With a market cap of $40.3 billion, Public Service Enterprise Group Incorporated (PEG) is a U.S.-based energy company operating electric and gas utility services and nuclear power generation through its PSE&G and PSEG Power segments. It delivers electricity and natural gas across an extensive transmission and distribution network while also investing in nuclear, solar, and energy efficiency initiatives.

Shares of the Newark, New Jersey-based company have underperformed the broader market over the past 52 weeks. PEG stock has fallen 3.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14%. Moreover, shares of the company are up marginally on a YTD basis, compared to SPX's 1.3% gain.

Looking closer, PEG stock has also lagged behind the State Street Utilities Select Sector SPDR ETF's (XLU) 10.7% return over the past 52 weeks.

Despite reporting weaker-than-expected Q3 2025 revenue of $2.37 billion, shares of PEG recovered marginally on Nov. 3 as adjusted EPS of $1.13 topped the consensus and rose from $0.90 a year earlier. Investors also responded positively to strong operating results, with Q3 adjusted operating earnings reaching $565 million, driven by $515 million from PSE&G, and to management’s decision to narrow full-year EPS guidance to the upper half of $4 - $4.06.

For the fiscal year that ended in December 2025, analysts expect PEG's adjusted EPS to grow 9.8% year-over-year to $4.04. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

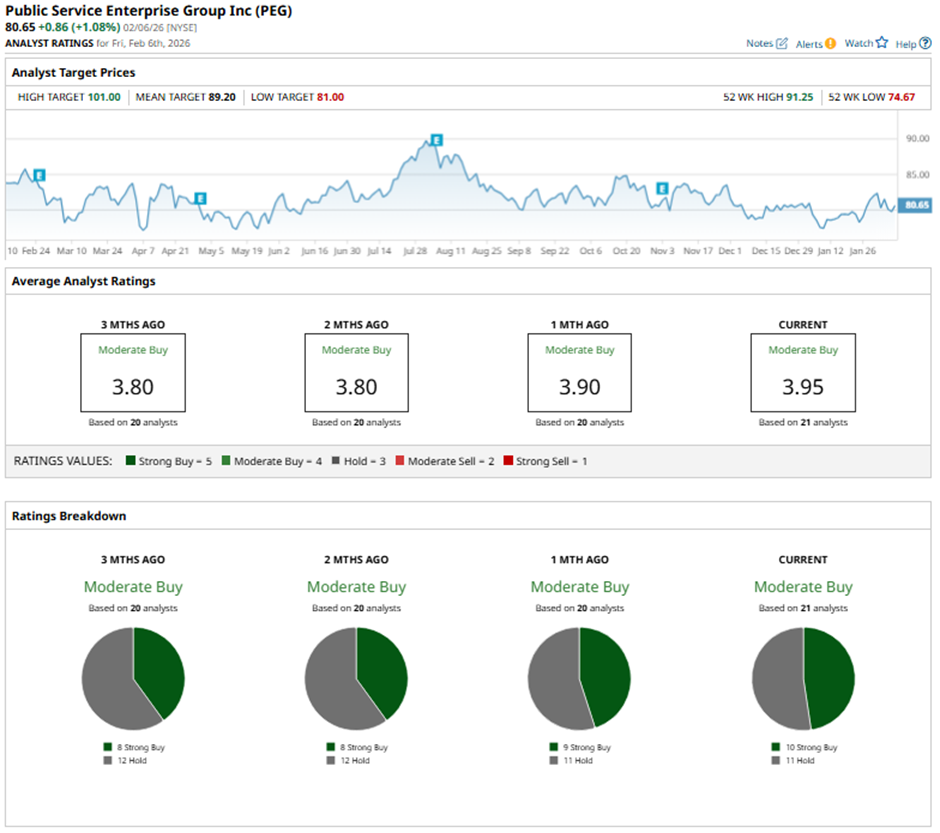

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings and 11 “Holds.”

This configuration is more bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Jan. 28, Bank of America Securities analyst Ross Fowler reaffirmed a “Buy” rating on Public Service Enterprise Group and set a price target of $84.

The mean price target of $89.20 represents a premium of 10.6% to PEG's current levels. The Street-high price target of $101 implies a potential upside of 25.2% from the current price levels.