concerns. If Turner handled the money wisely, there should be no concern about the immediate future for Sutter. But if there were more of these deals, taking place on a longer and longer time horizon, well … could they be sure baseball would even still be around?

“How well do you predict the sport will maintain its popularity?” agent Randy Hendricks, who represented players like Andre Thornton and Steve Trout, said to the Los Angeles Times. “Would I bet on the United States Football League? Noooo. Baseball is better. But I will say that the longer you go forward on deferral, the greater the risk. I’m not concerned about 10 years, but if someone comes up with a deal that goes to 2030, I’m leery.”

Moss had a different take. Baseball wasn’t going anywhere, he figured. When Sutter’s deal finished in 2021, and even after that, people would still be playing, watching and paying for baseball. Maybe they would even still be having debates about deferred contracts.

“Baseball is so basic and sound,” Moss said. “If it goes under, probably America will go under.”